Commentary

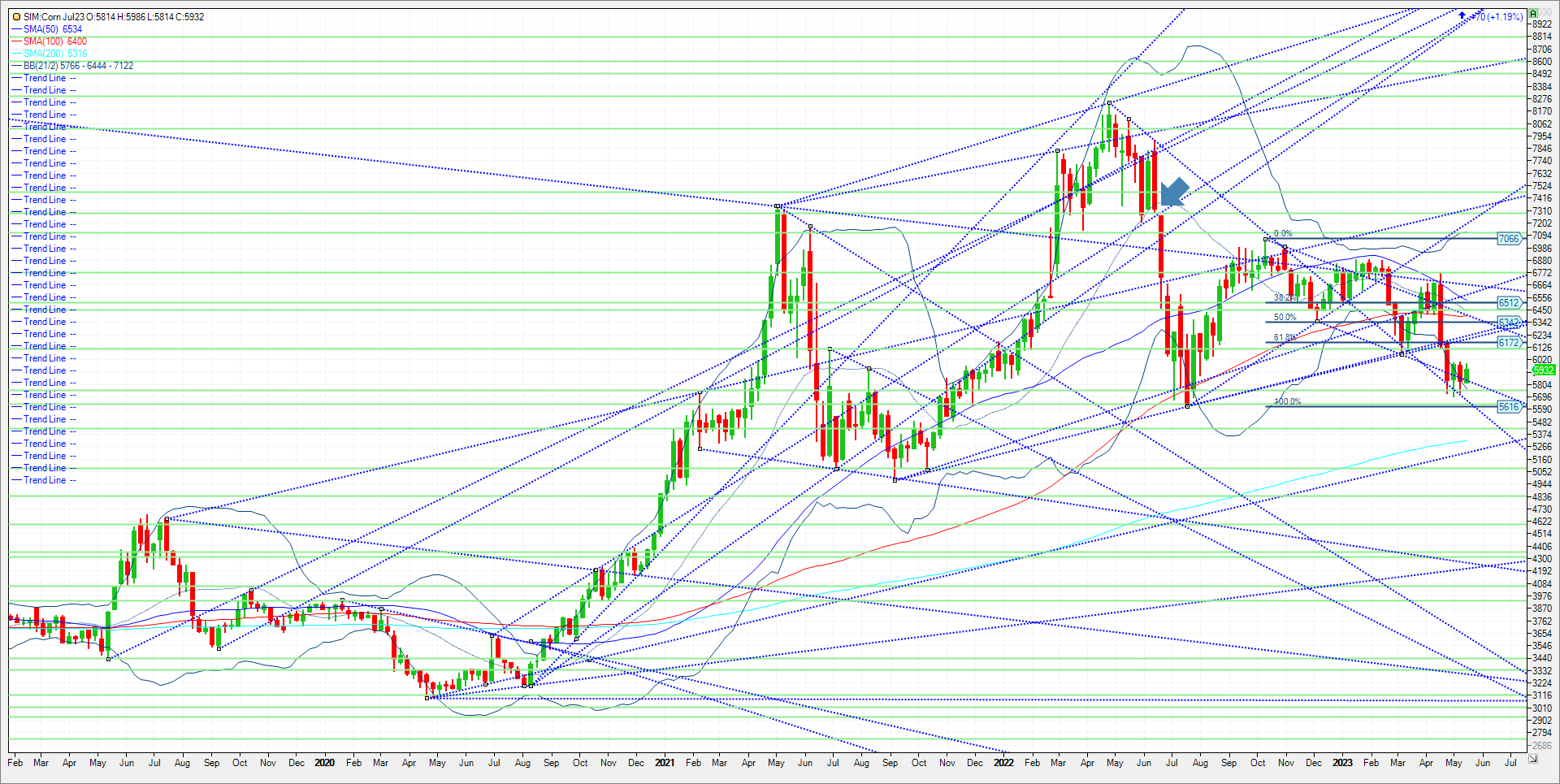

Corn’s push higher comes on three fronts today in my view. First, USDA inspected 46.2 million bushels of cornfor export shipment in the week ending May 11th. Inspections bested most expectations in my view as ships destined for China included an impressive 18.6 million bushels of corn. Second, worries about the extension of the Black Sea Corridor. The final two ships under the Black Sea Grain Deal will depart Ukraine on Tuesday. The deal is set to expire on May 18th as a renewal agreement has not been met. Russia has a list of demands before it will agree to the deal according to the Kremlin. The demands involving a reconnection to the SWIFT banking system as well as other protections for its own ag and fertilizer exports. Russia is also demanding a pipeline that carries Russian ammonia to Black Sea ports in Ukraine be restarted. Third, the grains currently have a positive basis in quite a few places. Some areas in Southwest Iowa put the corn basis at 50-65 cents over the spot month and beans are about 15-30 cents over. This makes it hard to be short in the old crop market for now in my opinion. Technically, July 23 corn failed at 6.00 yet again in the near term for the third time in as many weeks. Should we take out 6.00, look for the market to challenge 6.11, then the 6.19/6.22 level. Key support is at 5.84. It needs to hold in my opinion. A close below and it’s a brief stop at 5.77 then support at 5.66 and 5.61. Per Friday’s CFTC data, managed funds were net short 109K futures and options contracts. With the positive basis in many areas especially in the West intact for now, please consider the following trade.

Trade Ideas

Futures-N/A

Options- Buy the July 23 Corn 595 call and at the same time sell the March 24 610 call. Cost to entry even money plus trade costs and fees.

| ZCH24C610:N23C595[DG] |

Risk/Reward

Futures-N/A

Options- there is unlimited risk here, given one is short an option that expires in late February 2024 while long July option expires in 6 weeks. As we enter into this trade as a spread its important that one exit as a spread. Given the positive basis and potential Black Sea shutdown amid a heave net fund short, we could see old crop corn outpace new crop. If filled at even money, our exit to cover is at -25 cents. If thought July 24 corn closes under 5.84, I am out of the whole spread. Call me with questions.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604