Commentary

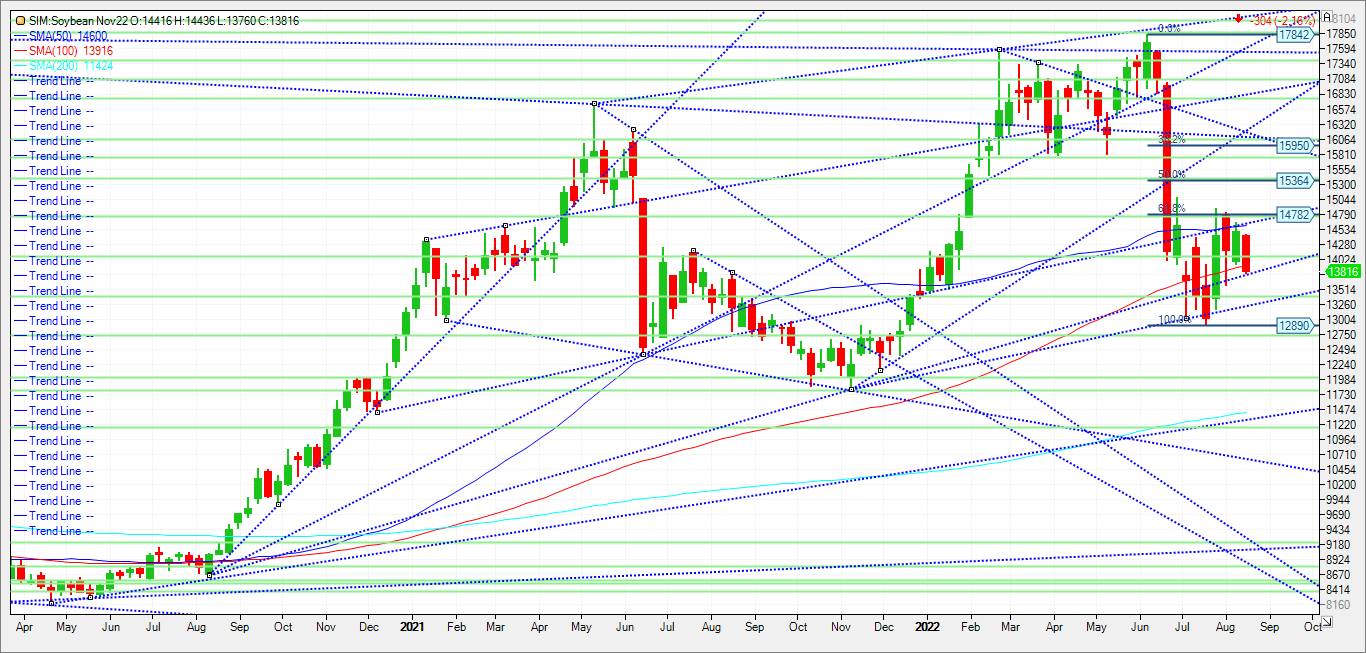

Soybeans fell to the lowest levels in over a week on an outlook for mostly favorable weather across the Midwest. Further pressure seen today maybe stemming from weakness in crude oil, which is trading near six-month lows. USDA late Monday reported 58% of the soybean crop in “good” to “excellent” condition, down from 59% a week ago and in-line with trade expectations. Upper corn belt and the ECB were up enough on the ratings to offset the sharp declines in the WCB, especially Iowa which fell 8 points. USDA pegged the crop at 51.9 bushels per acre in its August estimate on Friday, up from its previous trend yield estimate of 51.5 bushels per acre. It used a farmer survey, satellite data and its own modeling to arrive at that yield in my opinion. August is the critical month for soybean yields and the weather for now with is forecasted with cooler temps and better rain chances for places of need in the next 10 days. Chart below, but technical levels for the remainder of the week come in as follows for November 22 soybeans. Key support is 13.77. A close under and in my view the market could fall all the way to 1324. Under this level and we could push down to 1288 and then 1272. Resistance is first at the 100-day moving average at 1391 and then up at 14.06. A close above 14.06, could push the market back up to major trendline resistance at 14.61. If the market takes out that level, we could see a rally to 14.80 and then to the 15.36/15.40 area in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604