Commentary

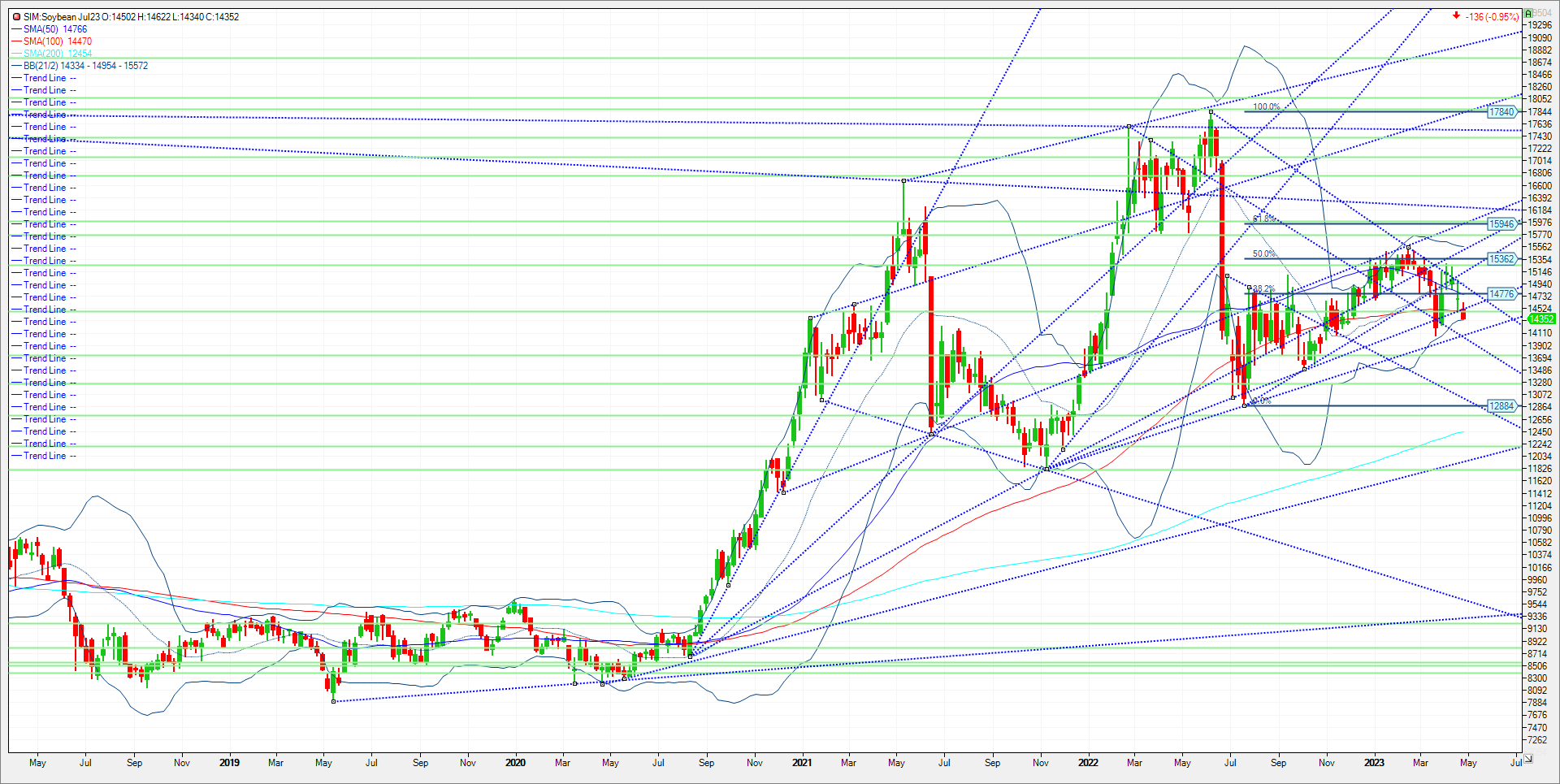

Old crop soybeans are starting to move lower on two fronts. Late last week it was reported that at least two cargoes of Brazilian beans have been sold into the US market. Despite old crop maintaining a significant inversion to new crop contracts, Brazil origin is trading at a $2 per bushel discount to the US market. It is my belief that with tight old crop domestic supply, that the door is opened for more bean imports into the Southeast from South America. Brazil is harvesting a record crop and farmers are selling as much as they can for immediate shipment because they don’t have the storage facilities to hold in my opinion. Brazil’s soy shipping pace puts it 3.5 million metric tons ahead of last year. On one end, Brazil has grown a bumper crop, while Argentina continues to suffer. Private estimates in Argentina now put the crop at 22.5 million metric tons, more than 50 percent down from last year. The market rallied early today, but even May 23 beans after rallying today to $15.00 after the open, fell apart mid-morning, and dropped 35 cents from the highs. Second, COT data showed managed funds long 135K contracts as of last Tuesday. Technically we have settled below key support for two sessions in a row. For me its profit taking amid liquidation that is adding to the selling pressure amid US imports and weaker basis levels. I included a weekly chart. Support is 14.33, bottom end of the Bollinger band. Should that level get taken out look for the market to retest trendline support at 14.09 and 14.05, which are the March lows. If those support levels are taken out. Look for the soybean market to test 13.72, which is the ten percent down for the year threshold. Resistance is at the 100-week moving average at 14.48. A close over here is needed plus as well as a close over the trendline just above it 14.53. Should that happen on a close over these levels, look for soybeans to revisit the 14.80 level , then 14.92, and 15.10. See weekly continuous chart.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Option-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm . We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604