Commentary:

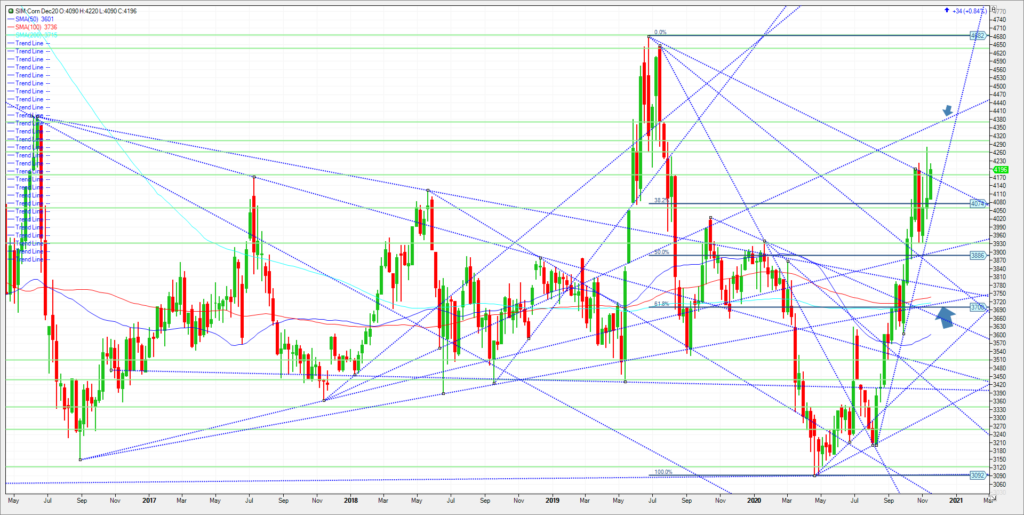

March 21 futures is now the most actively traded contract for corn. Look for potential rolls out of December into the weekend and into Thanksgiving. Seasonally we rally into Turkey day and the Friday after but I caution all that 2020 is an oddball year. So in my view throw seasonal tendencies out the window. Trade the charts. March 21 futures settled today at 426.6. That level represents ten percent higher on the year. The next level to the upside is 437. The recent March 21 high is at 4.35. Should 4.37 get taken out, there isn’t much in the way in my view, for the market to eventually test near last years high at my next resistance level at 464, (20 percent higher on year threshold). Although we could see a brief stop or resistance at 445, which represents the 15 percent higher target. If we fail to hold in here and profit taking ensues led by the bean market, these 250 K corn longs could look to book profits ahead of year end. Will traders and funds liquidate positions and book realized profits prior to year end ahead for tax avoidance purposes into 2021? A big question for the next 6 weeks. A close under 416 in March 21 futures could plunge prices to 406.2 and then the recent low double bottom at 393. If you are looking for a bearish option play moving forward, consider the following strategy below.

Trade Recommendation

Futures-N/A

Options-Buy the Feb Corn 400 put while at the same time selling the Feb corn 350/400 call spread. Bid -42 cents. The maximum loss on this strategy -50 cents.

Risk/Reward

Options-the maximum risk and loss is 50 cents or $2500.00 plus commissions and fees. However one is collecting 42 cents upon entry or $2100 minus commissions and fees. The risk is then 8 cents or $400.00 plus trade costs and fees. the options expire in late January, Call me with questions.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.