3/17/25

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

The Cattle Markets continue to climb higher. The June’25 Fats made another high today. June’25 Live Cattle were 1.72 ½ higher today and settled at 201.07 ½. Today’s high was 201.17 ½ and that is the new 1-month high as well. Today’s low was 199.20 and the 1-month low is 185.00 Since 2/14 June’25 Live Cattle are 10.62 ½ higher or almost 6%. The Feeders made a new high as well. May’25 Feeder Cattle were 2.65 higher today and settled at 285.30. Today’s high was 285.55 and that is the new 1-month high and contract high as well. Today’s low was 282.52 ½ and the 1-month low is 263.67 ½. Since 2/14 April’25 Feeder Cattle are 20.30 higher or almost 8%. The Hogs had another strong day today. June’25 Lean Hogs were 2.82 ½ higher today and settled at 99.12 ½. Today’s high was 99.70 and the 1-month high is 106.35. Today’s low was 96.50 and the 1-month low is 92.00. Since 2/14 June’25 Lean Hogs are 5.55 lower or more than 5%. The Cattle Markets have been on one heck of a run, but there is a top to every market. I believe the top in the Cattle Markets will be reached soon, and it will be a spectacular collapse when it happens. Make sure you are prepared when it happens, because it will move fast. The end of March will mark the end of the first quarter of the year, and profit taking makes sense. There are ten trading days left in March, and a Cattle on Feed Report this Friday the 21st. I feel the June’25 Fats will make their first stop lower around the 185 level. The 50% retracement from the 52-week high low is 185.95, the 1-month low is 185, and the 200-Day moving average is 184.67. I think the May’25 Feeders can trade through the 100-Day moving average of 261.35, and then head toward the 255 area. The 50% retracement from the 52-week high/low is 256.60, and the 200-Day moving average is 254.93. The June’25 Hogs settled below the 50-Day and 100-Day moving averages, both over 100.00. It looks like the 96.00 level will be a strong support level or turnaround point, with the 200-Day moving average at 96.00 and the 50% retracement from the 52-week high/low at 96.05. The June’25 Hogs rallied nicely off today’s low of 96.50 as well. I have new trades structured in the Fats and the Feeders, let me know if you would like to see them.

.

.

I see two big trades for this year. You are watching the Natural Gas trade unfold now, with much more upside to come in my opinion. The second is the Soybean Oil. It has been knocked down, and I feel it is ready to shoot much higher. Timing is everything, and there is still time to take advantage of both markets now. The first step is calling me and opening an account. TAKE ADVANTAGE OF THE BREAK IN NATURAL GAS

.

.

