Commentary

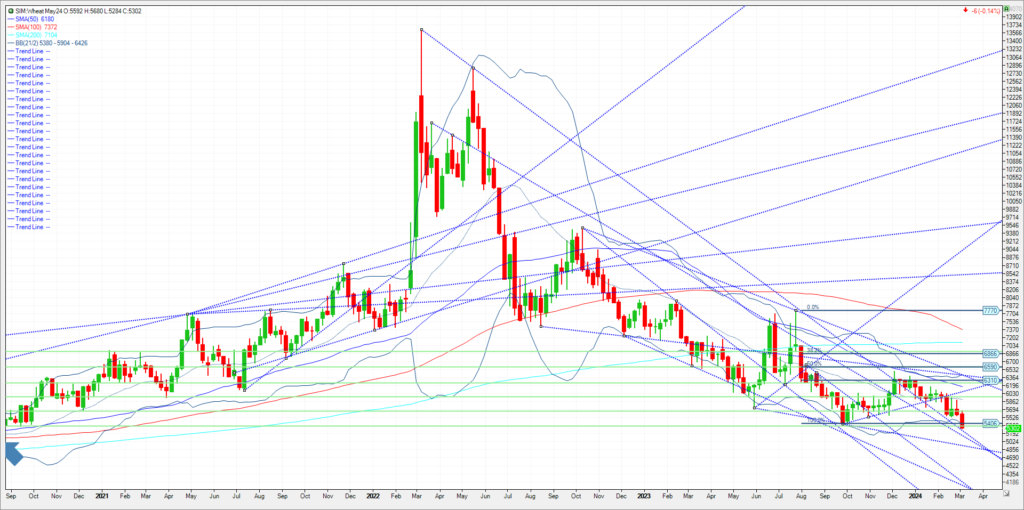

May Chicago wheat plunged 20 cents to $5.31, ending near the session low after a move to a fresh contract low. May KC fell 13 cents to $5.56 1/4, forging a low-range close, while May Minneapolis wheat fell 10 1/4 cents to $6.45 1/4. The break in prices especially in front month contracts comes on two fronts First, Black Sea/ Eastern European wheat continues to show weakness leaving US futures to follow in tow to remain competitive. Second and maybe more importantly rumors surfaced that China was cancelling of a previous sale for future shipment of old crop wheat, delivery prior to June 1st. The rumor hit the wheat spreads hard as the May 24/July 24 spread traded 7 cents lower to an 11,4 cent carry amid a high-volume day of 42K cars. The day prior saw volume of 20K cars. Now the trade looks for confirmation of the cancel. This could end up being a sell the rumor, buy the fact event. We have a WASDE from USDA on Friday at 11am and Stats Canada on Monday. For the WASDE, the average trade guess for ending stocks is 657 million bushels. That is down only1 million from last month, with the average trade guesses at 648 and 682 million bushels. Monday’s Statistics Canada planting intentions report is expected to show all Canadian wheat plantings for 2024 at 26.7 million acres, down from 27.0 million acres in 2023, with spring wheat at 19.3 million vs 19.5 million acres last year. Wheat bulls could use some friendly data as lack of demand and lack of weather premium translate to a sell the rallies mentality where managed funds are defending their positions. Technically, todays settle is one penny under trendline support and 15% down for the year at 5.33. Next support is 5.22. Should that not hold, look for an old gap to be filled at 5.08 from August 2020. 20% down for year is at 5.03 and underneath that is trendline support at 4.94. Yikes. The key resistance is 5.66.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now