Commentary

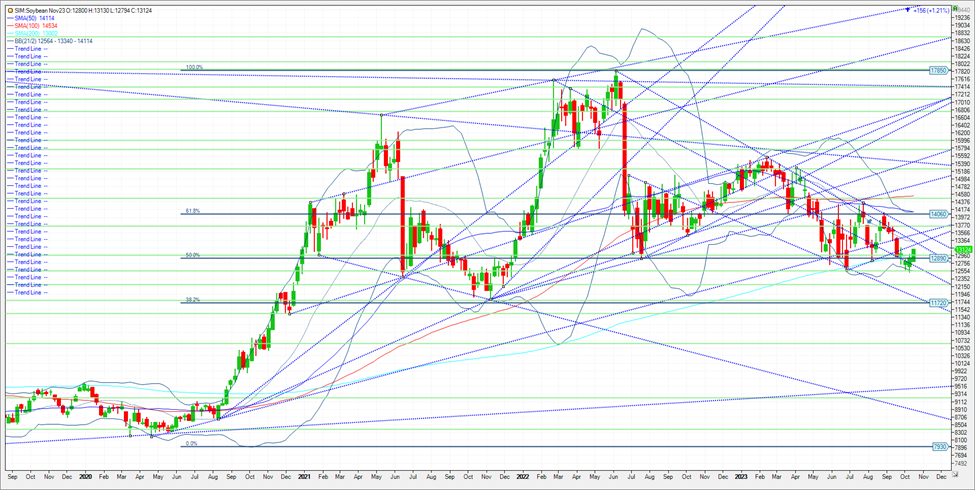

Managed funds after liquidating to a near neutral position in soybeans are in my view playing the soy seasonals and buying the dips following last week’s WASDE amid 60 percent harvest progress in my opinion. Rumors that China bought a few cargoes of US beans combined with a close over the 200-week moving average on the weekly continuous chart. However, it was meal that led the market today while bean oil weakened up after a bullish crush report on Monday. Whether its bean oil or meal leading the market, US crush margins are on the rise with cash returns gaining $.50/bushel in 1 week. Meal market continues to be supported by seasonal strength, Argentina’s record low supply of beans to crush, and China’s announcement of highest quarterly hog output in 10 years spurred more buying today. We will see if the conflict in the Middle East spills over to other countries in the region while the trade awaits the latest announcement on demand with sales for futures shipment released tomorrow morning. Until then bean technical levels for the remainder of the week come in as follows. Support is down at 1300, the 200-week moving average and then 1295. A close under 1295 and its katy bar the door to trendline support at 12.70. Under 12.70, the next level of support is the bottom edge of the Bollinger Band at 1256. Resistance is at 1323. A close over and its 1333.Over 1333, and the market can challenge 1365 and then 1377. Chart below.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604