The information and opinions expressed below are based on my analysis of price behavior and chart activity

February Lean Hogs

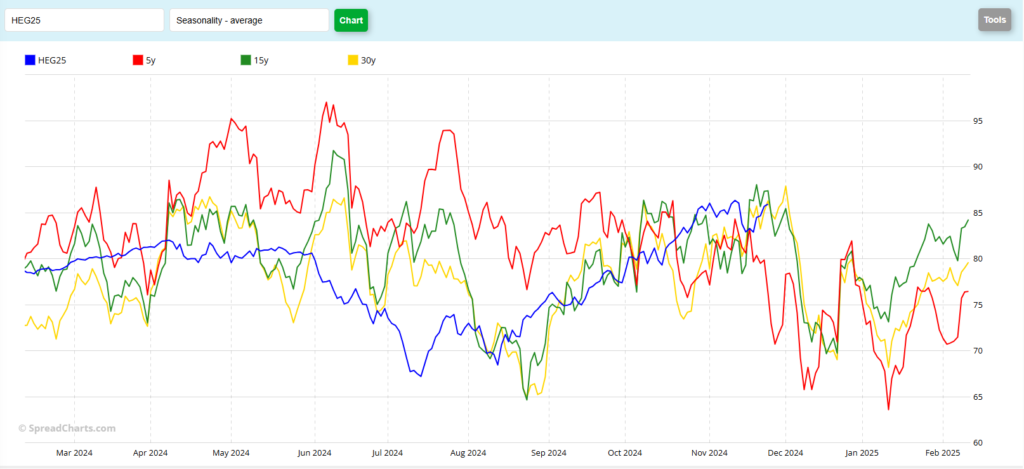

The last time I wrote about Lean Hogs was on Nov 14th, which was that big red down day about 9 bars ago on the chart. At that time, the market had just broken through the (red) trendline support. I suggested (go back and read it) that traders may want to wait (be patient) before getting long. The prices went sideways to lower for just a few days following that, before turning back higher last Wednesday. Fast forward a few days and we see the market setting new contract highs and, apparently, resuming the uptrend. I’ve heard some talk today about yesterday’s Cold Storage report moving the market (showing Pork stocks in our US freezers at the lowest level in about 20 years) but that report doesn’t usually move the market. Not to say that the numbers are wrong (I think they’re correct) just to say that the monthly Cold Storage report isn’t highly watched and followed like the Cattle on Feed (beef) or WASDE (grain and oilseeds) reports. And based on the way the market traded today, it seemed more to me like stops were getting run or hit at different times. It didn’t seem like a “report day” when the market makes a sharp move right away and then extends it. Today the Feb Lean Hogs closed up 2.35 at 88.27, easily clearing the previous contract high that was set on Nov 12th, which now becomes a support level at 86.900. Yesterday, the 5- and 10-day moving averages crossed over to the bullish side, in my opinion, and are now offering support at 85.800 and 84.785, respectively. In addition to the (red) trendline, I’ve added a (blue) price channel indicator. The upper end of that is at 90.800 or so and that seems like a reasonable upside target to me. And I think that it’s a good coincidence that the midline of that price channel follows along very closely with my red trendline. (there’s a blue dotted line just above the red) The Stochastics (lowest subgraph) and the MACD (right above that) are pointing toward higher prices at the moment, I think. Volume was strong today, jumping to the highest level since we saw the contract rollover, from Dec to Feb, which indicates good buying interest and strength to me. Well-margined and aggressive traders may do well to consider long positions in Lean Hogs, with an initial upside target near the 90.50 mark, with an additional target up near the 92.50 level. Volatility has been high, so protective stop orders on a futures trade may need to be far away from the market. Put Options may be a better tool to manage potential downside risk on a long futures position. Call options are still reasonable priced in my opinion, and traders that prefer to use Options may do well to consider the Feb 90.00, 91.00 or 92.00 calls. They give 80 days until expiration. Should you choose to buy Calls, when your buy order is filled, I would suggest placing a GTC order at or near 2x the premium paid, once you account for your commissions and fees. If you’d like to discuss this further and get a strategy specific and customized for you, please give me a call or send me an email. As you can see by the seasonal chart below, this may be a short-lived rally, as prices typically start to head lower right around Dec 1st. But also keep in mind that seasonals aren’t absolute, as fundamental conditions can change. Notice that the market doesn’t always hold to what the seasonal pattern or tendency has been, when you look at the chart below.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.