Commentary

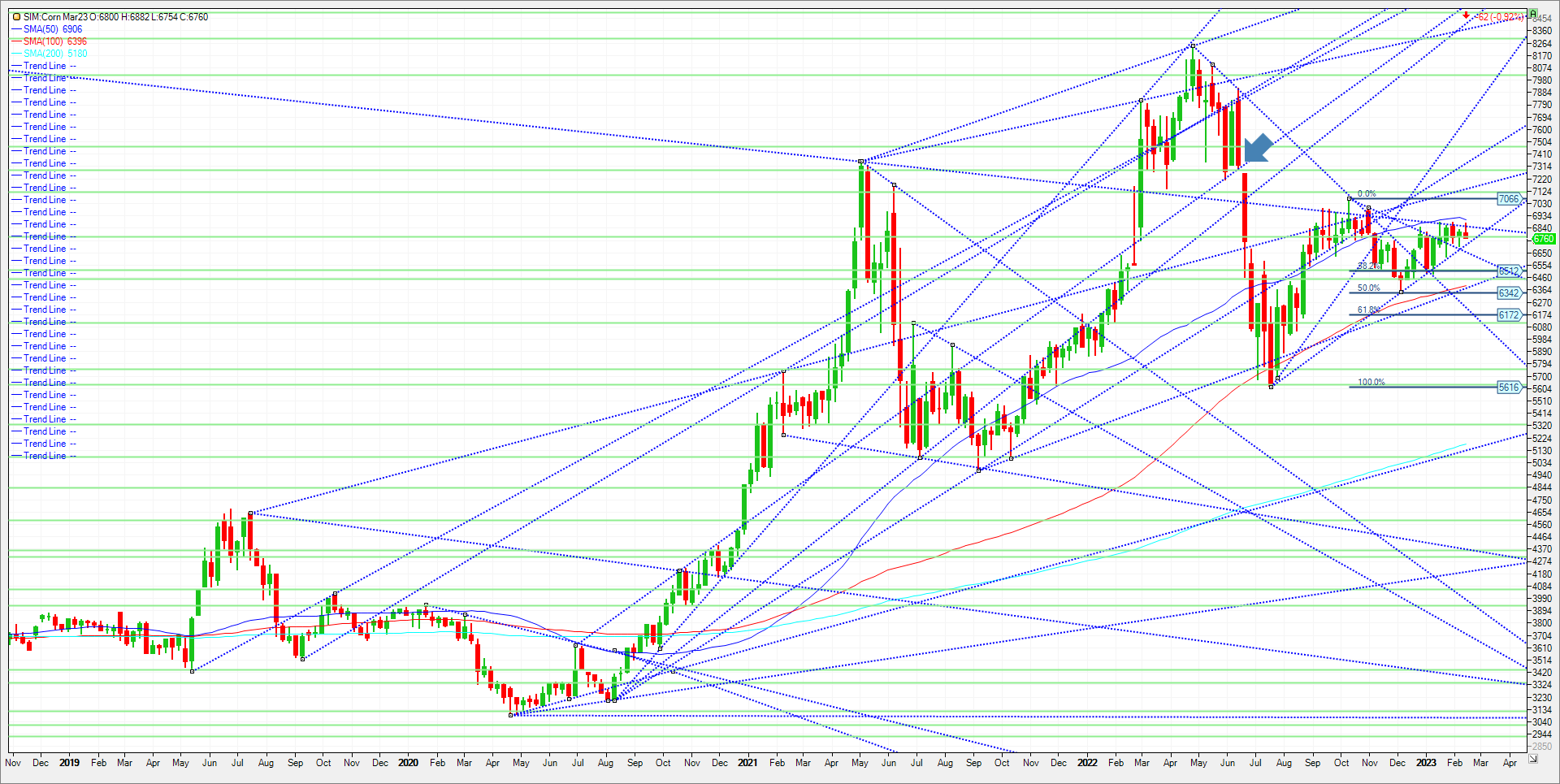

March corn again tested the $6.85-$6.88 3/4 resistance area this week, but that area has help as significant resistance. Bears therefore were able to follow through to the downside in today’s price action back to 6.75. The U.S dollar index rose to levels not seen since the first week of January, further pressuring corn and wheat prices in my view as retail sales data from January bested expectations. USDA reported a daily sale of 213,370 MT to Mexico this morning. This follows the recent dispute over GMO corn over the last several days, which resulted in Mexico allowing imports for GMO corn for animal feed and industrial use. There’s been a lot of chatter in regard to weather and its impact on future yields in South America. Why wouldn’t’ there be? We have 15.00 beans and 5.00 meal trading in the spot futures. Brazil is virtually inactive in offering corn for export currently. ANEC (Brazil’s USDA) says Brazil is likely to export 2.1 million metric tons (mmt) of corn in February which is down from the 2.3 (mmt) it was previously forecasting. It is my belief that Brazilian producers remain reluctant sellers of their 22/23 crop and thus are at their lowest percent committed to the expected total in 6 years per ANEC. That said, the majority of their exportable supply is being planted now as soybeans are harvested. Outside of anything new entering the market, we will be watching basis levels in North and South America, along with the technical levels. Technical levels for remainder of the week. March Corn has support at 671.4. A close under and the market moves to 6.65. Under 6.65 look for a move to 6.45. Resistance is at 6.84. A close over and it’s the 50-week moving average at 6.91. A close over 6.91 and its 7.12, which represents 5% higher on year.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604