3/28/24

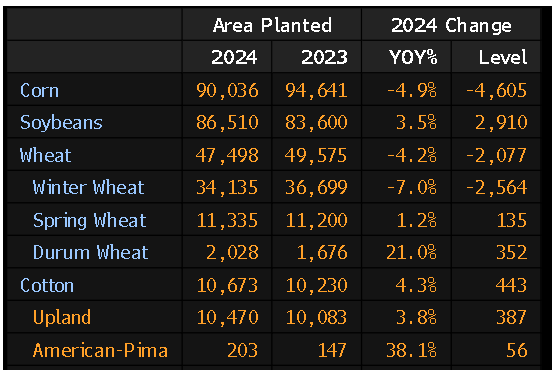

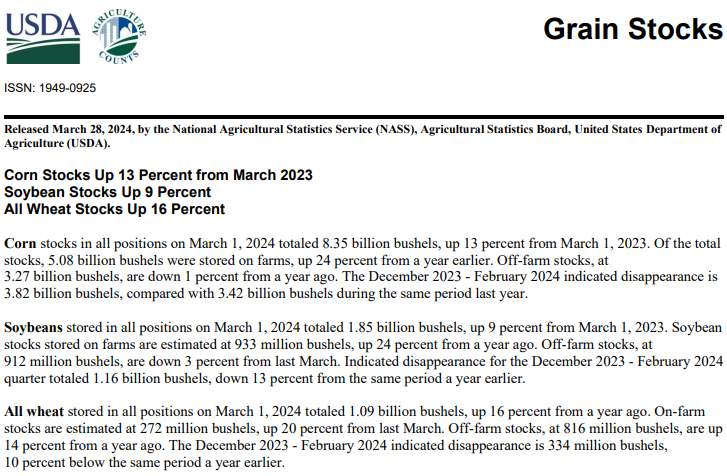

The Livestock and Grain Markets were all over the place today. June’24 Live Cattle were 1.57 ½ higher today and settled at 180.25, just below today’s high of 180.55. The 1-month high is 186.62 ½. Today’s low was 177.75 and the 1-month low is 176.40. Since 2/28 June’24 Live Cattle are 2.12 ½ lower or just over 1%. May’24 Feeder Cattle were 42 ½ cents lower today and settled at 248.70. Today’s high was 249.30 and the 1-month high is 260.60. Today’s low was 246.80 and the 1-month low is 245.42 ½. Since 2/28 May’24 Feeder Cattle are 9.52 ½ lower or close to 4%. June Lean Hogs were 15 cents lower today and settled at 101.45. Today’s high was 102.85 and the 1-month high is 103.47 ½. Today’s low was 100.67 ½ and the 1-month low is 98.62 ½. Since 2/28 June’24 Lean Hogs are 2.10 higher or more than 2%. I am still Bearish the Cattle Markets. In the cash market, prices averaged 184.85 over the last two days. Last week the cash averaged a price of 189.45, that’s a drop of 4.60. I still feel the Cattle Markets are overpriced and will continue to break. My downside targets in June’24 Live Cattle start at 176.40. That number is both the 1-month low and the 100-day moving average. The next level lower is 169.50 and then 163.00. My downside targets in May’24 Feeder Cattle start with 244.50. The next level lower is 239.50 and then 233.50. The low today was 246.80, and the 50% retracement from the 52-week high/low just happened to be 246.40. I feel that the selling will continue again next week, after the three-day Holiday weekend for Easter. The Planting Intentions Report was released today, and the Grain Markets started flying around. May’24 Soybeans were 1 cent lower today and settled at 1191 ½. Today’s high was 1199 ½ and the 1-month high is 1226 ¾. Today’s low was 1177 and that was also my first downside target level. The 1-month and 52-week low is still 1128 ½. Since 2/28 May’24 Soybeans are 46 ¼ cents higher or just over 4%. The Corn and Wheat Markets both had nice gains today but closed well off their highs. May’24 Corn was 15 ¼ cents higher today and settled at 442. Today’s high of 448 is also the 1-month high. Today’s low was 426 and the 1-month low is 422. Since 2/28 May’24 Corn is 13 ½ cents higher or over 3%. May’24 Wheat was 12 ¾ cents higher today and settled at 560 ¼. Today’s high was 568 ½ and the 1-month high is 581 ½. Today’s low was 544 ½ and the 1-month and 52-week low is 523 ½. Since 2/28 May’24 Wheat is 14 ½ cents lower or about 2 ½%. The morning started with the Brazil Soybean crop being raised. AgroConsult raised Brazil’s Soybean crop from 152.2mt to 156.5mt that’s an increase of 4.3mt. The Dollar was also at a 5-week high overnight. Along with weekly export sales for Soybeans down by almost 50%. Soybean weekly exports totaled 263,900mt way under the 300,000 – 700,000 metric tons expected. Just before the Report was released the Soybean Market was on its lows. The Report stated that fewer Corn acres then expected would be planted, down 5% and more Soybean acres would be planted, up 3 ½%. That’s what I have been saying for a while now. Along with Stocks increasing in all the Grain Markets. Corn Stocks were up 13%, Soybean Stocks were up 9%, and Wheat Stocks were up 16%. Then it was off to the races, and even the Soybeans were trading 7 cents higher at one point, before everything broke back down at the end of the day. I am still Bearish the Soybean Market and feel it will begin to head lower again next week. If the Beans do break, my downside target levels are 1166 and then 1150. After that 1128 ½ which is the 1-month and 52-week low. May’24 Corn set a new 1-month high today at 448. If the Corn continues to rally, my target level is 464 ¼, but if Corn gets dragged down following the Soybeans lower, then my downside level is 422 and then 408 ¾. My levels in May’24 Wheat range from 581 ½ on the upside and then 545 and 523 ½ on the downside. It looks like the USDA’s Soybean crop estimates for Brazil could be accurate at 155 million metric tons. I have been saying for months the Brazilian Crop would be huge. There was a lot of information released today, and after its all digested, over the 3-day weekend, I feel the Soybean Market will aggressively head lower. Have a Great Easter.

-Bill

312-957-8079

I have market commentary and Option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

at WWW.WALSHTRADING.COM and on Barchart

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.