Commentary

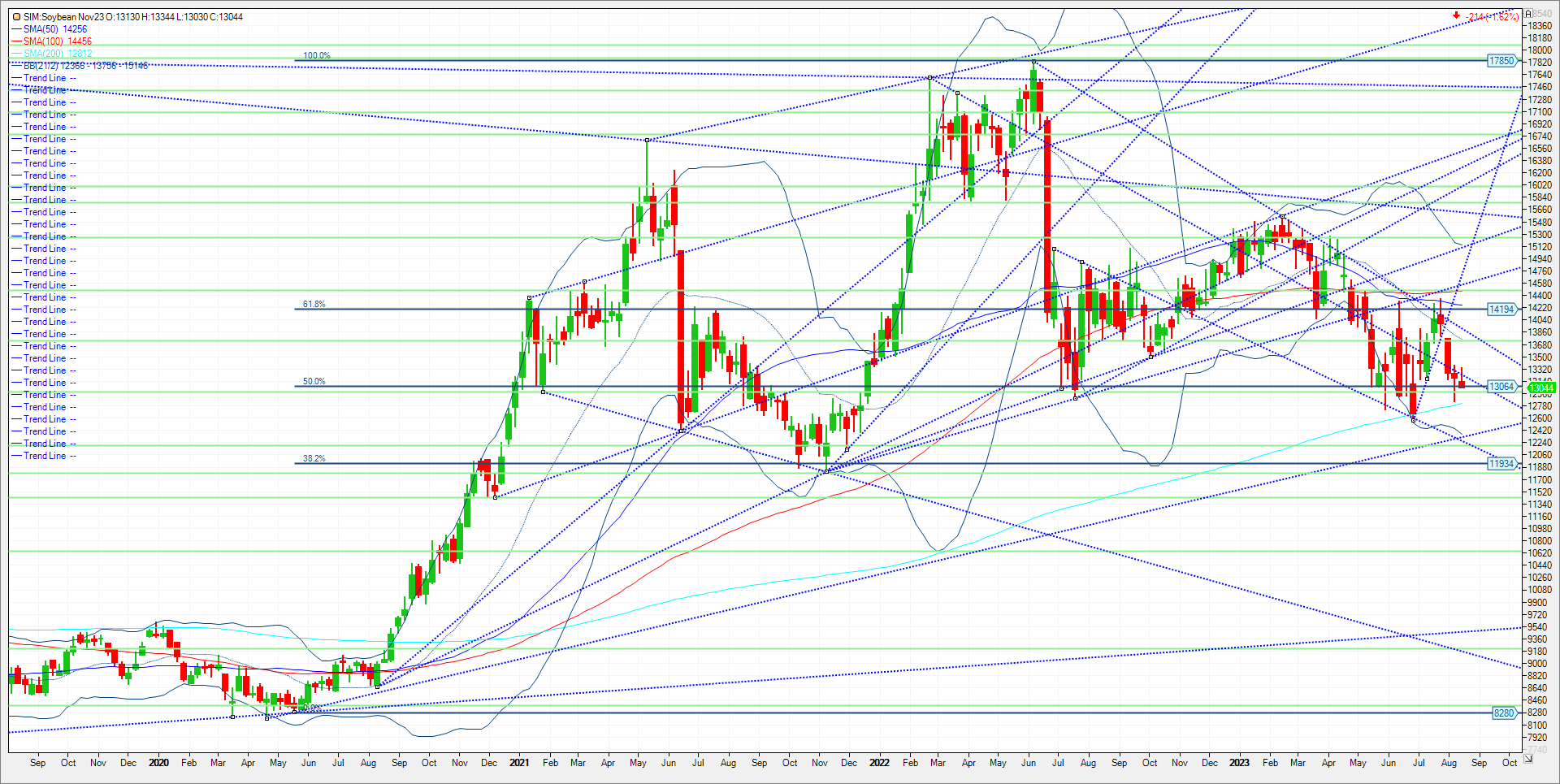

Both corn and soybean futures faded and drove lower today as crop condition soybean ratings improved 5 points in the good to excellent category while corn rose two points. A cooler and wetter Midwest for the first three weeks of the month of August has given thoughts that the worst is behind us as far as crop conditions are concerned. Yesterday there were and possibly still are concerns that a late August heat wave will impact the Plains and Western Corn Belt this weekend through the early to middle part of next week where extremes of 100 to 110 are likely in the Plains and 95 to 104 in the western Corn Belt. Dry weather is expected in the Plains and Midwest from the second half of this week through the first half of next week. Even if the forecasts verify hot and dry, it may not be enough to alter crop condition significantly lower where it affects the balance sheet to draw down ending stocks below 200 million bushels in my opinion. Aside from supply side (weather) concerns, demand is non existent for wheat and corn, while China continues to favor Brazilian origin for soybeans. China’s desire to take advantage of Brazil’s cheap currency and its bumper soybean crop continues to depress US new crop bean exports. It continues to import roughly 2 million metric tons per month more than it crushes, sticking the surplus soybeans away in its reserves. Corn’s balance sheet is cumbersome at 2.2 billion bushels while beans could be come tighter late, if weather damages yield. The USDA is at 245 million bushels, not overly excessive but not extremely tight either. Key support is at 1295, which is 15 percent threshold down on the year. Key support is the 200-week moving average at 1281. A close under and its katy bar the door to 1232. Resistance is at 1321. A close over is need ed again to challenge last weeks high at 1338. A close over this level and the market could challenge the gap at 1376 to 1380.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604