5/29/24

It’s getting interesting out there… The strong surge in the US Dollar Index, and the US Stock Market breaking (as of 1:00 Central Time) is not helping the commodities, especially the Cattle Markets. Continue to sell into strength in the Cattle and Soybean Markets. Make sure to protect your downside exposure. These Markets will continue to move fast. Today, August’24 Live Cattle were 1.62 ½ lower and settled at 180.20. Today’s high was 181.85 and the 1-month high is 182.15. Today’s low was 178.70 and the 1-month low is 170.07 ½. Since 4/29 August’24 Live Cattle are 4.35 higher or 2 ½%. The Feeders were hit hard. August’24 Feeder Cattle were 4.35 lower today and settled at 260.25. Today’s high was 264.95 and that is also the new 1-month high. Today’s low was 259.30 and the 1-month low is 249.05. Since 4/29 August’24 Feeder Cattle are 72 ½ cents higher or fractionally higher. The Hogs continued their decline. July’24 Lean Hogs were 20 cents lower today and settled at 96.32 ½. Today’s high was 97.80 and the 1-month high is 106.75. Today’s low was 95.97 ½ and that is also the new 1-month low. Since 4/29 July’24 Lean Hogs are 9.25 lower or almost 9%. The Cattle on Feed Report last Friday did not have much Market moving information, however the Cattle Markets rallied on Tuesday, after the three-day Holiday weekend. August’24 Feeders closed more than four dollars higher yesterday, and the August’24 Fats gained 70 cents. This happened after the long weekend, and the USDA saying on Friday, that Bird Flu particles were found in a Dairy cow that was sent to slaughter. The meat from that animal did not enter the food chain. Yesterday, it was reported that the US, and Europe are in talks with drug companies to produce a vaccine for H5N1, to be used to protect dairy and poultry workers. This morning it was reported that Bird Flu/H5N1 was found in Alpacas at a farm in Idaho. A poultry flock, on the same farm, was also found to have the virus. The H5N1 virus has also been found in another Dairy herd in Michigan, along with two cats in New Mexico. This morning, I was also told a large egg producer in Iowa, has a 4.2 million bird flock infected with Bird Flu, and it could be the biggest outbreak in years. The average dressed Cattle weight last week was 851 pounds, one pound heavier than the week before, and 38 pounds heavier than last year. Yesterday’s rally in the Cattle Markets was a great opportunity to hedge, sell, or put on a short position. The Cattle could be overbought at these levels, and cash prices could begin to slide lower. The Cattle Markets could revisit the monthly lows. The Hogs lost 70 cents yesterday, and today they lost another 20 cents. If the Funds decide to liquidate the rest of their long position, it could send the Hog Market much lower. If the July’24 Lean Hogs break below 95.00, I feel a selloff to the 52-week low of 89.87 ½ is possible.

The Soybean Market ran out of steam yesterday and July’24 closed 18 ½ cents lower, and today July’24 Soybeans were 15 ½ cents lower and settled at 1214. Today’s high was 1231 ¼ and the 1-month high is 1258 ¼. Today’s low was 1212 ½ and the 1-month low is 1156 ¼. Since 4/29 July’24 Soybeans are 34 cents higher or almost 3%. The Corn followed the Soybeans lower. Today July’24 Corn was 7 ¼ cents lower and settled at 455 ¼. Today’s high was 463 and the 1-month high is 475 ½. Today’s low was 454 ¼ and the 1-month low is 443 ¾. Since 4/29 July’24 Corn is 6 ½ cents higher or almost 1 ½%. The Wheat continued lower as well. July’24 Wheat was 7 ½ cents lower today and settled at 692 ¾. Today’s high was 706 ¼ and the 1-month high is 720. Today’s low was 688 ½ and the 1-month low is 593 ½. Since 4/29 July’24 Wheat is 85 ½ cents higher or 14%. Crop progress was released yesterday, and the soybean plantings were ahead of schedule with 68% of the crop already in the ground, while the 5-year average is 63% planted by this time. Corn plantings are slightly ahead of schedule as well, with 83% of the crop in the ground, while the 5-year average is 82%. So, it looks like all the rain the Midwest did not slow down or put a halt to planting. Granted there are still some wet areas, but the spring rains have also helped the moisture levels in the soil, and much of the drought or dryness in the planting regions is now gone, with a favorable forecast moving forward. With the crop mostly in the ground. We will now have to watch for any weather-related concerns. The combination of good planting data, favorable weather forecasts and dismal export sales, make the Soybeans look overvalued to me. Soybean inspections YTD are 17 ½% lower than last year, during the same time period. I feel we will see $12.00 Soybeans shortly, and then break from there. Last week I said the August’24/November’24 spread would come in. It was 24 ½ cents then and is 17 cents now. Last week, China and Argentina were finishing the details of their new Corn trade deal. China has approved two GMO varieties of Argentina’s corn to be imported. The Corn imports from Argentina to China could begin as early as this July. US Corn inspections YTD are more than 26% higher than the same time frame last year. The Wheat Market has been on a tear since April and could have some juice left to head higher again. I said a month or two ago that India might have to import Wheat this year. Today it was reported that India will end their 40% tax on Wheat imports. That has not moved the markets yet, but it could, if private traders in India start to buy foreign Wheat. India’s government does not want to sell any more of their reserve stocks of Wheat. With the Russian Wheat crop still dealing with freeze damage, drought and a cut in production, any large Wheat purchases could push the Market higher, even after the recent $1.50 rally.

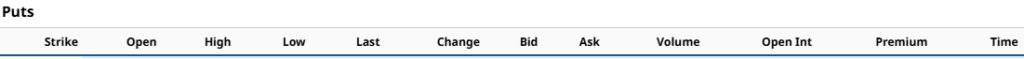

15-year August Feeder Cattle Chart Below

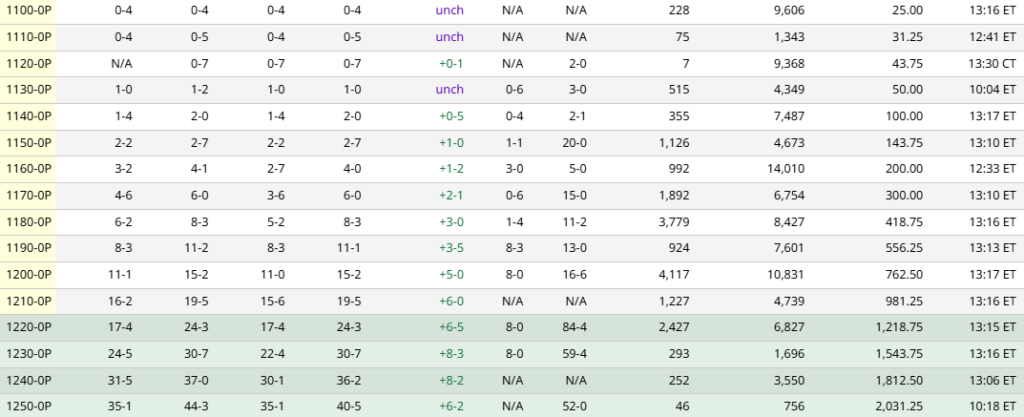

July’24 Soybeans Puts Below. You can see the daily volume and open interest.

I have a few new ideas. Give me a call.

–Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Listen Live at 7:25am on

Tuesday-Friday

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.