The grain rally up and through harvest so far has been impressive and comes on a few fronts. Dry August weather in the US apparantly reduced a potential bin buster crop to an average one. This comes as the market is also gearing up for USDA’s Crop Production and Supply & Demand Report (WASDE) released Friday at 11am Central. Pre-report guesstimates which should include smaller crop estimates from USDA amid robust demand. That is expected to pull its carryover projection around 90 million bushels lower than last month to 370 million bushels.Soybean futures are blowing off improving crop condition ratings and open harvest weather, with speculative money flowing into the market. Open interest topped 1 million contracts yesterday, hitting a new record on talk of Chinese crusher demand. In my view, trend and Index following funds are more focused on the slow start to planting in Brazil and continued strong export demand for U.S. soybeans. The U.S. inspected 1.677 MMT of soybeans for export the week ending Oct. 1, with the majority of those beans destined for China. Also encouraging, USDA announced a 154,000 MT daily soybean sale to “unknown” this morning. The market is also noting dry weather and heat have slowed planting in Brazil, but it’s still relatively early in the season and the lag is not all that severe. The bigger story is that slow planting could leave the U.S. export window open longer, deeper into February.

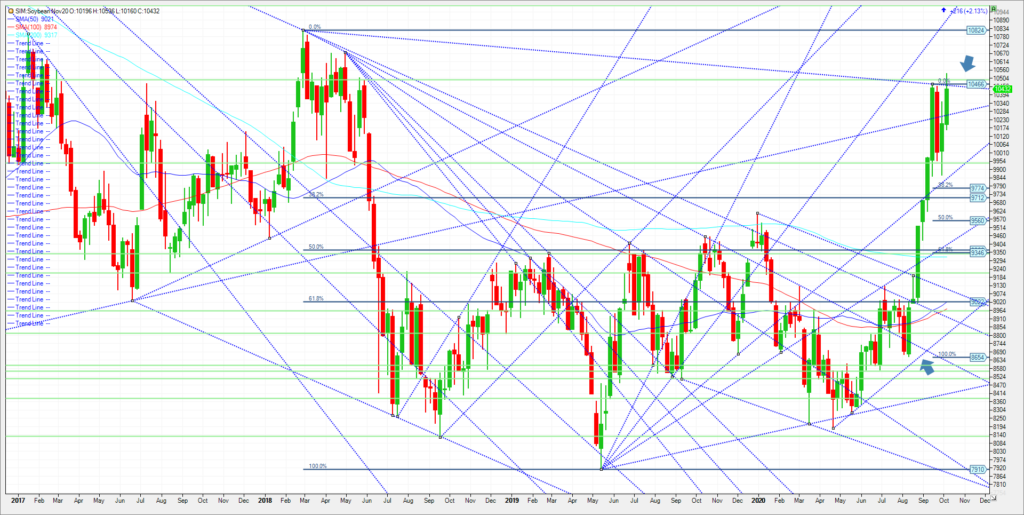

November soybeans made an intra day high at 1053 today, but closed just under weekly trendline resistance at 1046, to settle at 1044. (See chart).Watch that level as a close over could prod funds to push prices to test two year highs at 10.82. If that high gets taken out, look for the market to trade to the 15 percent higher on then year level at 10.97. Ten percent higher for year is at 10.50. We have failed at this ten percent threshold so far. However it maybe just a matter of time before its surpassed given the drought like conditions so far in South America. If they persist into November, I think funds push higher. Key support is at 10.26 this week, and with a close under, major support maybe tested at 9.88. Call or email me with some ideas into Friday’s report. Its bearish US weather and harvest pressure versus bullish demand and a potential weather event in South America.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.