Commentary

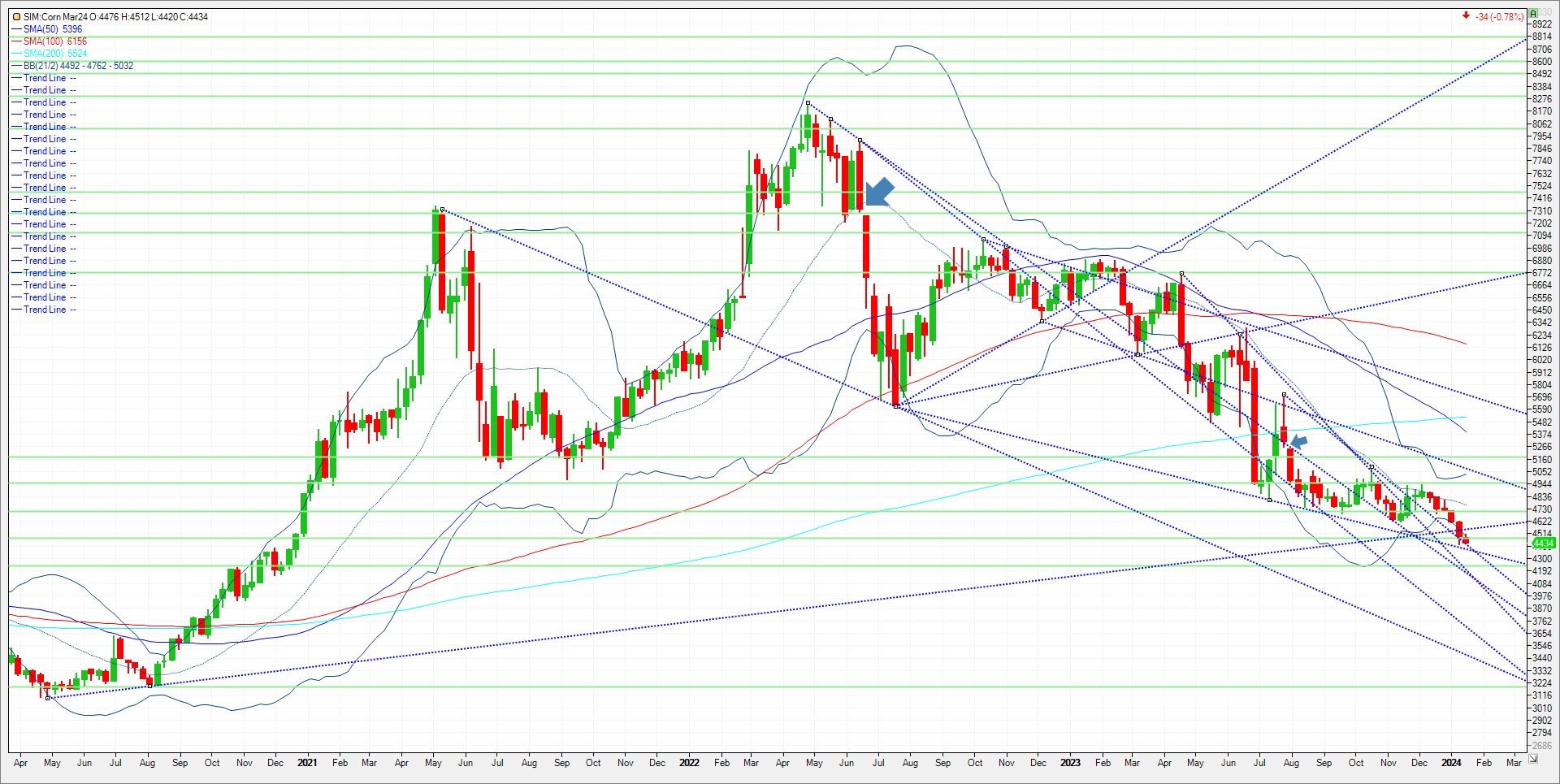

No favors from the USDA last Friday for the corn market as a surprise 2.4 bushel increase in yield didn’t come close to offsetting a decrease in harvested acres. Despite ethanol numbers and feed use being raised ending stocks still rose in corn 31 million bushels. If that wasn’t enough, per Hightower, the USDA cited China’s government corn stocks stats increasing their production by 13 million metric tons which caused global ending stocks to swell 10 million metric tons for the global carryout released Friday. What a joke to cite their numbers. It is an election year here don’t forget. Aside for the report day nonsense from USDA, the reality is that supply outstrips demand by a sizable margin. Corn needs a story and currently doesn’t have one. While that can change in a NY minute, sales for future shipment while meeting expectations for now, is doing nothing to give any thought to the USDA raising exports to lower a sizable 2.162-billion-bushel carry. The estimated net short by managed money coming in to today’s trade sits at 246K contracts short. The record net managed short is 344K. Not that far away. With crude oil, wheat, and beans sideways to lower as we begin 2024 amid a higher Dollar, where is the bull story to come to aid corn? If rains shut off in South America would be one answer; but for now, there is no case or weather premium to be made in my view. Unless we see and uptick in demand, I look for more of the same as sideways to lower could be the trend until we get to the AG Forum in Mid-February which gives the market its first look at planting intentions for the 24/25 crop. Technical levels for the remainder of the week for corn comes in as follows. Support is first at 442 and then 437. A close under 437 and its katy bar the door to 424 (10 percent down for year), and then 419. To turn bullish, we need a close above 4.55. A close above could push the market to 4.71 which is unchanged on the year and then the 21-week moving average at 476. Please notice the death cross on the weekly chart. The 50-week moving average is below the 200-week moving average. This needs to change in order for a corn rally in my opinion. See chart.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604