Commentary

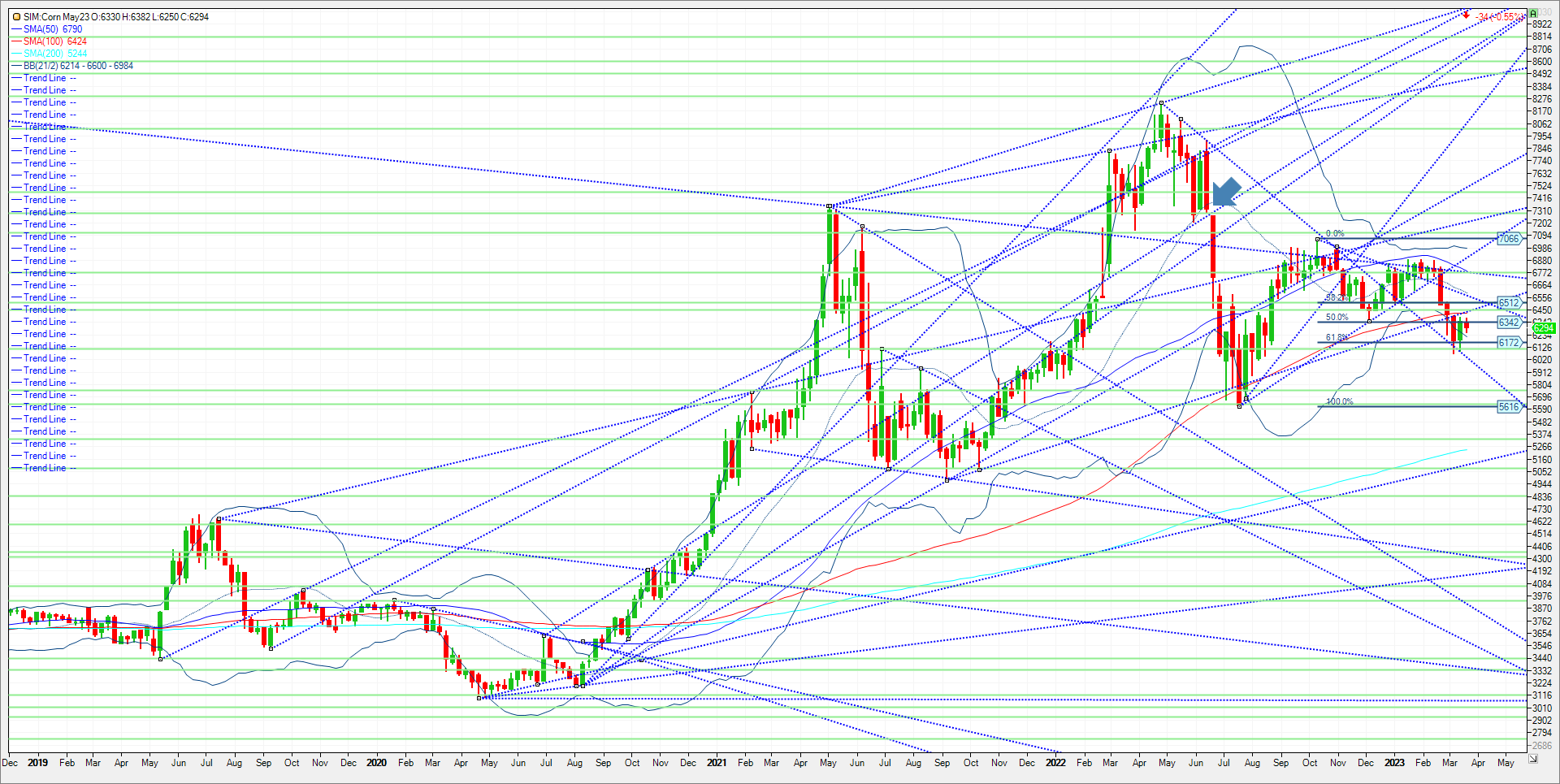

The USDA announced a flash sale announcement yet again into China for US corn. Todays purchased marks China’s its fifth daily purchase in the past six sessions. Today’s sale was light, this just 136k tonnes, or 5.35 million bushels. That brings the cumulative sales over that span to 88.5 million bushels, which will start to show up officially on the weekly export sales reports starting this Thursday. Total U.S. corn sales so far in 2022/23 stand at 268 million bushels which unfortunately is still behind last year’s pace by 200 million bushels. China imported 1.5 MMT of corn from Brazil over the first two months of the calendar year, according to the country’s customs data. The fear for the US producer is that they’ll likely make Brazil their main supplier when available, over more expensive U.S. supplies and reduced availability from Ukraine and drought-stricken Argentina. With a key rate announcement by FOMC tomorrow, banking contagion rumors all over the place, uncertainties abound in my opinion. Watch the technical action in my opinion. May corn has support at the 6.22/23 level. A close under and its 6.11 then 6.04. Resistance comes in at 6.42/6.45. A close over and the next level of resistance is 6.58. Disappointing day for the bulls in the grain sector in my opinion as the overnight/morning rally faded to a sea of red by the close. A lot of noise and upcoming announcements that have major ramifications for the credit markets and greenback may have had something to do with it. That said, the announcement by the Treasury Secretary that any and all Banks like SVB will be supported moving forward created some uneasiness that may have pushed some longs to liquidate today. Weekly Corn continuous chart attached.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me every Thursday at 3pm for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.