Commentary

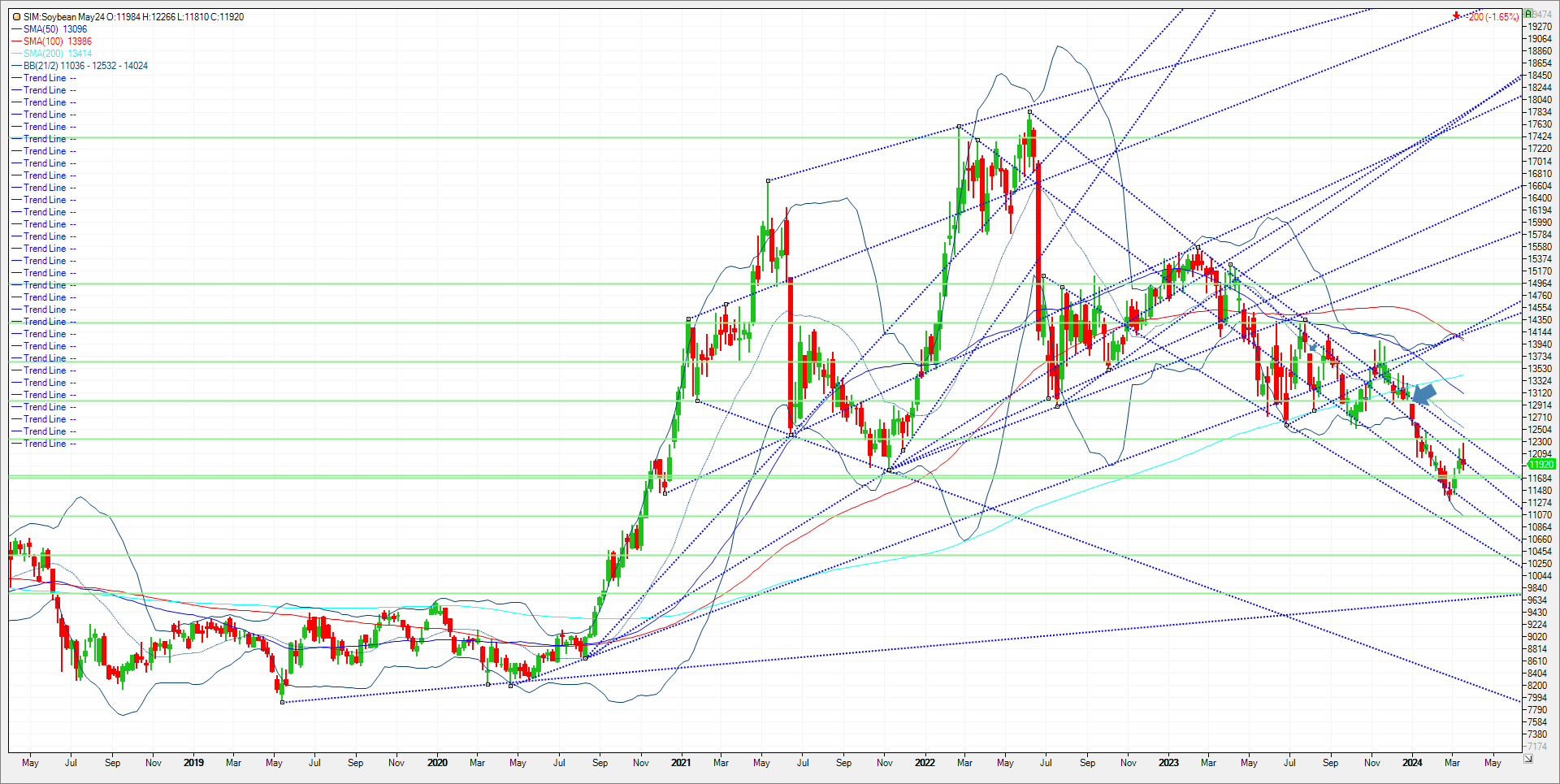

Brazil’s soybean crop is expected to fall well short of last year’s record, but it’s also said to be over 60% harvested. That suggests increased South American competition in the near future with Argentina’s harvest following later in the Spring. Despite the double digit move lower today, volumes chasing the break were low. The US continues to struggle with export demand and with Brazilian basis weakening it provided further drag on futures. The great debate about the size of Brazil’s crop continues with no further indications coming from Stat agencies until April 11th when the USDA and CONAB update their estimates. Managed money as of this past Tuesday puts the soybean short at 148K contracts, while meal is at 46K, and Bean oil at 14K. There is growing noise and guesstimates for next Thursday’s long awaited planting intentions report. The scuttlebutt has soybean acres rising by 2 million acres to 85.6 million. Most of the gains come at the expense of Corn, but this report is usually full of surprises. Corn looks to lose on average 2.9 million acres or (3.1%) from last year. It is hard to remember a year that the predictions weren’t less corn and more beans. It is my belief that producers love planting corn and the outcome more times than not is more corn acres vs expectations amid slightly less beans. I think if any surprises were to occur, it would be on farm stocks. Let’s see the numbers Thursday and see if the acreage trend continues. Weekly continuous chart in beans below. Key support is 11.88 for the most actively traded May contract. It’s a key level. A close below and next support is 1168/72. A close below that and its katy bar the door to 1127. Should the market hold 1188 support on consecutive closes, the market could run to 1231 and 1234 resistances. A close above 1234 and the market could push to the 21-week moving average at 1253.

Trade Idea

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604