Commentary

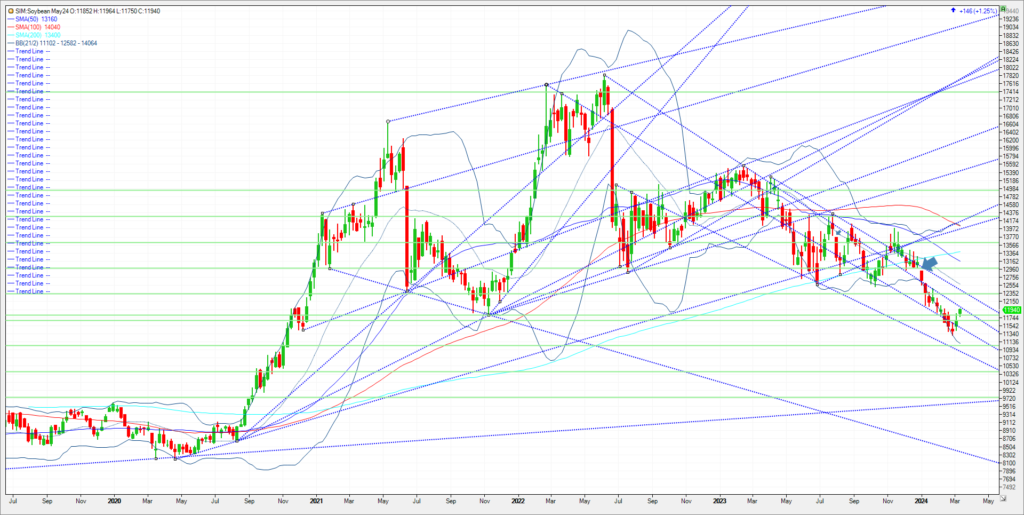

May soybeans rallied 16 3/4 cents to $11.96, a one-month-high close, while May meal rose $2.00 to $339.20. May soy oil surged 118 points to 47.82 cents, marking the highest close since Feb. 8th. The market in my view rallied on one headline. Brazilian government supply agency CONAB, which is the Brazilian version of the USDA cut their 2023/24 soybean production estimate from 149.4 to 146.9 MMT this morning, compared to 154.6 MMT last season. Total corn output fell from 113.7 to 112.8 MMT, down from 131.9 MMT last year; second-crop production fell from 88.1 to 87.3 MMT, compared to 102.4 MMT in 2022/23. Beans down to 146 million metric tons versus the USDA at 155. Will the USDA come down in next months WASDE, and will it matter, as the market slowly focuses on Spring plantings. A little tidbit in last week’s WASDE had USDA raising China’s soybean imports to 105 million metric tons which is a record. Today’s cut by CONAB gave the funds some reason to short cover in my opinion. Brazil currently is 55% harvested. Farmer sales are close to 37 percent versus 50% the 5-year average. Longer term for old crop beans the fundamentals are still bearish in my view. Despite Brazil being downgraded again, Argentina’s bean production is 20 to 25 million metric tons versus last year. That doesn’t help old crop demand in my view, or the fact that beans into China from Brazil are still significantly cheaper than US origin. In my view in the interim, it is wise to focus at technical levels in May soybeans. Major resistance is 11.99, just above todays close. A strong close above it and we could trade up to 5% down for the year marker at 1234, then trendline resistance at 1245. A close above 1245 and I think the market will challenge the 21-week moving average at 1258. Support is 1168. A close under 1153. A close under 1153 and its katy bar the door to 11.17 on the weekly continuous.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604