Commentary:

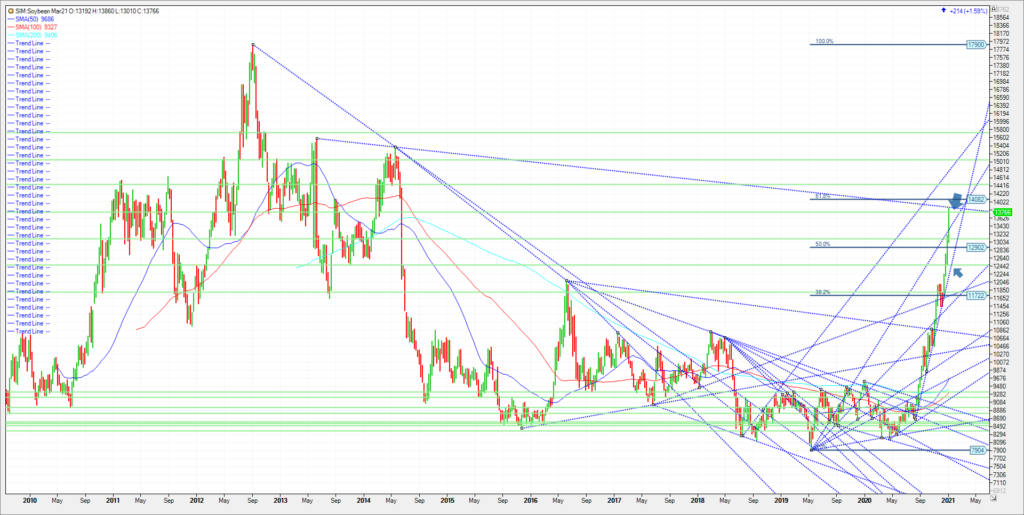

Beans closed a volatile 2020 in the teens ending the year at 1311. What seems like decades ago, the 2020 low made last Spring during the height of the pandemic and initial lockdown was 818. The August lows were at 8.65. Since then we rallied almost 4.50 into year end and for 2021, we have pushed 5 percent higher for the year in the first week. La Nina in South America and insatiable demand in China are two of the reasons. In my view it’s a percentage game now and the reason I say that is because we are 6.5 year highs. We need to go back to the 2012-2014 for some context moving forward on where prices may go from today’s settle at 1374 basis March 21 beans. Weather will be the ultimate bellwether on prices in the long run given that we are said to be in a severe La Nina that is affecting South America. However, prior to that we have one of the biggest crop reports of the year released Tuesday January 12th. Perhaps we will see some profit taking prior to the reports release and then again maybe we will not. The number I am focusing on for Beans is Ending Stocks. Last month it was 175 million bushels. The average trade guess for this report is 139 million (105-166) range. Any variance outside of the range could send beans 40 to 50 cents in either direction. The USDA is known for throwing the trade curve balls in these reports, and this report is one of the most watched of the year given the amount of data from prior crop years, planting data for wheat, Global production and future supply and demand. It’s a quarterly stocks report combined with a monthly supply/demand. With the potential for US ending stocks to trickle below 100 million bushels and lower crop sizes in SA, this market could get crazier. Don’t rule anything out regarding a 3.00 break or rally from here into March.

As stated we closed 2020 at 13.11. Percentage levels of note into 2021. 13.76 is 5 percent higher.(achieved).

10 pct-1442

15 pct-1507

20 pct-1573

25 pct-1639

30 pct-1704

Five percent lower for the year is at 1245.

10 pct-1180

15 pct-1115

20 pct-1049

25 pct-983

30 pct-918

Trade Recs-

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71