Grain prices rallied Friday as short covering in the soy complex lifted corn and wheat prices to finish the week. Today, beans finished 20 cents higher, soy meal four handles higher,with bean oil up 46 ticks. The net short coming into the week totaled near 100 K shorts of beans, meal. and oil. Uncertain weather outlooks, late plantings in key areas, and low crop ratings were most likely the cause for the short covering into the weekend. Corn finished up 6 cents, while Chicago Wheat finished 9 higher.In my view we saw some unwinding of long corn/short bean positions today as well as wheat vs corn. We saw the grain market rally into last weekend, only to see those highs faded once the crop ratings were released last Monday afternoon. Will we see the same price action next week?

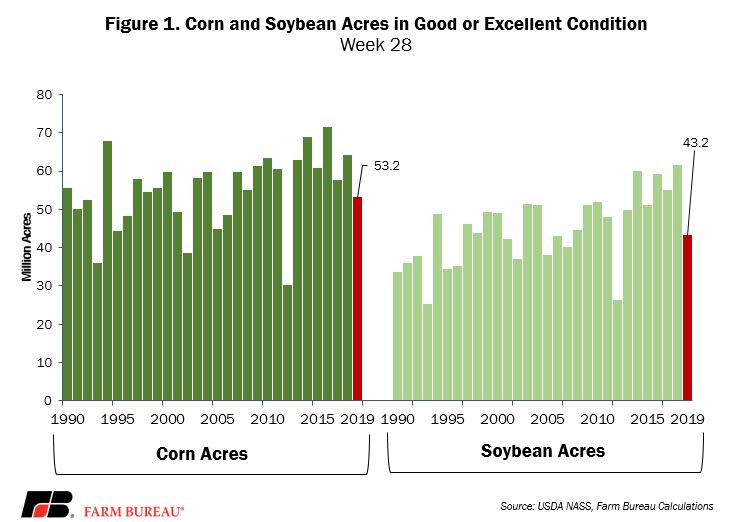

I copied the above crop condition table from the Farm Bureau website. They note we haven’t had ratings this low since 2012 for acres in good to excellent condition. Note: we planted on time that year and then were plagued by an epic drought that sent futures prices soaring. This year, we planted very late but now have decent growing conditions in many areas. Crop ratings are very subjective and can improve or deteriorate rapidly each week. Because of the late planting dates, the market will most likely remain in a buy the dips mode until next months crop report, where acres, yield, production and ending stocks data will be released (8/12). Currently Dec corn sits at trend line support at 4.36. Next major support is at 420. A failure there and its 404 and then 392.4. Key Resistance is at 463, (this weeks high). A close over and it 4.68 (20% higher for year). If they blow through this level its 4.91, and then 5.07, which is 30 percent higher for year. I don’t think we are going to hang around sideways at 4.30-445 area for much longer and probably not after the Aug 12th report. I would suggest using option strangles for strategy. Using October options priced off the December contract that expire in late September, consider the following strategy. Buy the Oct 460/500 call spread for 7 cents. Buy the Oct 410-380 put spread for 5 cents. Work to buy the strangle at 12 cents OB. For Soybeans we settled at 920. Over 936 and its 971 and then 980 November beans. Under 902 and its 885, and then 868 and possibly 862. Buy the Oct 880 put for 8 cents for downside protection. For upside exposure, buy the Nov 19/Nov 20 spread at 36 cents Nov 19 under. You can use a stop loss at 44 cents, Nov 19 under or buy the Oct 880 put for protection.

I have plenty of speculative and hedge ideas for your needs. Call me at 888 391 7894 or email me at slusk@walshtrading.com with any questions or comments. Please join me every Thursday at 3 pm Central time for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts along with trade ideas and hedge strategy. A recording link will be sent to your email. Sign Up Now