4/5/24

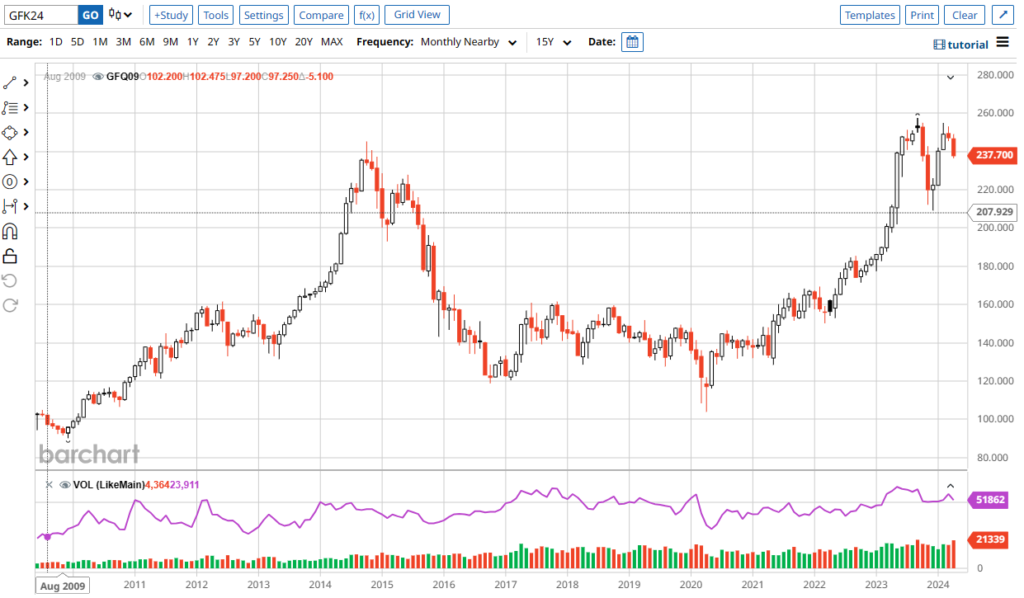

I hope your broker advised you well. This Cattle break I have been warning about is here, and was not hard to see, if you knew where to look. I believe the Soybean Market will be the next to fall. The Cattle Market was down big again today. June’24 Live Cattle was 3.80 lower today and settled at 172.05. Today’s high was 175.92 ½ and the 1-month high is 186.62 ½. Today’s low was 171.40 and that is also the 1-month low. The 52-week low is 162.75*. Since 3/5 June’24 Live Cattle are 11.57 ½ lower or more than 6%. The Feeders took it on the chin today. May’24 Feeder Cattle were 5.70 lower today and settled at 238.17 ½. Today’s high was 243.95 and the 1-month high is 260.60. Today’s low was 236.67 ½ and that’s the new 1-month low as well. The 52-week low is 216.76 ½. Since 3/5 May’24 Feeder Cattle are 20.05 lower or almost 8%. The Hogs continue to climb. June’24 Lean Hogs were 2.90 higher today and settled at 107.90. Today’s low was 105.37 ½ and the 1-month low is 98.62 ½. Today’s high was 108.00 and that is also the 1-month and 52-week high. Since 3/5 June’24 Lean Hogs are 6.30 higher or more than 6%. I believe I said it would be a vicious break in the Cattle Markets, and it’s not over yet. May’24 Feeder Cattle traded 260.60 on 3/21, and in two weeks and a day, it is 22.42 ½ lower at 238.17 ½. I feel that the Cattle Markets can continue to break, and my downside targets in June’24 Live Cattle are 169.57 and then 162.75. My downside targets in May’24 Feeder Cattle are 233.50, and then 221.00, and if continues lower, then the 52-week low of 216.67 ½. If the Hogs turnaround and break, they would probably head to the 98.00 level. I feel that the Soybean Market will be the next to break. I like the 1128 ½ level in May’24 Soybeans. Today May’24 Soybeans were 5 cents higher and settled at 1185. Today’s high was 1190 ¾ and the 1-month high is 1226 ¾. Today’s low was 1173 and the 1-month low is 1140 ¼. Since 3/5 May’24 Soybeans are 35 ¾ cents higher or more than 3%. Corn had a small decline today. May’24 Corn was 1 cent lower today and settled at 434 ¼. Since 3/5 May’24 Corn is 7 ¾ cents higher or almost 2%. The Wheat Market looked strong today. May’24 Wheat was 11 cents higher today and settled at 567 ¼. Today’s low was 555 and the 1-month and 52-week low is 523 ½. Today’s high was 574 ¾ and that is also the 1-month high. Since 3/5 May’24 Wheat is 15 cents higher or almost 3%. My downside targets in May’24 Soybeans start at 1173 ¼ and then 1140 ¼ on the way to the 52-week low of 1128 ½. Soybean exports have not been great, and China does not seem to have any interest buying anything from the U.S. Farmer. The Corn Market could rally and if it does, I like the 448 level and then 461. If the Corn Breaks back to the 423 ¼ level, I recommend buying it. The Wheat Market has been all over the place. If it continues to rally, my upside targets are 575 ¾ and then 588. If it breaks back down, my levels are 549 and then 543. Protect your downside exposure.

15-Year May Feeder Cattle Chart Below

Call me and let’s talk about the future movement of these Markets.

-Bill

312-957-8079

I have market commentary and Option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

at WWW.WALSHTRADING.COM and on Barchart

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.