Commentary

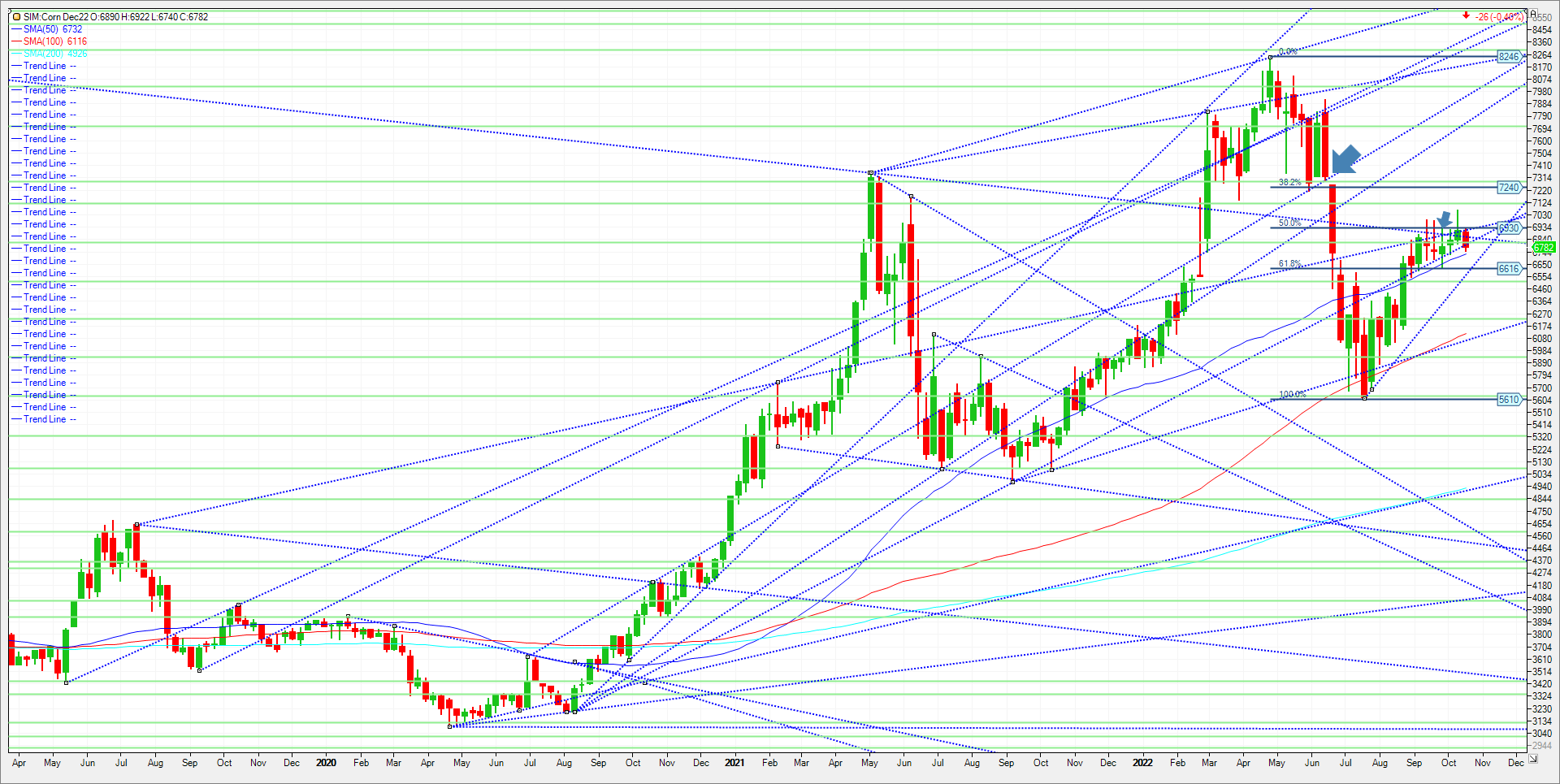

Soybean and corn harvest is moving along rapidly in most areas. Some areas are better than they thought; some worse. But that always seems to be the case. For the amount of rain received in some areas, overall, the corn crop is better than expected in my opinion. As harvest advances the unknown production estimates become a known in my opinion. The USDA will update their findings on Wednesday November 9th. After that report, grains become a demand driven market in my opinion, as US production becomes a known. Export sales data will be released tomorrow giving an updated look at the export situation. The previous export sales report for week ending October 6, showed 528 million bushels of corn sold so far for the 2022/23 marketing year. At this same point last year, 1087 million bushels had been committed to export. The 5-year average is 791 million bushels. 105 million bushels of corn has actually shipped for 2022/23 compared to 134 million bushels at this point in 2021/22. In my opinion, demand needs to pick up the pace or the market could see a corrective pullback to perhaps a 50 percent retracement from the July low at 5.61 to last week’s high at 7.06. That level comes in at 6.32. However, a close over 6.93 could push the market up to 7.28, where there is a gap on the weekly continuous chart.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax