Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

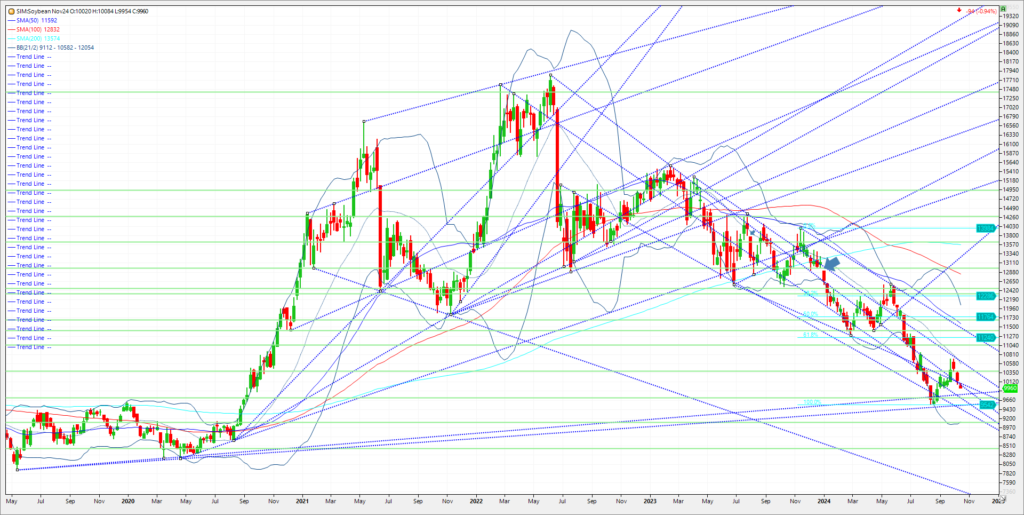

Corn and soybean markets are lower again today as dry weather allows for harvest to rapidly move forward in the U.S. Favorable rains are finally falling on many dry areas in Brazil adding to the downward pressure as South America is in the early stages of planting. Weather forecasts in Brazil are forecasting new systems moving in which in my view is starting to slowly lower risk models there. Brazil’s 24/25 planting progress is at 11% planted vs 18% the same week a year ago. Last Friday, the USDA raised its corn yield estimate by 0.2 bushels per acre on Friday to 183.8. If realized, this will beat the previous US record corn yield by 6.5 bushels per acre set in 2023 at 177.3 BPA. New records are expected in many main corn producing states including Illinois, Iowa, and Nebraska. Illinois’ 2024 corn yield is estimated at 222 bushels per acre vs. the previous record of 214 set in 2022. Iowa is pegged at 214 vs. 204 BPA set in 2021 and Nebraska at 196 vs. 194 previously set in 2021 as well. The 2024 US soybean crop is expected to yield 53.1 BPA according to the October Crop Production report. This is 0.1 bushel lower than the September report. This will be a new record for the US beating the previous high of 51.9 BPA set in 2016. So far, the last two WASDE reports did not show any stress from a hot and dry September. In summation, you have an eroding weather premium in Brazil coupled with a huge crop being harvested amid a sizable 550-million-bushel carry. For those putting beans in the bin, please consider the following trade.

Trade Ideas

Futures-N/A

Options-Buy the March 25 10.00 puts. Sell the Sep 25, 1160, calls for even money minus commissions and fees.

Risk/Reward

Futures-N/A

Options-Unlimited risk here and this trade should only be used for those who have unpriced beans in the bin. We are using the 10.00 puts as a level of protection in case prices trade to the mid to low 9s on too much supply/weak demand in the weeks and months to come.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.