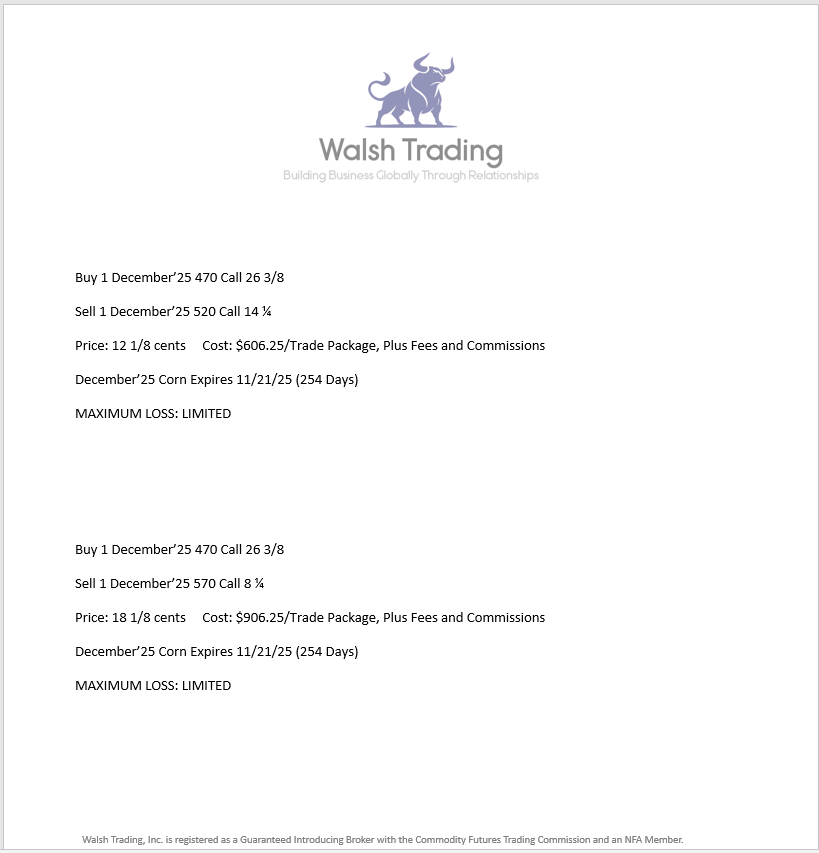

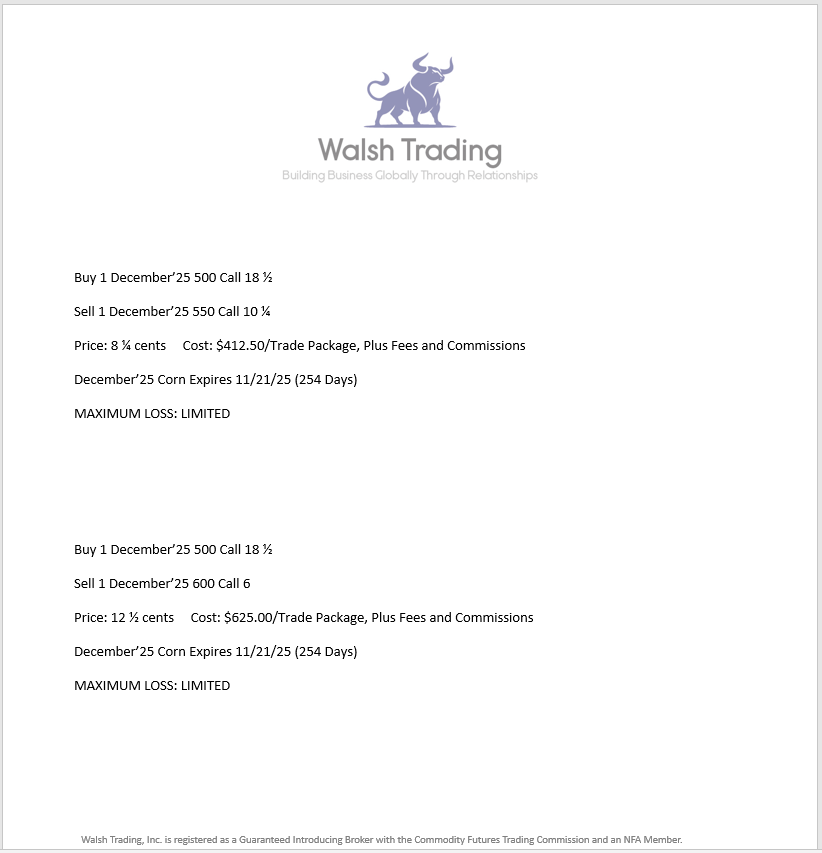

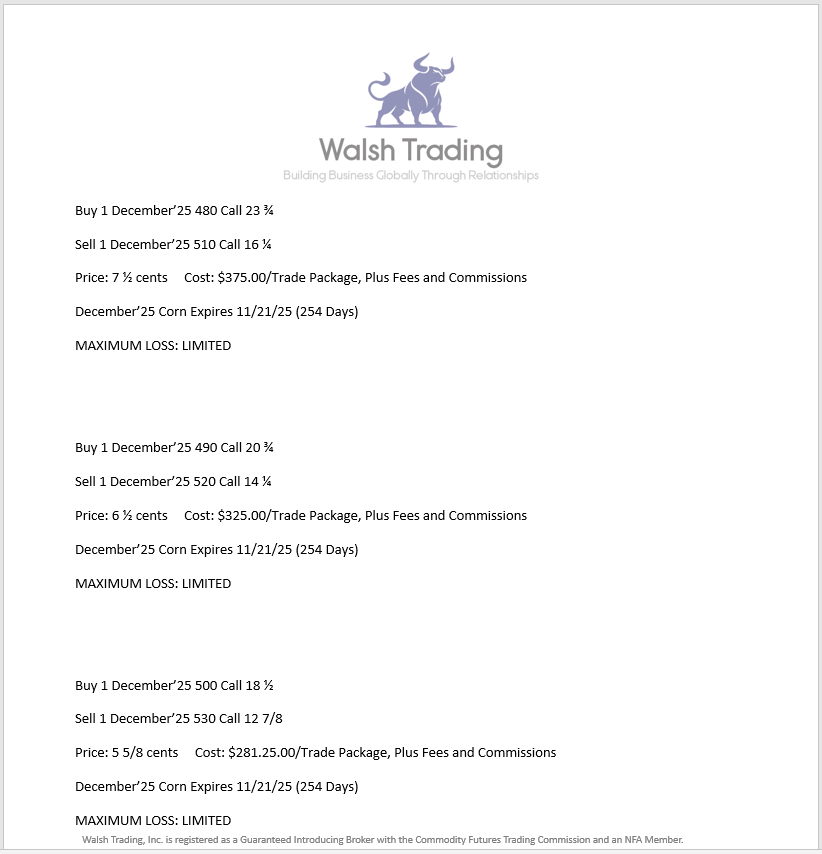

The Grain Markets were mixed today, but mostly higher. May’25 Soybeans were ½ a cent lower today and settled at 1015 ½. Today’s high was 1021 ¾ and the 1-month high is 1066 ¾. Today’s low was 1010 ¼ and the 1-month low is 991. Since 2/14 May’25 Soybeans are 37 ¼ cents lower or about 3 ½%. The Corn market gained again today. May’25 Corn was 2 ½ cents higher today and settled at 461. Today’s high was 465 ½ and the 1-month and 52-week high is 518 ¾. Today’s low was 457 ¼ and the 1-month low is 442 ½. Since 2/14 May’25 Corn is 47 ¾ cents lower or more than 9%. The Wheat Market shot higher today. May’25 Wheat was 11 1/2 cents higher today and settled at 568 ½. Today’s high was 575 ¼ and the 1-month high is 621 ¾. Today’s low was 559 and the 1-month and 52-week low is 530. Since 2/14 May’25 Wheat is 45 cents lower or more than 7%. It is time to be long all of the Grain Markets I believe. This morning I put out a new Walsh Gamma Trader. Take a look at it, and it will show you where I think these market can trade in the next couple of months. I think the Beans can trade up to 1096 and then over 1100, the Corn up to 485 and then over 500, and the Wheat over 600 and then head toward 650. The Corn Call Spreads from last week are still shown below. TAKEN FROM THE VAN TRUMP REPORT TODAY 3/17/25 “Chevron to Develop U.S. Data Centers with Power Generation: Chevron is advancing plans to tap into data center power demand, with the oil major recently entering the permitting and engineering phases for multiple U.S. sites to develop the centers and the electricity to supply them, a company executive told Reuters. Energy use for U.S. data centers, which are essentially giant server warehouses, is expected to triple in the next three years as the race to expand artificial intelligence intensifies. Big Tech has struck unprecedented power purchase deals to quickly access vast quantities of electricity, including buying directly from nuclear power plants and inking agreements with utilities to bring power generation