Good Morning Farmers, Commercials and Traders,

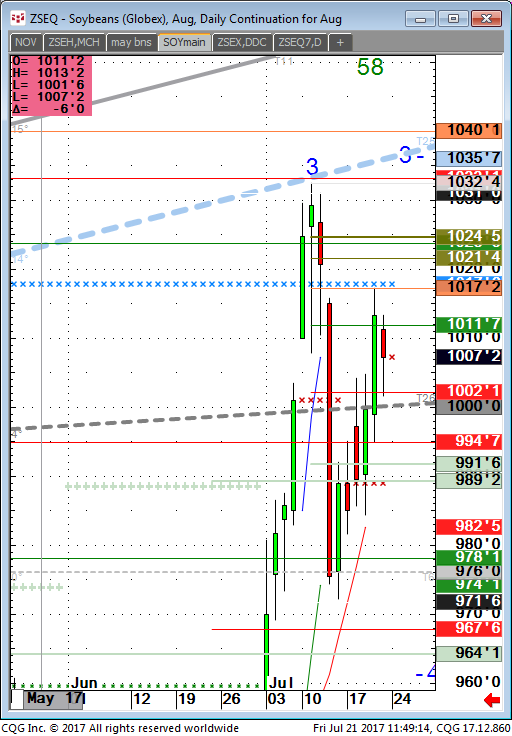

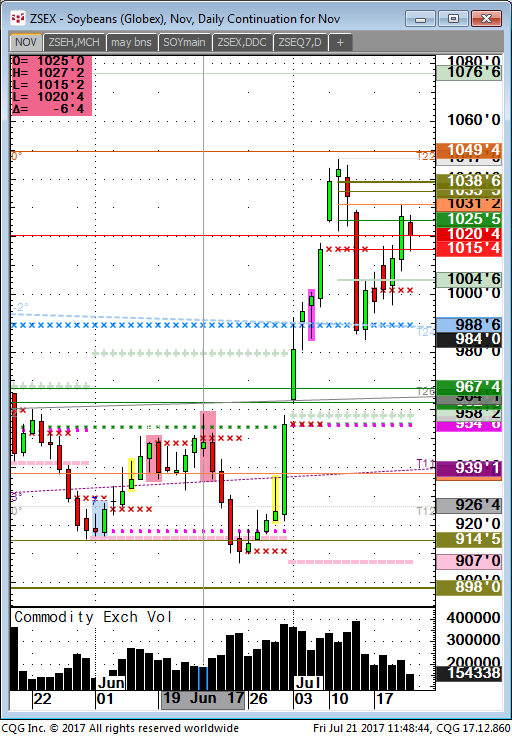

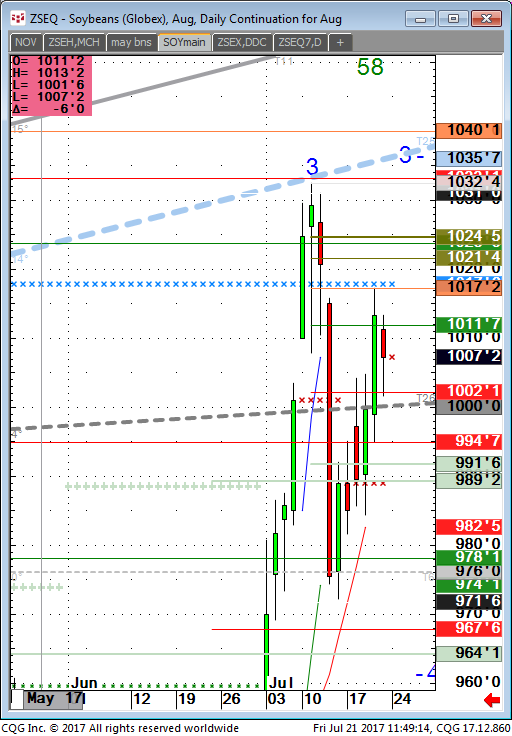

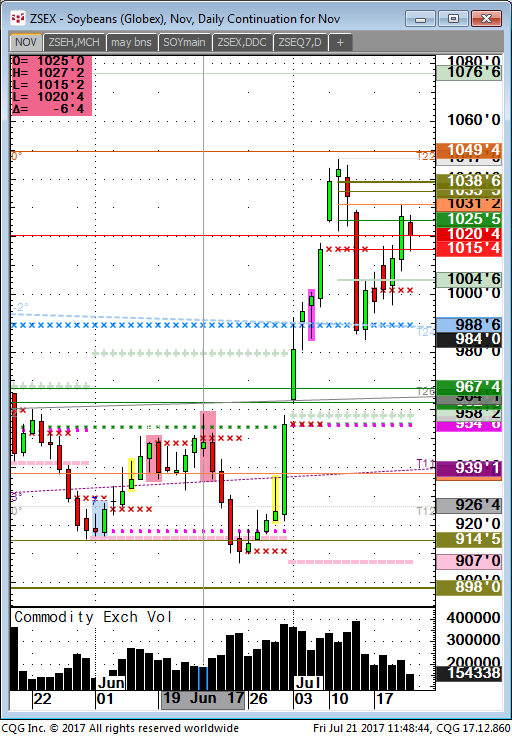

Part of being a successful trader requires having levels that you confident about, followed by a trading methodology that allows you to shoot bigger with a tighter risk profile. Last month gave a precise example with soybeans where, for instance if you were a 10 lot trader you might buy 5 @ OLB#1 thin $9.23, especially since I had cited a confluence of events at 9.22, and then the other 5 at the OLB between 9.06 and 9.0975. The chart displayed below had these levels mapped out with two sets of olives. Interpretation of my charts, with two OLB#2’$ @ 909.75 & 9.06 basis Aug futures, illustrate why you would want to buy beans for a host of reasons, including better odds because the street chatter was increasingly bearish that soybean prices would drop sharply to $8.00 before this bear mkt ran its course. What unfolded was a high volume trade at the olives setting up the technicals I look for. Only one, but important and time tested, rule prevails; You must hang onto winning trades until the street is “begging” to buy, which is exactly what happened 11 days later at my major red horizontal line (target) in beans at $10.33 1\8.

Why trade at Walsh with ARP? There are many trading opportunities unfolding and I can help to identify and advise on how to take advantage.

___________________________________________________________

Not much going on in my book but some small extremes are the way to trade if your a day or swing trader. Beans and corn yesterday hit some levels cited and you could have sold if long.

I think the way to trade is to look for very low risk situations that offer 5-8% moves in fast vertical price adjustments like what I have shown last two months since here at Walsh. The pattern of these olives happens everywhere and had a nice 16 tick scalp in bonds with a 3 tick risk.

