Chart courtesy of CQG.

While weather issues in Brazil and Argentina remain a concern, significant chart damage was done in corn in the last 48 hours of trading. On Sunday night, February 2, May corn gapped lower. In my opinion, that looked bearish. Today the corn market rallied and filled the gaps. The corn market is very good at filling gaps, in my opinion.

Today’s volume in March corn was 294,000 contracts. Sometimes, in my opinion, volume is a better indicator than price discovery. In my opinion, corn could go to $508 in the next 48 hours. It will take a lot of buying to get to that level and maintain it.

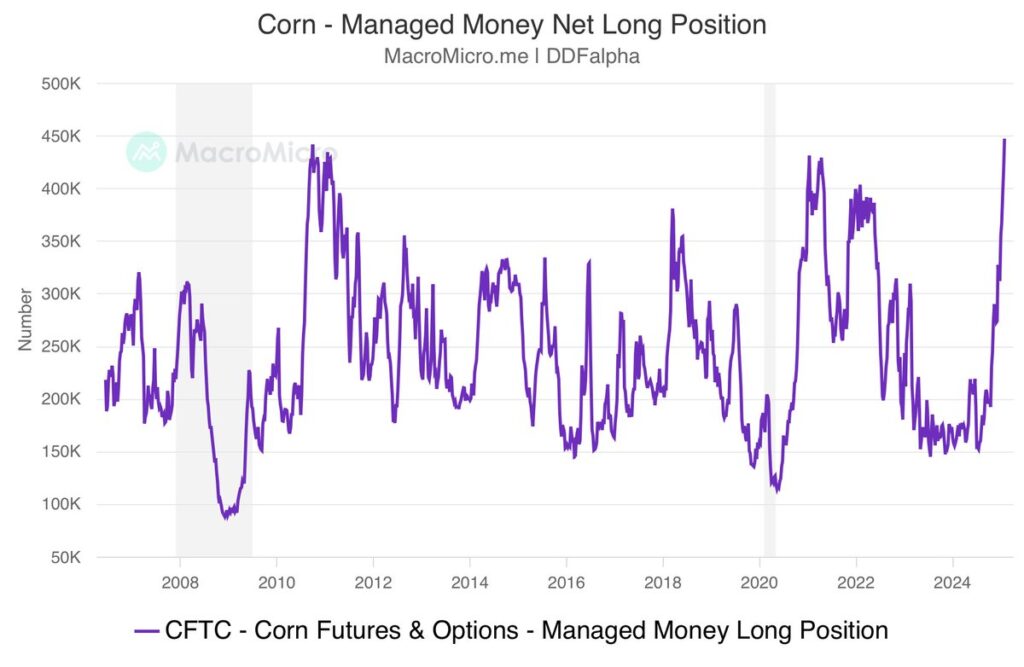

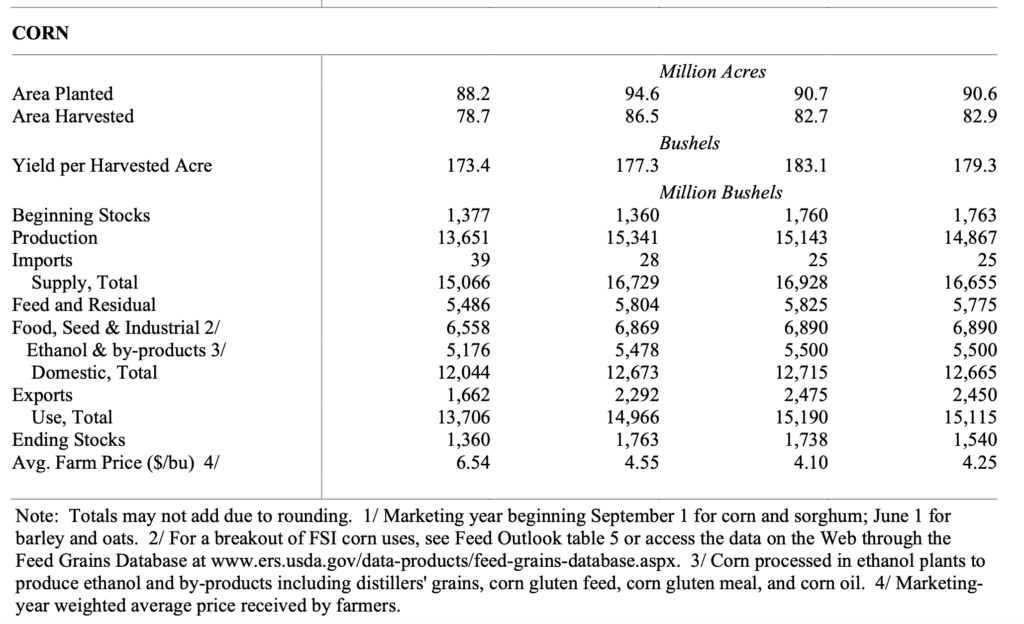

Managed money has bought the corn market all the way through the rally. Corn exports and demand for ethanol continue to put a bullish spin on the market. According to the United States Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates (WASDE) Report released on January 10, the yield per harvested acre of corn decreased 3.8 bushels per acre. This may have added steam to the managed money buying trend. The previous record in the managed-money long position occurred in February 2011 at 432,000 contracts. After today’s managed money long position at 425,000 contracts, we could be looking at a new record.

So where does it go from here? In my opinion, corn is a buying opportunity at last night’s low price of 484 and a selling opportunity in the short term if it goes to 510. I like the short-dated corn option week 2 that expires on February 14. These short-dated options give you coverage through WASDE Report due on February 11.

Source: USDA WASDE Report, January 10, 2025

Bullish or bearish, if you like short-dated options, call me to discuss strategies.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878-2391 8248

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.