4/10/24

I hope you are on the right side, for the rest of the move lower. I have been saying the same thing for months, and it’s not over yet. The Beans and the Cattle were both lower again today, and I feel that could accelerate tomorrow. Today, June’24 Live Cattle were 2.00 lower and settled at 172.85. Today’s high was 175.27 ½ and the 1-month high is 186.62 ½. Today’s low was 172.17 ½ and the 1-month low is 171.40. The 52-week low is 162.75*. Since 3/8 June’24 Live Cattle are 10.75 lower or almost 6%. The Feeders were down as well. May’24 Feeder Cattle were 2.92 ½ lower today and settled at 236.52 ½. Today’s high was 240.00 and the 1-month high is 260.60. Today’s low was 235.22 ½ and that is also the new 1-month low. The 52-week low is 216.67 ½. Since 3/8 May’24 Feeder Cattle are 20.85 lower or more than 8%. The Hogs fell back to earth today. June’24 Lean Hogs were 3.02 ½ lower today and settled at 105.55. Today’s high was 109.65 and that is also the new 1-month and 52-week high. Today’s low was 104.82 ½ and the 1-month low is 98.62 ½. Since 3/8 May’24 Lean Hogs are 3.15 higher or above 3%. The Cattle Markets continued their slide lower today and feel the market will continue to move lower. There is too much beef in the market, the weights are still high, exports are not good, and imports are increasing. I don’t see the demand lasting at these prices. If that was not negative enough, the stock market was down big today when the Livestock and Grain Markets closed, and the dollar index surged today and set a new 1-month high at 105.085. That was too much for the Cattle Markets to take, and now technical factors can push the markets lower. I still recommend selling into any strength. Today the USDA announced it will no longer have a July Cattle Inventory Report, along with ending County estimates for Crops and Livestock, because of cost cutting measures. They will only have one Cattle Inventory Report a year, in January. My downside targets in June’24 Live Cattle are 169.57 and then 162.75, which is the 52-week low. For the May’24 Feeders my downside targets are 233.50, and 231.75, and then 221.00. If the June’24 Hogs continue to break, my downside target remains the same at 98.55, that is the 50% retracement from the 52-week hi/low. 98.62 ½ is the 1-month low and 96.27 is the 100-day moving average.

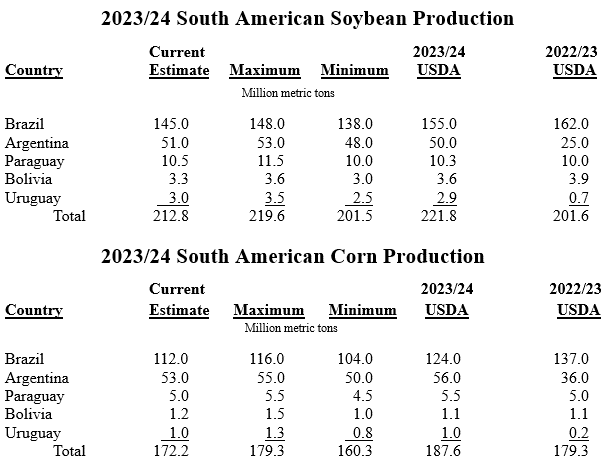

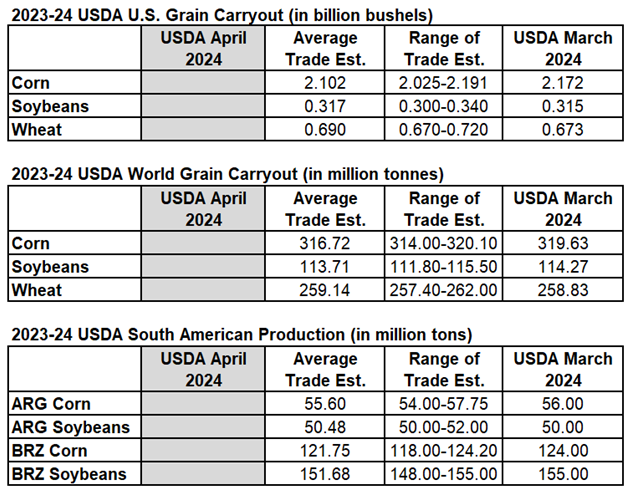

The monthly WASDE Report will be released tomorrow at 11;00am Central Time. I feel that it will be a Bearish Report for the Soybean Market, and a $10 handle is not too far away. Today the Soybean Market continued to decline. May’24 Soybeans were 9 ¾ cents lower today and settled at 1164 ¾. Today’s high was 1180 ¾ and the 1-month high is 1226 ¾. Today’s low was 1163 and that is also the new 1-month low. The 52-week low is 1128 ½*. Since 3/8 May’24 Soybeans are 18 cents lower or just over 1 ½%. The Corn Market was higher today. May’24 Corn was 3 cents higher and settled at 434 ¼. Today’s high was 435 ¾ and the 1-month high is 448. Today’s low was 430 ¾ and the 1-month low is 424 ½. Since 3/8 May’24 Corn is 6 cents lower or over 1%. The Wheat Market closed positive today. May’24 Wheat was ¾ of a cent higher today and settled at 558 ½. Today’s hi was 567 ¼ and the 1-month high is 574 ¾. Today’s low was 555 ¾ and the 1-month low is 523 ½. Since 3/8 May’24 Wheat is 21 ¼ cents higher or almost 4%. Tomorrows WASDE Report should help show where the Markets are going to move from here. CONAB’S estimates and the USDA estimates are far apart, and it will be interesting to see the numbers. There are two charts below that show the Soybean and Corn estimates in South America and the Grain carryover in the U.S. and the world Grain carryover. In my opinion we will see a Bearish Soybean Report and a Bullish Corn Report tomorrow. I feel that May’24 Soybeans will head toward their 52-week low of 1128 ½, and July’24 Soybeans will do the same, and head to their 52-week low of 1140 ½. My downside target today was 1165 ¾, that was hit, and my next level is 1140 ¼, and then 1128 ½. In the Corn Market my upside targets in May’24 Corn are 441, and 448, then 459. If the Corn Market breaks, then 424 ½ as a downside level. The Wheat Market could move in any direction, and my downside level would be 549 and the upside target level is 566 and then 574 ¾. We will see how everything works out tomorrow.

–Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.