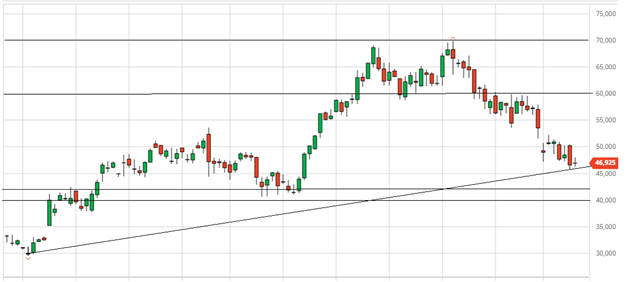

Bitcoin (BTCZ21) trading just above $ 47,000 as of this post with a volume of 16000 and range trading between $41000 TO $59000 the last few months. Pressure in Bitcoin is still from the new corona virus threat in my view. Also weighing on Bitcoin is potential FED/FOMC action and inflation issues. Near term support levels in Bitcoin futures have been tested amid the Monday low at 45,730. This comes as over 1.2 BILLION Bitcoin Ethereum and other Altcoins were shifted from different platforms to Coinbase in my opinion. Downside risk could still be prevalent, in my opinion.

Interesting chatter in the sector from the SEC and Congressional Testimony with Cryptocoin brokerage officials around the world wanting better ways to confirm transactions and transparency. It is my belief this helped push Bitcoin lower, giving the overall Cryptocoin space a push lower amid some uncertainty.

Metaverse ,Altcoins and NFT’s for gaming use or buying products and services could be strengthening the overall Cryptocoin space and many retail and institutional traders bought Altcoins during the selloff, not just Ethereum and Bitcoin.

A positive note for Bitcoin and Altcoins is the potential drive by Pension Funds, Sovereign Funds and Brokerages making Cryptocurrencies available for their clients. Analyst expectations have still not changed in my view being bullish longer term. However in the same breath they are issuing caution on volatility and potential sharp moves lower in the near term over a possible hawkish Fed into 2022. I urge everyone to please use caution on levels when you enter the futures market. Expect more of this type of movement and possible corrections as global issues come forward in my opinion.

MICRO Bitcoin futures (MBTZ21) at 47,000 as of this writing and volume of over 16000 futures contracts. This allows for good leverage in the market in my opinion. The micro contracts minimum tick value is ($5 per tick), with a $2500 maintenance margin. That margin and can change without warning by the CME, and is a continuous monthly rolling contract.

Weekly Pivots MBTZ21 (12/13-12/17)

Resistance #2- 54303

Resistance #1- 51397

Pivot- 49300

Support #1- 46397

Support #2- 44303

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Peter Ori

peterori@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

DISCLAIMER: Cryptocurrencies are a high risk investment and may not be suitable for all members of the public and all types of investors. Before investing in or depositing cryptocurrency, you must ensure that the nature, complexity and risks inherent in cryptocurrency are suitable for your objectives in light of your circumstances and financial position. You should not purchase or hold cryptocurrency unless you understand the extent of your exposure to potential loss.

YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

More information can be found at: NFA Investor Advisory—Futures on Virtual Currencies Including Bitcoin CFTC Customer Advisory: Understand the Risks of Virtual Currency Trading