to the grid. That growth – and the need to access vast amounts of electricity fast – is upending the country’s power industry, which is seeing record peak demand after dismal growth over nearly two decades, and giving new rise to natural gas consumption. And Big Oil is tapping into that growth. Chevron and Exxon Mobil last year announced plans to begin power generation, largely using the natural gas that they produce, for data centers for the first time. Most significant power generation by the oil majors has historically been used for their own operations. Chevron is targeting the development of data center sites and power plants that are around 1 GW in capacity and targeted to come online in 2027 or 2028.” That is just one little aspect of why the Nat Gas market will substantially increase in value. The Natural Gas market will be climbing higher for years to come, and Now is the time to get long Natural Gas, spread over several contract months. September’25 Natural Gas was just over 7 cents lower today and settled just short of 4.50. I think we can see September’25 Natural Gas trade well over 6.00. May’25 Soybeans Oil was 51 cents higher today and settled at 42.10. August’25 Soybean Oil was 47 cents higher and settled at 42.53 today. I still believe we will see August Soybean Oil trade above 65.00. Have a great night, and St. Patrick’s Day.

.

Corn Call Spreads Below

.

.

I will be out of town starting this Friday, March 14th – 23rd. I will be back in the office Monday, March 24th. I will always be available to take calls and enter trades.

.

.

It was a pleasure to meet everyone at the Commodity Classic in Denver, and at Cattle Con last month in San Antoino. If I can do anything for you, please give me a call.

.

.

August’25 Natural Gas 5-Year Chart Below.

.

.

.

.

September’25 Soybean Oil 5-Year Chart Below.

.

.

.

.

December’25 Corn Call Spreads to Protect Feed Costs Below

.

.

.

.

.

.

.

..

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canandian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link Walsh Gamma Trader

.

.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.