Commentary

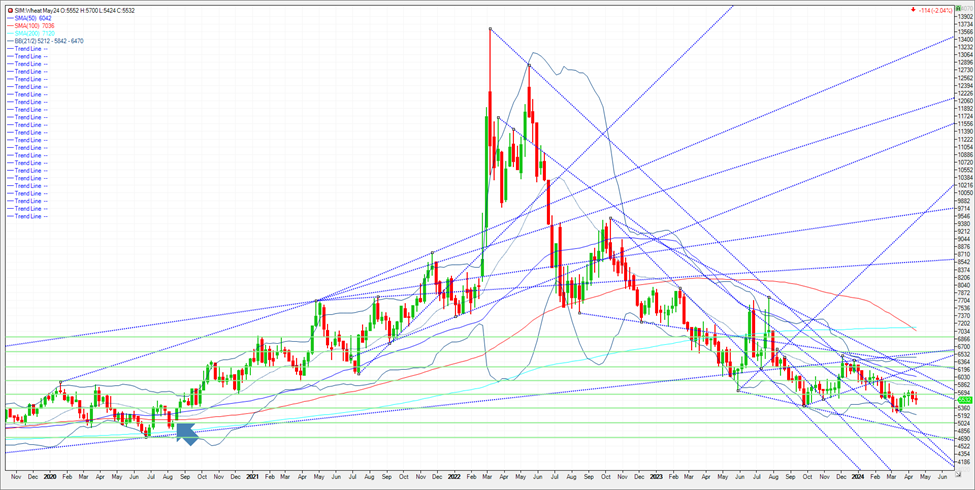

Technical levels took a decisive turn lower here today with more weakness likely in wheat in my opinion. KC wheat closed near the lows and well below the 50-day moving average today. May Chicago wheat closed 12 3/4 cents lower to $5.37, while May KC wheat dove 14 3/4 cents to $5.72 3/4, each closing near the session low. May Minneapolis futures fell 5 cents to $6.33 1/4. Chicago or Soft Red winter wheat futures faced heavier selling to a one-month lows today as technical pressure combined with a strong U.S. dollar weighed on prices. In my opinion it feels as though a breakout to the recent lows is more likely than a surprise higher as crop prospects remain decent for new crop and would need a disaster at this point to change this fact. It is my belief crop ratings for Chicago wheat are in very good condition now with record yield potential. A move to the low 5.00 levels could be seen.

Trade Ideas

Futures-N/A

Options-For even money, buy the at the money June 550 puts while at the same time sell the Dec 520 puts. June is a serial month of the July futures contract and is trading 40 cents under December. ZWZ24P520:M24P550[DG]

Risk/Reward

Futures-N/A

Options-There is unlimited risk here. One is short a put with an expiration 6 months longer than the long put. In fact, June options expiration is May 24th. The target is for Chicago wheat to challenge the gap at 5.08 sooner rather than later. Managed money continues to defend their short position. (see Chart). Risk 8 cents from entry or $400 plus trade costs and fees.

Please join me for a grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.