8/5/24

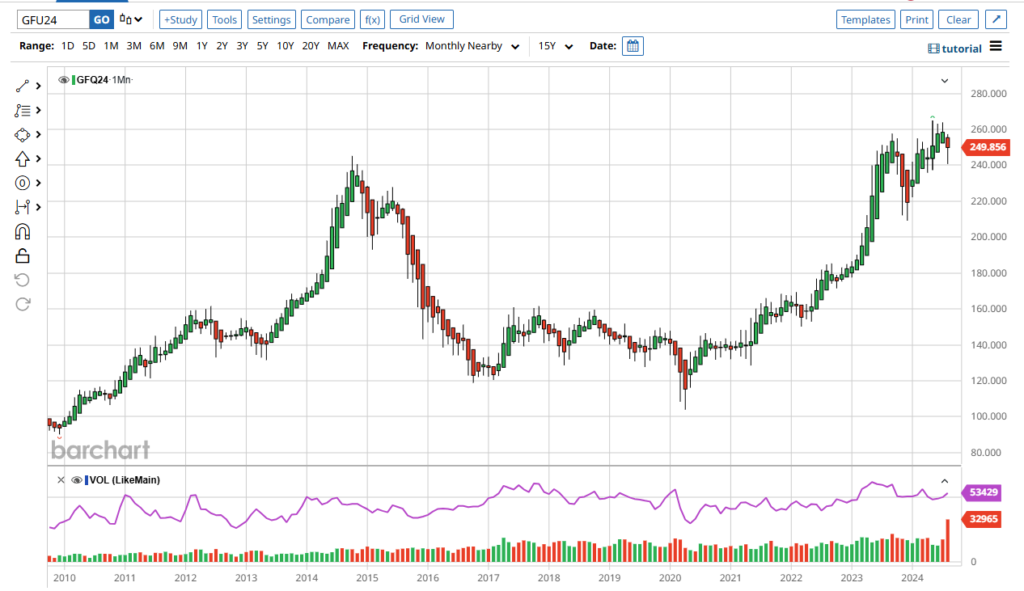

It was a wild day in the Cattle Markets. September’24 Feeder Cattle were Locked Limit Down just after the open today. October’24 Live Cattle were 3.07 ½ lower today and settled at 179.00. Today’s high was 180.50 and the 1-month high is 189.05. Today’s low was 176.35 and that is also the new 1-month low. The 52-week low is 168.50. Since 7/5 October’24 Live Cattle is 8.07 ½ or close to 4 ½%. The Feeders took a big hit today. September’24 Feeder Cattle were 6.90 lower today and settled at 241.25. Today’s high was 244.15 and the 1-month high is 263.77 ½. Today’s low was 238.90 and that is the new 1-month low as well. The 52-week low is 233.05. Since 7/5 September’24 Feeder Cattle are 20.62 ½ lower or almost 8%. The Hogs followed the Cattle lower today. October’24 Lean Hogs were 85 cents lower today and settled at 75.72 ½. Today’s high was 76.00 and the 1-month high is 78.70. Today’s low was 73.90 and the 1-month and 52-week low is 68.05. Since 7/5 October’24 Lean Hogs are 2.25 lower or just over 3%. September’24 Feeder Cattle were Locked Limit Down early this morning. The limit in Feeder Cattle is $9.25, and September’24 Feeder Cattle traded down to 238.90 and were locked there for a minute or two, before the market bounced off the limit move. It was just one week ago today, that I said September’24 Feeders would break another 7% from the current levels. On 7/29 September’24 Feeders settled at 256.07 ½, and 7% lower from there is 238.15. Today’s low was 238.90, but I am calling that a quick accurate win, I know my clients are. If this break continues from here, my next level lower is 231.50, just below the 52-week low of 233.05. I have numbers below that, and they are ugly. Let me know if you would like to see them. I included the 15-year Feeder Cattle Chart again, just to remind you of what can happen. When the Feeders broke hard last time, they fell roughly 95 dollars from 7/15 to 10/16. I am not calling for a break like that, only showing what is possible. However, in the Walsh Gamma Trader that I write, the March’25 200P almost doubled today, up 72 ½ cents and settled at 1.65. March’25 Feeder Cattle settled at 235.67 ½, down 7.57 ½ today. The Dow Jones Index was down about 930 points when the Livestock markets closed today and September’24 Dow settled down 1031 points. If the Stock Markets continue to break, I feel the Cattle Market will as well. I believe an Iranian attack on Iseral would only add fuel to the downside in the Stock Markets, putting more pressure on the Cattle Markets. It is now being reported that Iran closed their airspace for civilian aircraft as well.

The Grain Markets were all higher today. November’24 Soybeans had a slow but steady rally today. November’24 Soybeans were 13 ¼ cents higher today and settled at 1040 ¾. Today’s high was 1042 and the 1-month high is 1125 ¼. Today’s low was 1015 ½ and the 1-month and 52-week low is 1013. Since 7/5 November’24 Soybeans are 89 cents lower or almost 8%. The Corn gained as well today. December’24 Corn was 3 ¾ cents lower today and settled at 407. Today’s high was 407 ¾ and the 1-month high is 423 ¾. Today’s low was 396 and the 1-month and 52-week low is 395. Since 7/5 December’24 Corn is 17 cents lower or just over 4%. The Wheat ended the day fractionally higher. September’24 Wheat was ½ a cent higher today and settled at 539 ½. Today’s high was 541 ½ and the 1-month high is 590 ¾. Today’s low was 519 ¾ and the 1-month and 52-week low is 514 ¼. Since 7/5 September’24 Wheat is 51 cents lower or more than 8 ½%. The Grains were slow to rally today, with the Cattle and Stock Markets in a freefall lower this morning. I still feel the November’24 Soybeans will head toward their 20-Day moving average of 1049 ¼ before heading south again. I sent out an email (to a large number of you) before the open this morning, recommending buying November’24 Soybean Calls or Call Spreads, a few minutes after the open and selling them before the close today. I know many of you did that trade today, and it worked out well. December’24 Corn is approaching its 20-Day moving average of 409. If it gets through there, I think it can run up to the 1-month high of 423 ¾. September’24 Wheat traded up to the 20-Day moving average of 541 ½, before settling two cents lower for the day. If the September’24 Wheat can get through 541 ½ I feel it can head toward 552 ½ and then 561 ½, and if there is an increase of military conflicts around the world, the Wheat Market can head straight up, probably dragging the Corn with up with it. There is a WASDE Report one week from today, on the 12th, and we will see what surprises that has instore for us. There are many factors in all of these markets, and the volatility we are seeing, is going to be here for a while. If you are not being advised properly, give me a call. The days of using your uncle or cousin, or high school or Family Friend are over. These are Global Markets that need to be understood, respected and traded in real time. It is also your Business.

15-Year September Feeder Cattle Chart Below

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 S. Wacker Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.