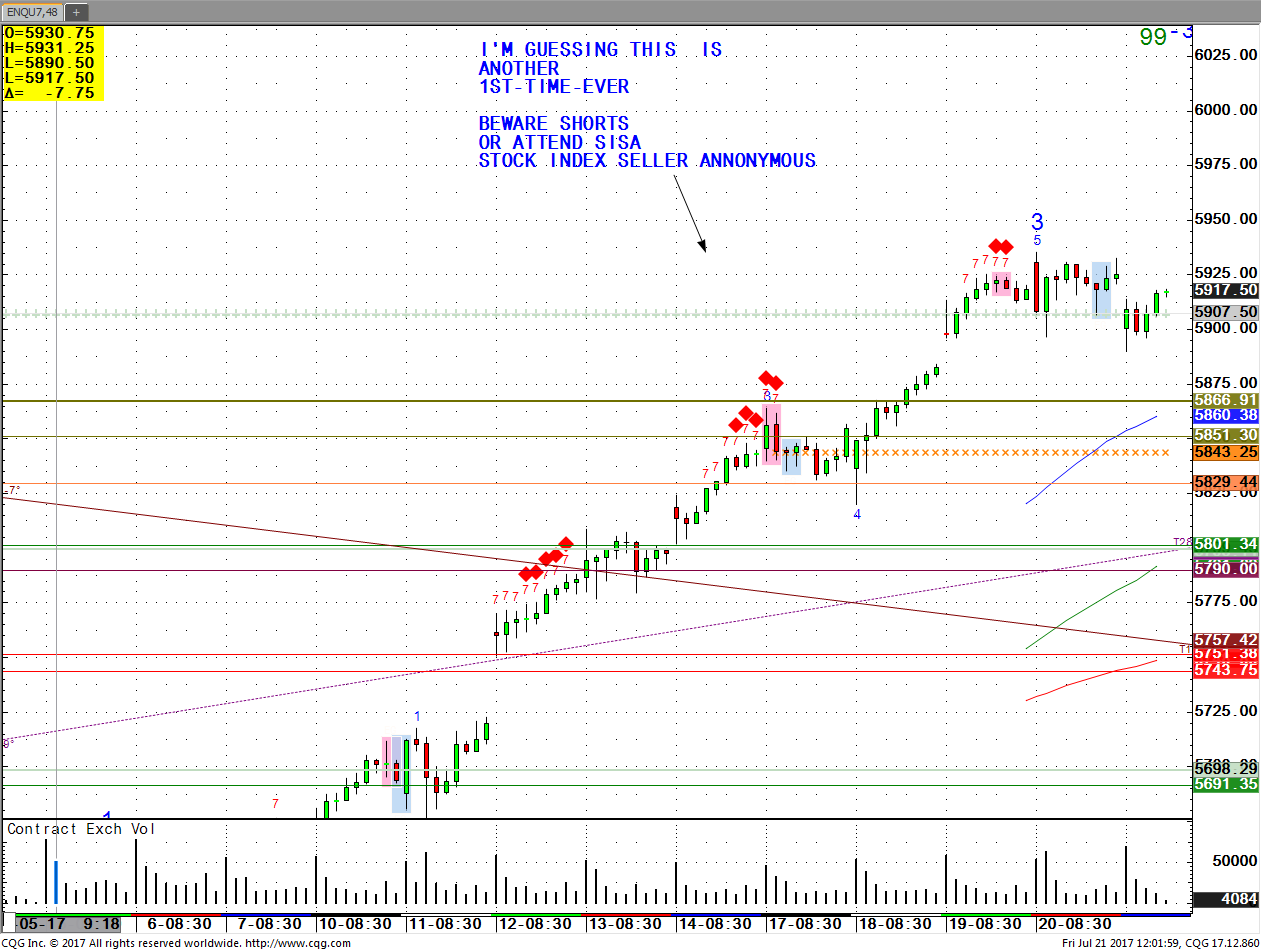

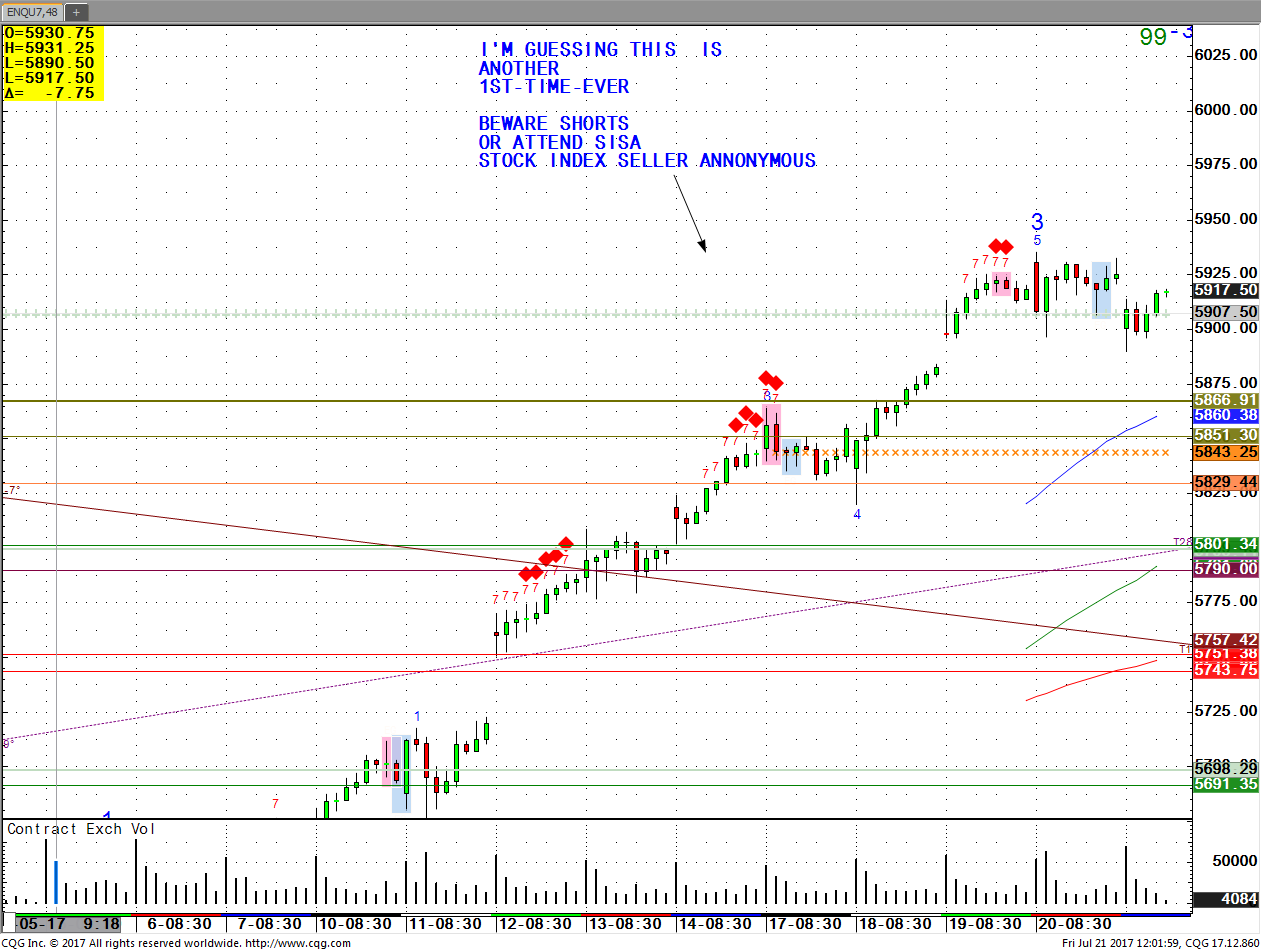

Once over my sell OLS becomes a buy like today in bonds and Nasd this week earlier.

I think this is only way to approach trading in today’s markets. Low risk high reward.

If you like that and I can interest you when these occur in your market please feel free to call and chat markets.

US Dollar- Bears came out of woodwork last few days so what are we going to look for? The olive line and I have one at 93.50 about 20 ticks away. We’ll see. Don’t sell US Dollar short now or you may become a victum of the olive but I encourage anyone out there

