Commentary

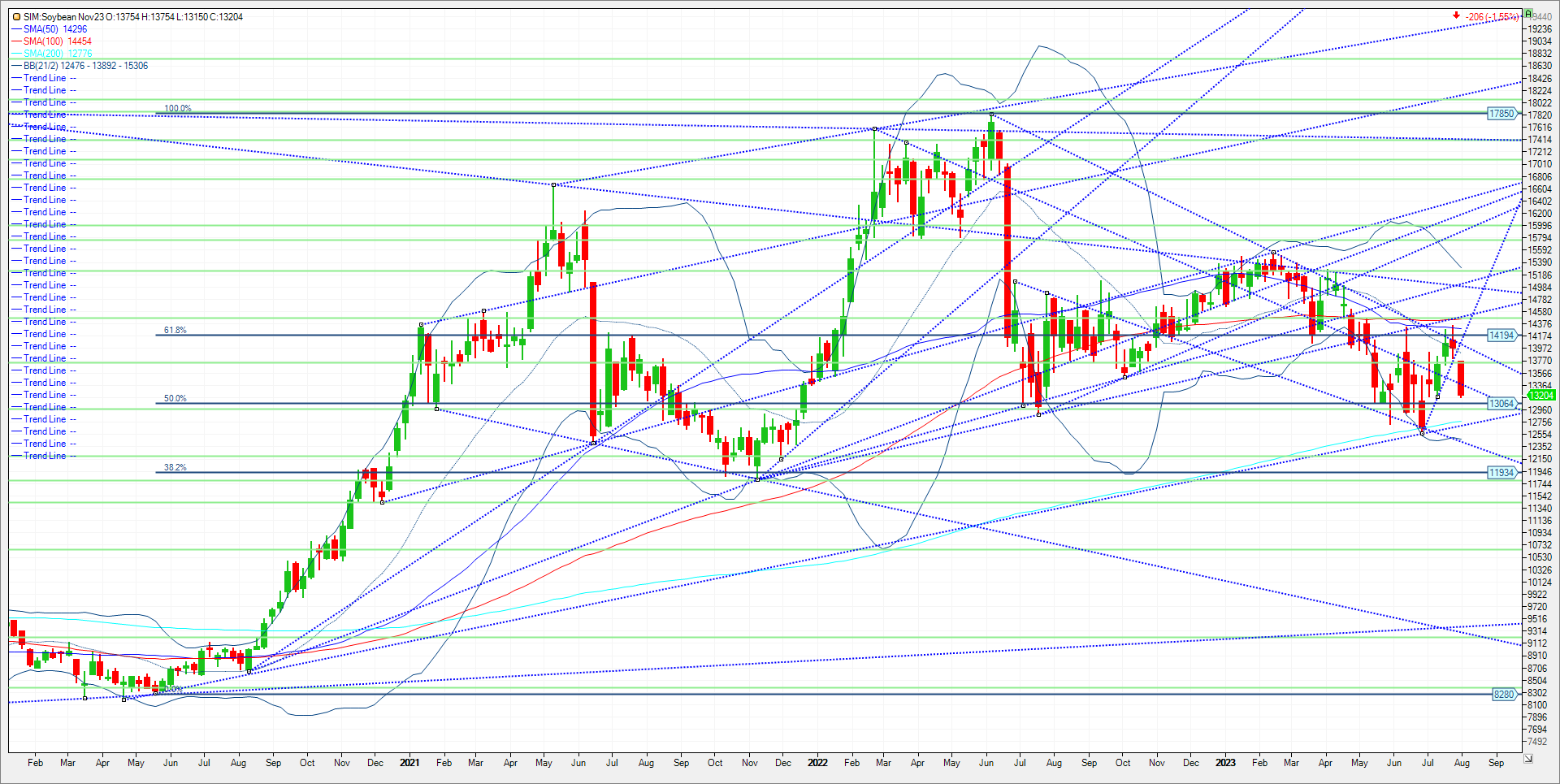

Today’s forecast models continue the shift toward cooler and wetter for the Midwest corn and soybean crops. In my opinion we may start to see crop ratings stabilize again in USDA’s crop progress report the next few weeks but the rains in my opinion will have to verify. Farmers told USDA they planted 83.505 million acres to soybeans, down 4 million acres from March intentions with a large portion of reduced soybean plantings going to corn and sorghum. Through July, the soybean crop was stressed by expanding dryness/drought and some heat pressure. Nonetheless, the most important weeks of the growing season are in August and early September. Timely rains and moderate temperatures would be quite beneficial, and that is what is predicted to happen through the first 3 weeks of August. Once the crop becomes a “known”, demand concerns return the forefront in my opinion. Remember last month’s WASDE showed USDA decreasing demand 150 million bushels to put ending stocks at 300-million-bushel carry. The trade going into that report was at 200 million. The result though was the funds bought the Board as demand can always be adjusted from bearish to bullish while come back lost supply/production from a weak crop is gone forever. That said now that weather forecasts look to verify a cooler and wetter outlook and better production possibly for the nations bean crop, funds may continue to liquidate their long positions in beans and meal. Support this week was pierced with todays 20 cent loss, leading me to believe the path of least resistance is lower. Again though, the rains need to verify, should they miss, the market returns to trading the “unknown”, which means higher. Producers in my view, should use current levels for a small percentage hedge. Trade idea below.

Trade Ideas

Futures-N/A

Options-Buy the October 23 Soybean 13.00 put. Sell the July 24 12.00 put. Offer the spread at even money. ZSN24P1200:V23P1300[DG]

Risk/Reward

Futures-N/A

Options-There is unlimited risk here as one is short a July 24 put option that doesn’t expire until later June 2024, while the October option expires in 7 weeks. This is a gamma play where we are looking for weather and harvest pressure to send November beans down to the June lows in the mid 1250s. Should that occur, I’m exiting the trade.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604