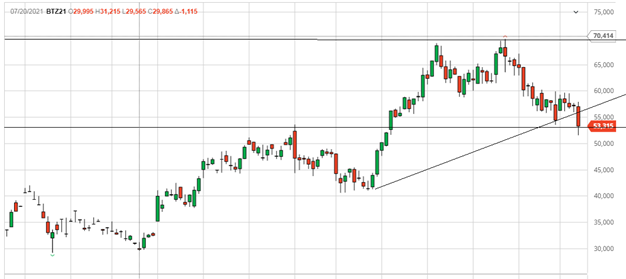

Bitcoin (BTCZ21) closed last week at $53,545 with a volume of 29000 and range trading between $51,585 to a high of $59,6800. Pressure in Bitcoin in my view comes from the fear of a new corona virus variant.

Interesting talking points in the sector come in as follows. First, was news from the SEC in rejecting Wisdom Tree’s SPOT Bitcoin ETF. This comes with more concern and claims by government officials around the world wanting better ways to confirm transactions and transparency. These maybe are weighing on new buyers entering into Bitcoin giving the overall crypto coin space a corrective push lower in my opinion.

Metaverse, Altcoins, and NFT’s for gaming use or buying products and services are underscoring the overall crypto coin space and can top one trillion dollars on inflows spread across the spectrum of Crypto currencies, not just Ethereum and Bitcoin in my view. A good example was the Spiderman movie NFT with AMC Theatres for movie goers ability to get movie tickets online in advance of the release. Another example is CryptAxx, an NFT to buy custom guitars.

Second, Interesting talk in the sector also includes Goldman Sachs, JP Morgan, and Citi Group looking at new ways to create Bitcoin based loans. Fidelity is now involved in Bitcoin mining.

Generally, analyst expectations have not changed minus issuing caution on volatility and sharp moves lower in my opinion, please use caution on levels when you enter the market. Expect more of this type of movement and corrections as global issues come forward in my opinion.

MICRO Bitcoin futures (MBTZ21) also closed at $53,545 last week as well. Fridays daily volume of over 29,000 futures contracts allows for good leverage in the market in my opinion. The micro contracts minimum tick value is ($5 per tick), with a $2500 maintenance margin. That margin and can change without warning by the CME, and is a continuous monthly rolling contract.

Weekly Pivots MBTV21 (12/06-12/10)

Resistance #2- 73000

Resistance #1- 60500

Pivot- 52500

Support #1- 48500

Support #2- 45000

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Peter Ori

peterori@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

DISCLAIMER: Cryptocurrencies are a high risk investment and may not be suitable for all members of the public and all types of investors. Before investing in or depositing cryptocurrency, you must ensure that the nature, complexity and risks inherent in cryptocurrency are suitable for your objectives in light of your circumstances and financial position. You should not purchase or hold cryptocurrency unless you understand the extent of your exposure to potential loss.

YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

More information can be found at: NFA Investor Advisory—Futures on Virtual Currencies Including Bitcoin CFTC Customer Advisory: Understand the Risks of Virtual Currency Trading