3/12/25

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

The Cattle Markets are completing their orbit around the sun, gaining speed, and will be sent back towards earth faster. The April’25 Fats set another high today. April’25 Live Cattle were 1.85 higher today and settled at 201.40. Today’s high was 202 ½ and that is the new 1-month high as well. Today’s low was 199.90 and the 1-month low is 189.50. Since 2/12 April’25 Live Cattle are 5.65 higher or almost 3%. The Feeders made a new high as well. April’25 Feeder Cattle were 3.02 ½ higher today and settled at 280.72 ½. Today’s high was 281.52 ½ and that is the new 1-month high and contract high as well. Today’s low was 278.45, and the 1-month low is 264.05. Since 2/12 April’25 Feeder Cattle are 15.50 higher or almost 6%. The Hogs were unable to stay positive today. April’25 Lean Hogs were 5 cents lower today and settled at 86.50. Today’s high was 87.40 and the 1-month high is 94.70. Today’s low was 85.82 ½ and the 1-month low is 80.72 ½. Since 2/12 April’25 Lean Hogs are 7.82 ½ lower or more than 8%. The Cattle markets continue to defy gravity and keep heading higher. The April’25 Fats made a new 1-month high today of 202 ½ and settled 5.70 below the contract high. The April’25 Feeders made a new contract high today of 281.52 ½. Over the last month the April’25 Feeders are $15.50 higher, and that is ridiculous. There are 13 trading days left in the month, and the end of March is the end of the first quarter, and we will see where the market goes. I still like the 190 level for starters. The 50% retracement from the 52-week high/low is 191.62 ½, the 200-Day moving average is 189.95, and the 1-month low is 189.50. For the Feeders the 260 area looks good. the 1-month low is 264.05, and the 100-Day moving average is 260.61. The April’25 Hogs settled in the middle of today’s range and gave back a nickel. I still like the upside and the 50-Day moving average is 88.47, the 100-Day moving average is 88.68, and the 1-month high is 94.70.

.

.

I see two big trades for this year. You are watching the Natural Gas trade unfold now, with much more upside to come in my opinion. The second is the Soybean Oil. It has been knocked down, and I feel it is ready to shoot much higher. Timing is everything, and there is still time to take advantage of both markets now. The first step is calling me and opening an account. TAKE ADVANTAGE OF THE BREAK IN THE SOYBEAN OIL AND NATURAL GAS

.

.

The Grain Markets were all sent lower today, while the tariff situation is worked out. May’25 Soybeans were 10 ¾ cents lower today and settled at 1000 ½. Today’s high was 1014 and the 1-month high is 1066 ¾. Today’s low was 994 and the 1-month low is 991. Since 2/12 May’25 Soybeans are 45 ¼ cents lower or more than 4%. The Corn market closed almost a dime lower today and presented a buying opportunity. May’25 Corn was 9 ½ cents lower today and settled at 460 ¾. Today’s high was 472 and the 1-month and 52-week high is 518 ¾. Today’s low was 456 ¼ and the 1-month low is 442 ½. Since 2/12 May’25 Corn is 43 ¼ cents lower or approaching 9%. The Wheat Market slip lower today as well. May’25 Wheat was 2 ¾ cents lower today and settled at 554. Today’s high was 561 ½ and the 1-month high is 621 ¾. Today’s low was 546 ½, and the 1-month and 52-week low is 530. Since 2/12 May’25 Wheat is 34 cents lower or almost 6%. With uncertainty enveloping most commodity markets, all the Grains traded lower today. The May’25 Soybeans traded down to 994 but were able to rally back and settle above 10.00 at 1000 ½. I think we will see more upside in the Soybean Complex. There are drought concerns, along with a potential trade deal with China, and either one would send all the crop markets higher. I like the 1050-1060 area right now for the May’25 Soybeans. The 50-Day moving average is 1043 and the 200-Day moving average is 1060 ½. The May’25 Corn settled between the 200-Day and 100-Day moving averages today, and I see it as a long-term buying opportunity, or protection from rising feed costs. The Brazilian Corn crop was just planted, and if they have any issues, the market could head higher, along with any potential drought in the Midwest, and Trade deals being worked out. 500 Corn is not that far away. The Wheat Market can, and does do whatever it wants, but as a whole I would rather be long at these price levels than short. The 50-Day moving average is 569 ½, the 100-Day is 573 ¼, and the 200-Day moving average is 598 ½. The 50% retracement from the 52-week high/low also sits at 650 ¾ for the May’25 contract month. The Soybean Oil and Natural Gas Markets both took a hit today, and that’s what happens to contracts that have been moving up for a while… That is also why I have recommended the differed contract months of September’25 for the Bean Oil and August’25 for the Natural Gas, and these are great levels to buy both of them. There is a very strong demand for Soybean Oil, and low stocks, and the whole planet is in need of energy, and the US will sell its immense Natural Gas supplies to the world. It will be a demand driven market.

