8/28/24

The Livestock and Grain Markets were mixed today, and it was a slow trading day, even with the price action. October’24 Live Cattle were 77 ½ cents lower today and settled at 178.62 ½. Today’s high was 180.17 ½ and the 1-month high is 188.97 ½. Today’s low was 177.92 ½ and the 1-month low is 173.72 ½. Since 7/26 October’24 Live Cattle are 9.87 ½ lower or more than 5%. The October’24 Feeders were able to stay positive late today. October’24 Feeder Cattle were 20 cents higher today and settled at 238.57 ½. Today’s high was 239.50 and the 1-month high is 259.32 ½. Today’s low was 236.70 and the 1-month and 52-week low is 229.35. Since 7/26/24 October’24 Feeder Cattle are 19.70 lower or more than 7 ½%. September’24 Feeders were 62 ½ cents lower today and settled at 241.30. The Hogs were a little lower today. October’24 Lean Hogs were 40 cents lower today and settled at 81.67 ½. Today’s high was 82.42 ½ and the 1-month high is 82.47 ½. Today’s low was 81.52 ½ and the 1-month low is 71.32 ½. Since 7/26 October’24 Lean Hogs are 3.52 ½ higher or 4 ½%. The Fats and the Feeders attempted to rally after opening lower this morning, but that did not work out and was another selling opportunity. The high in October’24 Live Cattle was 180.17 ½ and that looks like a new resistance level. The October’24 Feeders continued with their big swings today, and almost had a 3-dollar range, and were able to close in the green today, but were still almost a dollar off the highs. The September’24 Feeders closed 1.25 below their highs today. The October’24 Lean Hogs a quiet day and settled a little lower. On today’s lows, the October’24 Fats were only $4.20 away from the 1-month low of 173.72 ½. For the October’24 Feeders, on their lows today, they were $7.35 away from the 1-month and 52-week low of 229.35. I will remain Bearish the Cattle Markets until I see something to change my mind.

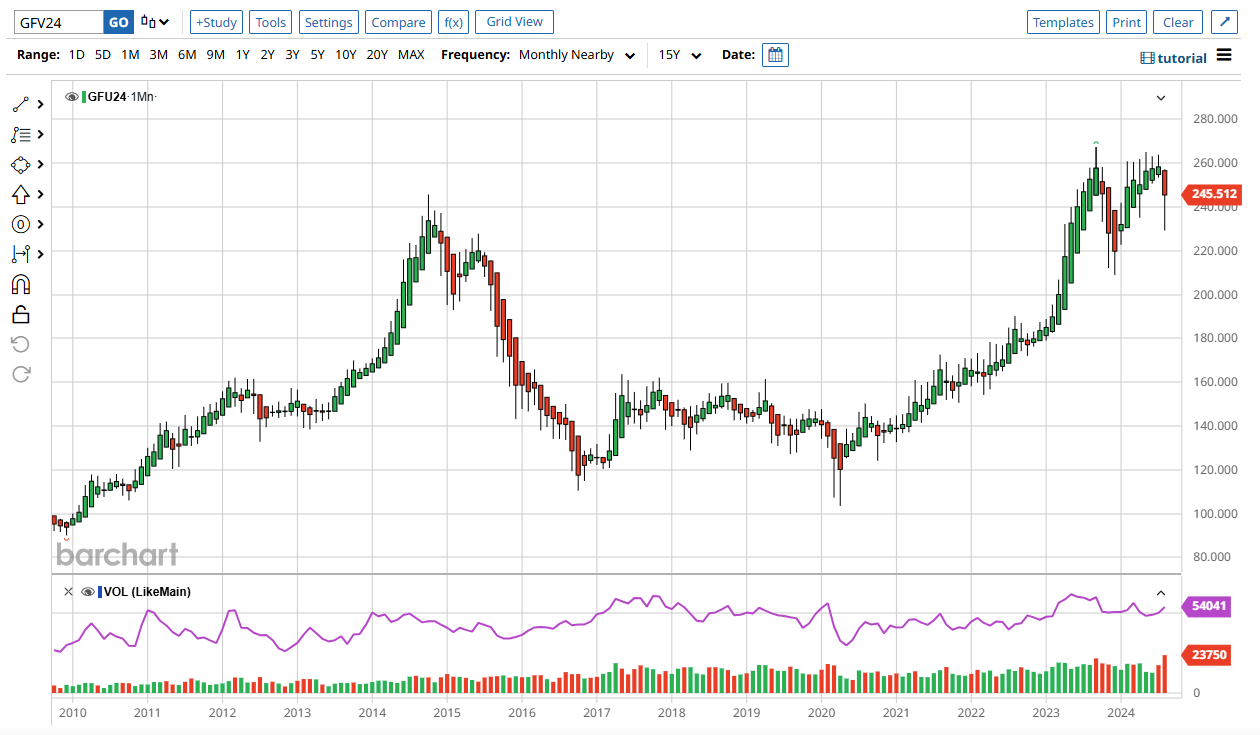

15-Year October Feeder Cattle Chart Below.

The Soybeans continued their break today, as the Wheat climbed higher, and the Corn Market was stuck in the middle and followed the Beans a little lower. The Beans broke from the 980’s again today. November’24 Soybeans were 9 ½ cents lower today and settle at 977. Today’s high was 988 and the 1-month high is 1044 ½. Today’s low was 972 ¾ and the 1-month and 52-week low is 955. Since 7/26 November’24 Soybeans are 71 ½ cents lower or almost 7%. The Corn ended the day a little lower. December’24 Corn was 2 cents lower today and settled at 390 ¾. Today’s high was 394 and the 1-month high is 413. Today’s low was 388 ¾ and the 1-month and 52-week low is 385. Since 7/26 December’24 Corn is 19 ¼ cents lower or almost 5%. The Wheat Market continued to climb higher today. December’24 Wheat was 6 cents higher today and settled at 541 ½. Today’s high was 543 ¾ and the 1-month high is 574 ¾. Today’s low was 533 and the 1-month and 52-week low is 520 ¾. Since 7/26 December’24 Wheat is 7 cents lower or almost 1 ½%. If the November’24 Soybeans get into the 980’s again, I recommend selling them again. I do not see any reason why the Soybean Market won’t continue to break. The Soybean crops here in the US will be huge and just fine. Argentina plans on planting more Soybeans this year as Farmers there are switching from planting Corn to planting Soybeans because of the leafhopper issue. In Brazil, the Farmers are planning on planting 47 million hectares of Soybeans, 1 million hectares more than last year. Parts of Brazil are dry, but it’s a rain forest and should be just fine. I sent out a Soybean trade today, and part of it was buying March’25 puts below the $9.00 level. November’24 Soybeans are only 22 cents aways from the 52-week contract low. The Corn wants to Rally, but still can’t let go of the Beans. I feel that the Corn will start to rally with the Wheat Market sooner than later, and I feel the Wheat Market can head toward the 580 level. I also sent out new Corn and Wheat trades this morning. If you are interested in seeing my past or future trades, just send me an email. BALLEN@WALSHTRADING.COM

-Bill

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.