Commentary

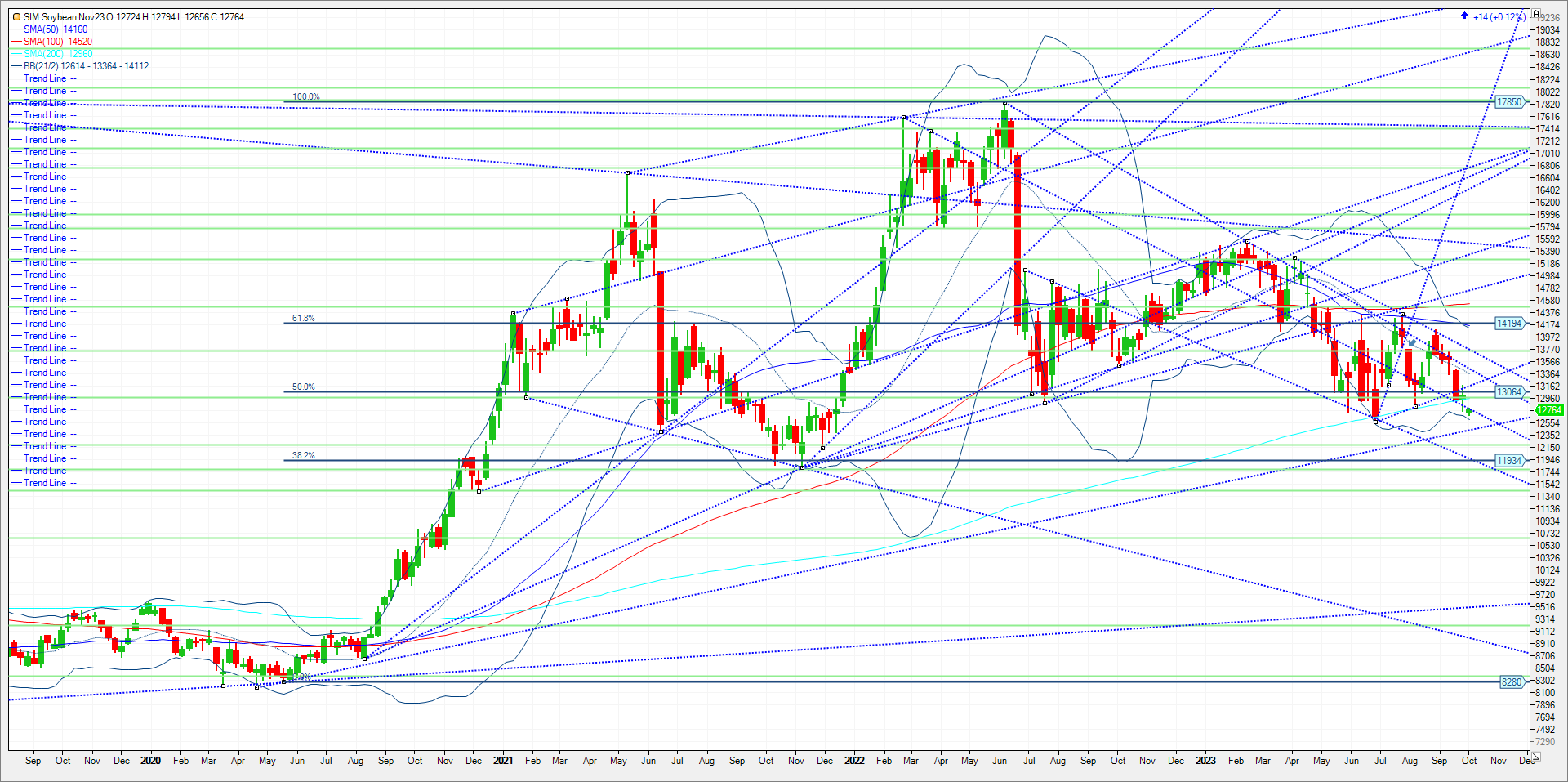

November soybeans rose 2 cents to $12.77 after marking the lowest intraday level since June 29. December meal fell $6.90 to $374.30, the lowest close since June 12, while December soy oil rallied 160 points to 57.43 cents, ending the session above the 200-day moving average. Soybeans struggled to garner much bullish momentum from the surging corn and wheat markets as the crush market continues to slide. Friday, Sept. 29 quarterly grain stock report was friendly for corn, negative for beans, and neutral for wheat. Wheat is 90 days from high to a low on the quarterly stock report. The report showed a lot of on farm corn left over. Marketing year to date soybean export inspections through the first four weeks of the year total 73 million bushels. That falls short of the seasonal pace needed to hit USDA’s target by 9 million bushels. However, the seasonal pace picks up with huge spikes of inspections in the weeks ahead, rising to more than 80 million bushels per week over the coming four weeks. In my opinion the market should get a good feel over the next two to three weeks on China’s intentions for taking U.S. soybeans this year. Technical levels for the remainder of the week in November soybeans comes in as follows. Support is bottom of the Bollinger Band at 1261 then trendline support at 1247. A close under trendline support could push the market down to 1220 (20% down for year), and then 1196. Resistance is at 1282, a close over and it is 1294 and then 1299. A close over 1299 and its 1317. Over 1317, then its 1345.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604