.

.

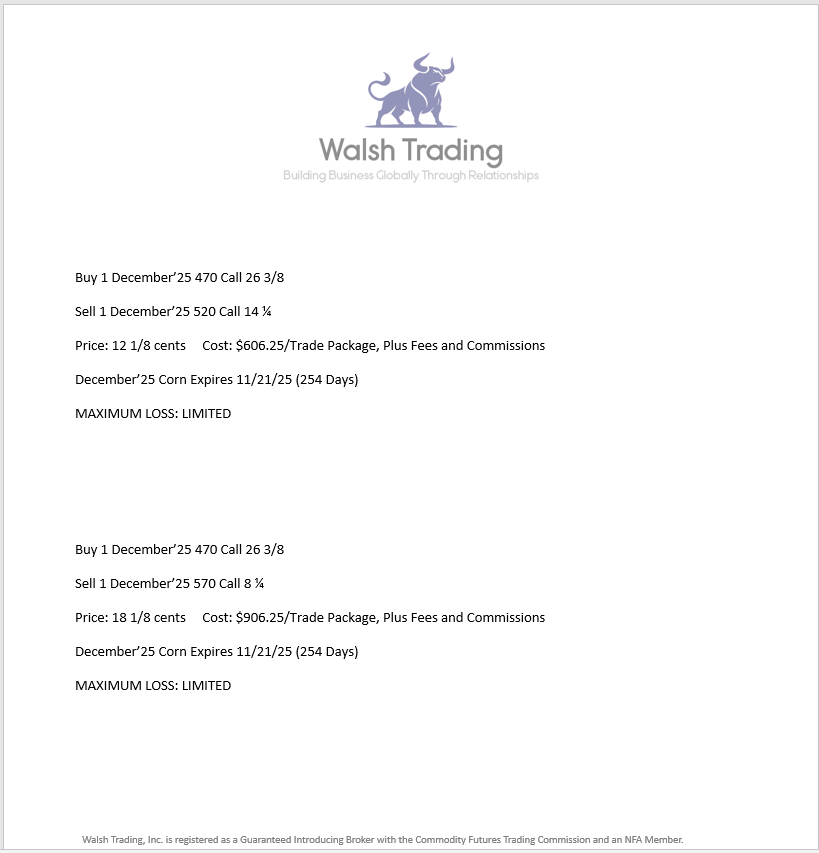

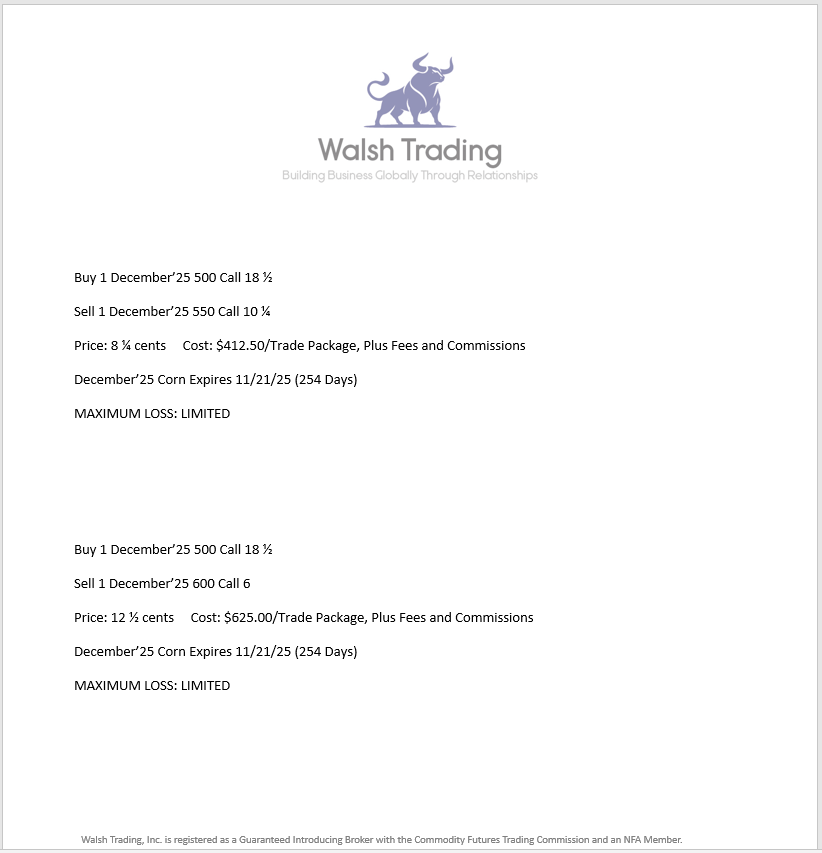

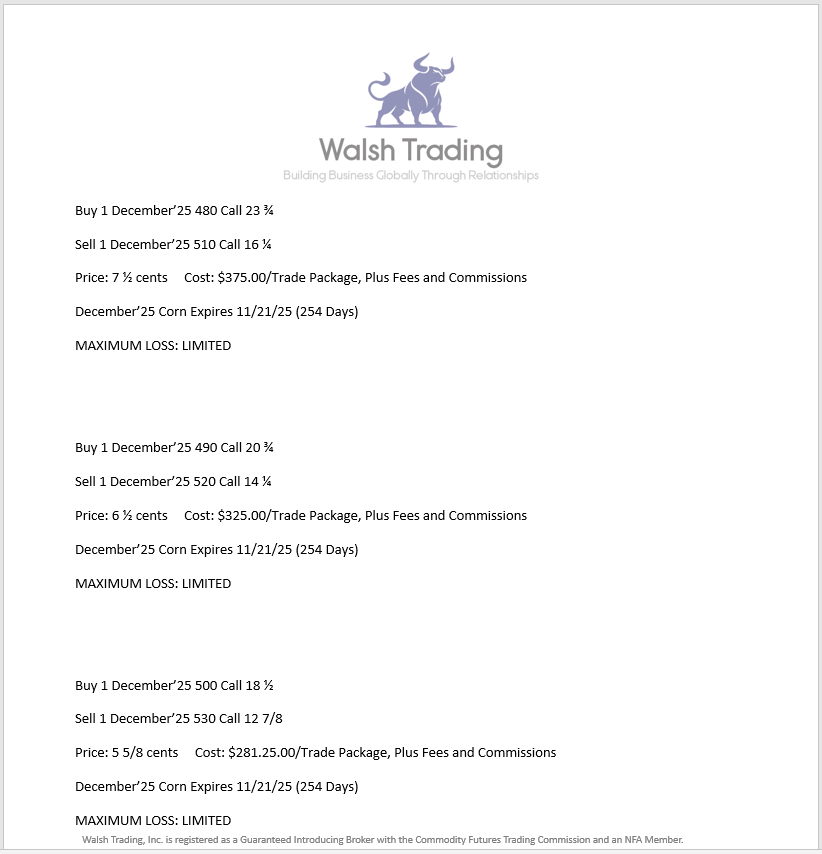

Corn Call Spreads Below

.

.

I will be out of town starting this Friday, March 14th – 23rd. I will be back in the office Monday, March 24th. I will always be available to take calls and enter trades. Pure Hedge – Livestock and Grain and Walsh Gamma Trader will return on 3/24/25.

.

.

It was a pleasure to meet everyone at the Commodity Classic in Denver, and at Cattle Con last month in San Antoino. If I can do anything for you, please give me a call.

.

.

August’25 Natural Gas 5-Year Chart Below.

.

.

.

.

September’25 Soybean Oil 5-Year Chart Below.

.

.

.

.

December’25 Corn Call Spreads to Protect Feed Costs Below

.

.

.

.

.

.

.

..

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canandian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link Walsh Gamma Trader

.

.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.