Commentary

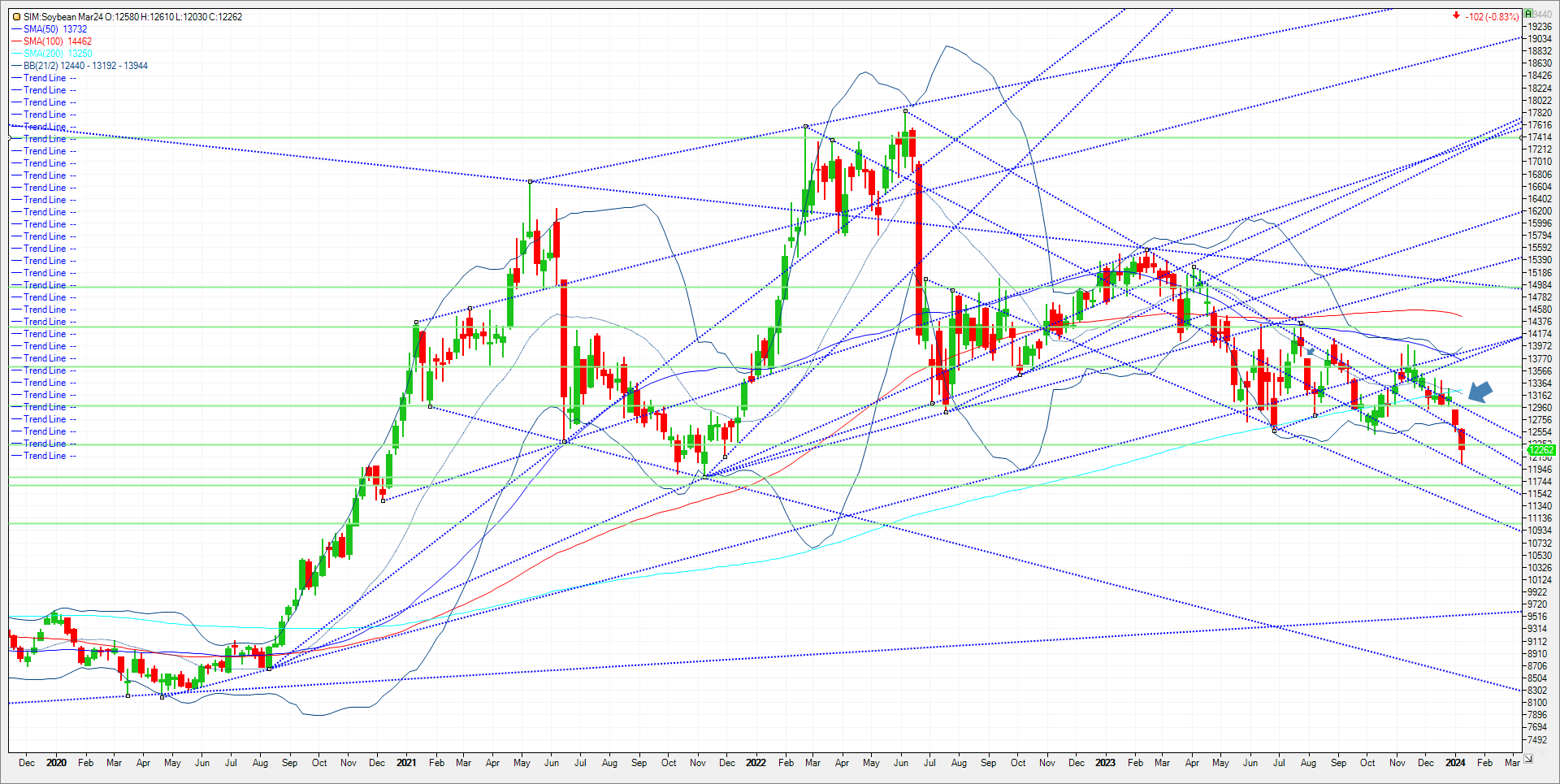

Bigger US soybean yields that overcame smaller US acreage were the main factor in driving the soy complex lower today in my opinion. USDA raised its soybean production estimate 36 million bushels to 4.165 billion bu., which was 38 million bushels more than expected. USDA increased yield 0.7 bu. to 50.6 bu. per acre. Harvested area was cut 435,000 acres to 82.356 million acres. States contributing the greatest to the increase came in as follows… IL up 2, WI up 2, MO up 3, and TN down 3. The USDA kept the demand base virtually unchanged and put the added production into the carryout. The US has the largest nominal carryout since 2019. Where to from here? See chart below. We just missed hitting a long term downward trendline at 12.02 today, with the day and week low made post report at 12.03. Market firmed late into the three day weekend. Since the close of 2023 we have seen the bean market open up 2024 with a gap open lower of 6 cents, then a fall to the 5 % threshold down for the year at 1234. Today’s report sent the bean market another 30 cents lower, before shorts covered into the close. Resistance next week is the bottom edge of the Bollinger band at 1244 and trendline resistance at 1250. A close over both these levels matters as to give any thoughts and potential for a rally to the gap at 1291-1296, (see blue arrow on chart) with trendline resistance in between at 1295. What would rally the market from today’s close? Quick answer would be weather in South America. A return to hotter and drier conditions in Brazil might prod recent shorts to cover. Outside of a weather premium, demand in my view would need to exceed expectations to stage a rally or something else friendly would need to enter into the market in my view. Each new low will bring some bargain buyers and I think we saw some bargain hunting/short covering into todays close. Could more be forth coming? Sure, but I think a likely scenario and bearish from a demand standpoint will be possible Chinese cancellations of previously made purchases. In my view between China and “Unknown Destinations”, there is a total of 400 million bushels unshipped. If we see maybe 10 to 20 percent of these sales cancelled in favor of cheaper South American origin, the USDA will have to account for the cancellations on the balance sheet. We could see endings swell past 300 million bushels. The USDA made no changes to demand on today’s report. I doubt that it stays that way. With this in mind consider the following options trade especially if you grow beans or have unpriced old crop supplies.

Trade Ideas

Futures-N/A

Options-Option risk reversal here. Buy the May 12.00 soybean put and at the same time sell the Nov 24, 1380, call. Bid at even money. ZSK24P1200:ZSX24C1380

Risk/Reward

Futures-N/A

Options-Unlimited risk here as it is a hedge strategy built for a soybean producer with unpriced bushels. That said one is long a put with a late April expiration vs naked short a call option that expires late in October 24. As one enters into the position as a spread one should exit as a spread. Spec traders can play this too, but I would use an appropriate stop loss on a GTC basis. Call me with questions. My initial downside target is 1168. which represents 10 percent down for the year.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604