I have talked about a top in stocks in August for over 3 months, maybe longer on one of those throw out an idea in Jan Feb. Back then I said you were nutty to sell into all

ARP Wheat Pit

time contract highs, ever. 1st time ever’s are bullish, ask why. Especially option players.

Week recap. Dow jones futures of which I was on pit committee this past week hit a target that is so long term and a perfect ending to this grand bull market of 2017. Before we do a swan dive to steady on year one might ask themselves if they are ready to act when Major Macro Events occur. When they happen most don’t realize it so watch for tremors. I am sure you saw the one in the last 24 hours.

ARP HANDS OUT DOW PIT

IT IS TIME TO HAVE YOUR HANDS OUT SELLING DOW FUTURES in my humble opinion.

Trade as if the top is in. Oh, what is that you say? Oh, you’ll see the next rally?

I have only heard that 100 times.. . . .

The last 18 months. The Morgan Stanly guy in bonds last Summer the exact one year timeframe? One more rally.

I think the top is in and will present the largest trading opportunities since 1980- when I traded Silver at Mid Am Exchange for a Winnipeg Dealer, I was 21 years old, the earliest you can legally be a Pit Trader. If I traded in the 1970’s I might think we were going to see those type of markets. Well in OILSHARE it could happen, OSZ.

Grains- This feels like long term possibly bull but can change if N Korea because there are a bunch of guys that would take 4-6,000 contracts in a nano second. OK, exaggeration here. It would at least take a half a day. I am making a point.

SANTELLI BANKSTER’S- I say Rick, coined term, uses regularly and other day City Hall meeting about JP wanting a special exemption to open bank on property city aimed at promoting resident foot traffic of which it does not. 5th bank in 1000′ small suburb. These ATM people never see it coming. It’s rage out there in my opinion.

Dow chart- Meets a target that has important implications. Find out what could be in store. I am not here to goof around. You decide to make clean simple bets on my chaos and panic extreme levels where we have a chance to make big money with small risk stops that must be placed and forget about the winner for a while. This is what I bring from the trading floor.

DOW-MAJORTARGETS22000

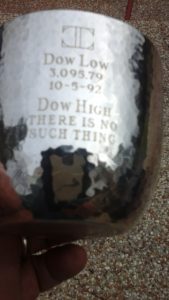

On the note of calling this a top I must fully disclose that the next picture is a Silver Cup I have from Tudor that gave these out at a Christmas party

Ok, so maybe a 10 year high.

ARP