9/6/24

The Soybean and Cattle Markets were pounded lower today, and it’s not over yet. The Fats dropped over 2 bucks. Today the October’24 Live Cattle were 2.07 ½ lower and settled at 175.17 ½. Today’s high was 177.97 ½ and the 1-month high is 182.52 ½. Today’s low was 174.92 ½ and the 1-month low is 173.72 ½. The current 52-week low is 168.50. Since 8/6 October’24 Live Cattle are 3.75 lower or over 2%. The Feeders also got smacked today. October’24 Feeder Cattle were 3.62 ½ lower today and settled at 230.95. Today’s high was 235.95 and the 1-month high is 243.45. Today’s low was 230.42 ½ and the 1-month and current 52-week low is 229.35. Since 8/6 October’24 Feeders are 8.07 ½ lower or almost 3 ½%. The Hogs tried to stay strong today but broke late in the day. October’24 Lean Hogs were 1.20 lower today and settled at 79.50. Today’s high was 81.30 and the 1-month high is 83.37 ½. Today’s low was 79.42 ½ and the 1-month low is 71.32 ½. Since 8/6 October’24 Lean Hogs are 3.10 higher or more than 4%. The Cattle Markets had some good price action today, and it worked out well if you were prepared for it, and this is why I always use the Option Markets to structure trades. It allows you to take some heat, if thigs don’t initially go your way. The Cattle Markets are now approaching the 52-week contract lows, and if they are breached, it will simply be very bad. I have been saying that I thought the Cattle markets would retest the 52-week lows, and now we are close. The October’24 Fats are just 1.45 from the 1-month low of 173.72 ½, and only 6.67 ½ from the 52-week contract low of 168.50. The Feeders are almost there again. October’24 Feeders are just 1.60 from the 1-month and 52-week contract low of 229.35. It was a bad way to close the week as well. Over the last three days of the week, the October’24 Fats lost 4.10 and the October’24 Feeders lost 8.37 ½. Technically it does not look good either. Live Cattle have now broken below trendline support, and settled below it, along with closing below a major support level of 175.79. The Anthrax scare and the major collapse in the stock market, only added fuel to the fear of an economic downturn in the U.S. economy, and the possible decline in demand for beef. If the Cattle Markets do collapse, the selling pressure will be extortionary, and it will drop more than you think. Remember that this is a globally traded commodity, by people that don’t care about cash markets or input costs, because they are trading widgets. There is still time to get protection from a catastrophic collapse. BALLEN@WALSHTRADING.COM 312-957-8079 I can help.

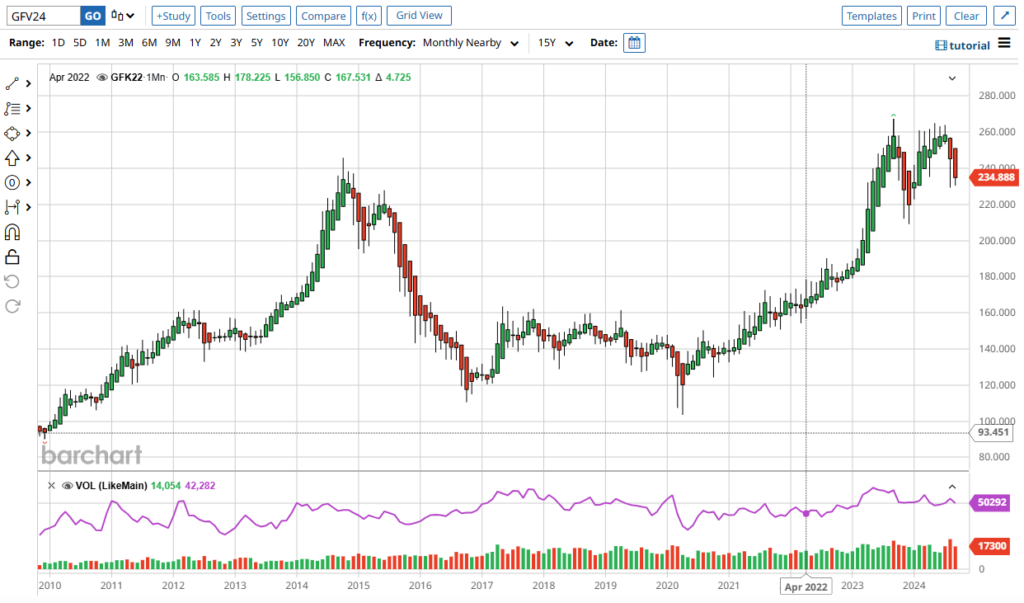

I hope you continued to sell into strength, sell calls and buy puts… The Soybean Market made a new 1-month high today and then broke more than 26 cents. November’24 Soybeans were 18 ½ cents lower today and settled at 1005. Today’s high was 1031 ¼ and that is also the new 1-month high. Today’s low was 1003 ½ and the 1-month and current 52-week low is 955. Since 8/6 November’24 Soybeans are 21 ¾ cents lower or more than 2%. The Corn Market also made new 1-month highs today but dropped from there. December’24 Corn was 4 ½ cents lower and settled at 406 ¼. Today’s high was 416 and that is also the new 1-month high. Today’s low was 405 ½ and the 1-month and 52-week low is 385. Since 8/6 December’24 Corn is 1 cent higher. The Wheat Market traded up to my 580 level again today, and then fell apart. December’24 Wheat was 7 ¾ cents lower today and settled at 567. Today’s high was 580 and the 1-month high is 582 ¾. Today’s low was 656 ¾ and the 1-month and 52-week low is 520 ¾. Since 8/6 December’24 Wheat is ½ a cent higher. Well, the Grains did not close very well. Today was great if you continued to sell calls and buy puts. Using Options, that is the only way you can trade these markets, without getting blown out. The November’24 Beans closed 1 ½ cents off the lows today. The December’24 Corn closed ¾ of a cent off the lows, and December’24 Wheat settled 1 ¼ cents from the lows of the day. It all looked ugly. Could there be another run higher in the Soybeans, sure it’s possible, and would be a gift to sell it higher, but a significant rally looks unlikely right now. I still feel we will see much lower prices in the Soybean Market. I believe the Beans can head toward the 910-930 level, then possibly head lower. There is great opportunity in the option markets on a move like that. I would be happy to show you an example if you are interested. I still feel there is upside potential in the Corn and Wheat Markets, but if the Soybeans break hard, they will probably follow the beans lower, at least in the beginning. I am still Bearish the Soybean and Cattle Markets and will continue to be, until I see something to change my mind. If you have any questions for me, just ask. BALLEN@WALSHTRADING.COM – 312-957-8079. There is a 15-Year Feeder Chart Below. Have a great weekend.

October Feeder Cattle 15 Year Chart Below

-Bill

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.