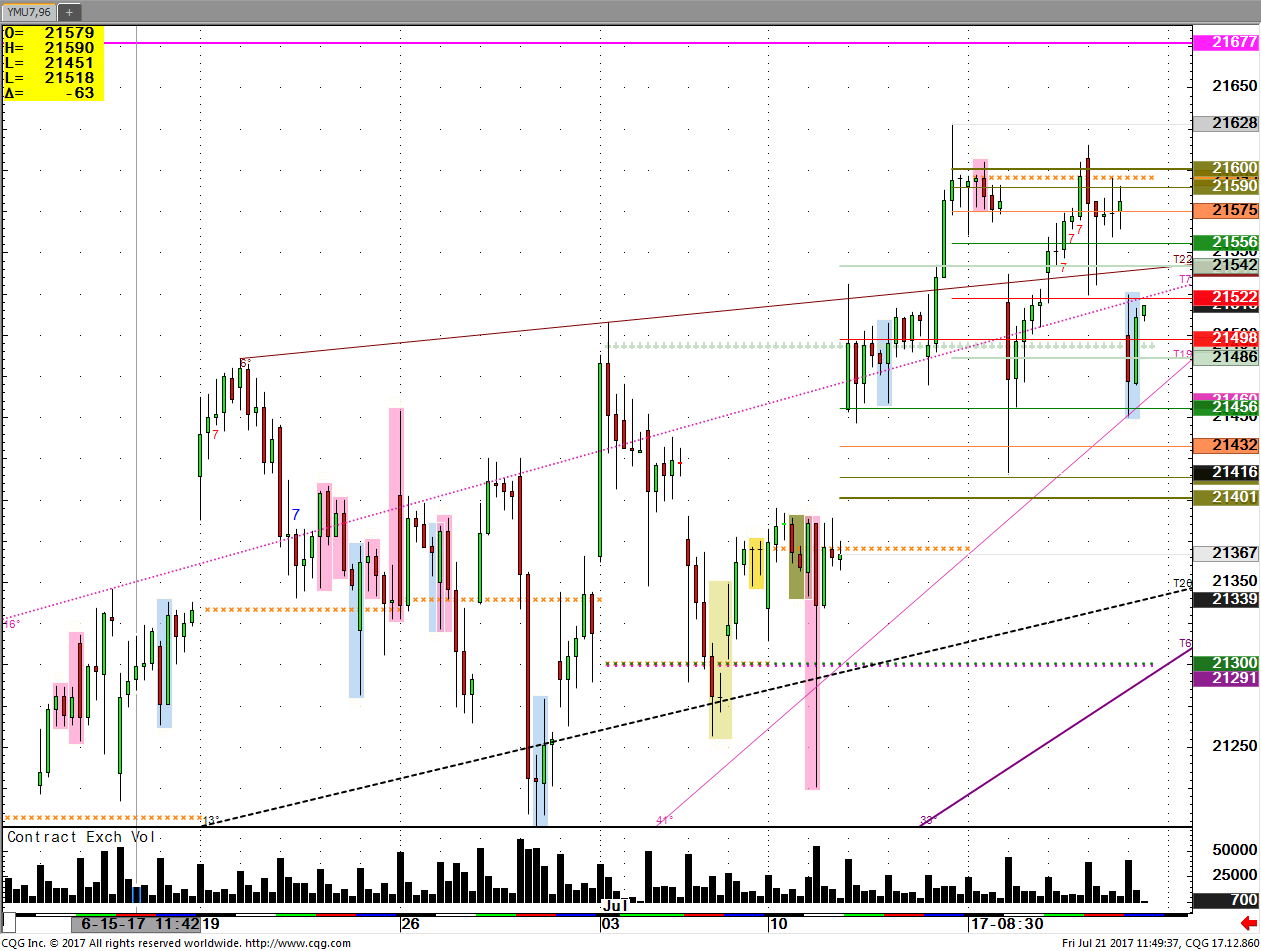

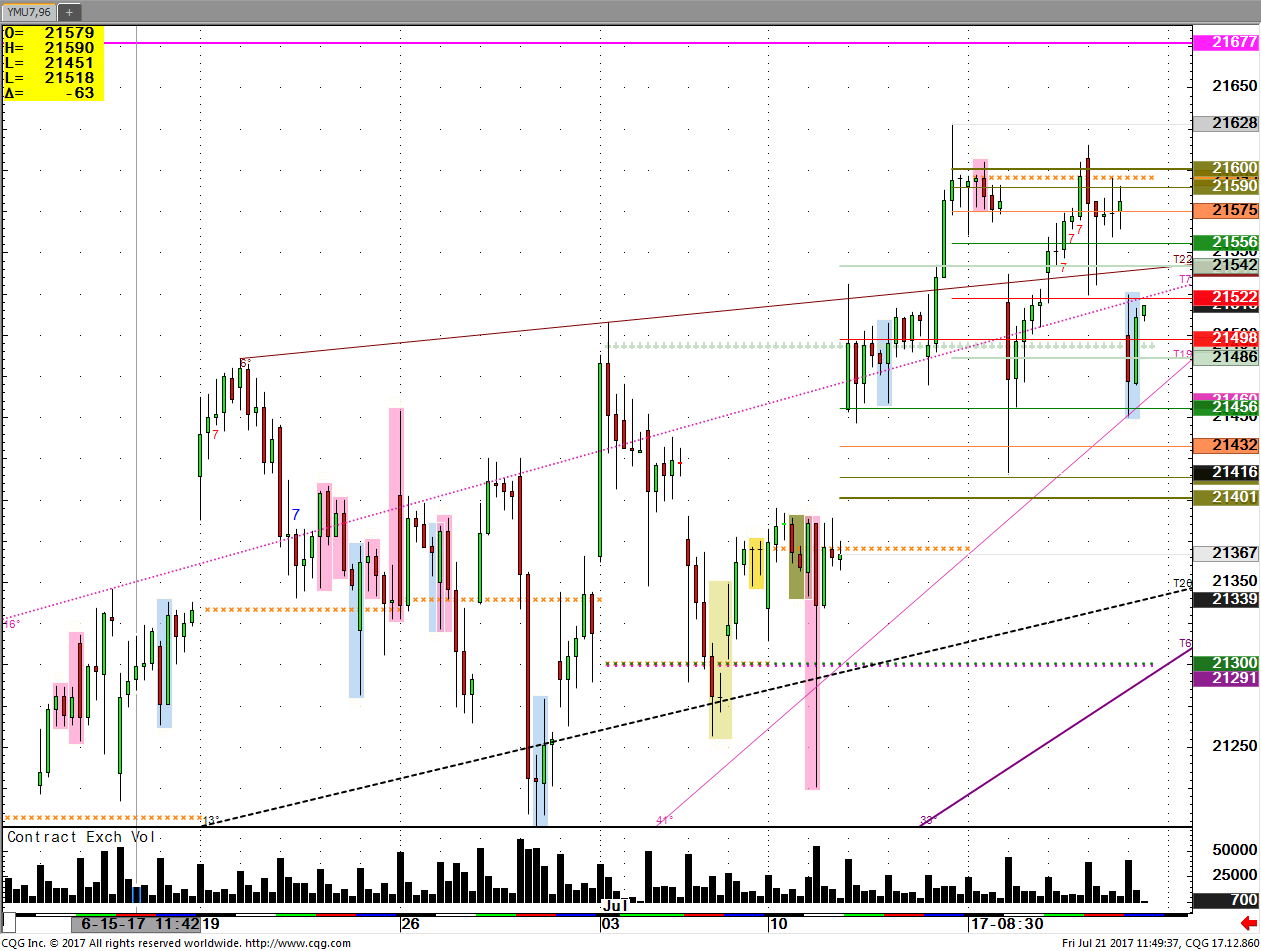

DOW JONES FUTURE- 1st bar today pretty much had high and low for you my customers. These are a few dozen conditions you need to learn and use to your advantage.

Powder blue XXX’s a buy in one and sell in another. Got it?

to fade the olive line.