1/13/25

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Cattle Markets were lower today, with the Hogs closing higher. The Fats dropped more than a dollar today. February’25 Live Cattle were 1.37 ½ lower today and settled at 197.40. Today’s high was 198.75 and the 1-month high is 199.10. Today’s low was 197.32 ½ and the 1-month low is 186.27. Since 12/13 February’25 Live Cattle are 5.37 ½ higher or almost 3%. The Feeders were down a buck and a half today. March’25 Feeder Cattle were 1.50 lower today and settled at 267.90. Today’s high was 270.05 and the 1-month high is 271. Today’s low was 267.45 and the 1-month low is 254.00. Since 12/13 January’25 Feeder Cattle are 10.22 ½ higher or almost 4%. The Hogs held on to a gain today. February’25 Lean Hogs were 62 ½ cents higher today and settled at 83.17 ½. Today’s high was 83.80 and the 1-month and 52-week high is 86.60. Today’s low was 82.42 ½ and the 1-month low is 78.45. Since 12/13 February’25 Lean Hogs are 2.42 ½ lower or almost 3%. The Cattle Markets pulled back today, while the Hog numbers stayed green on the screen. The Fats and the Feeders made contract highs on Friday but pulled back after hitting those new highs Friday, and the trade lower continued today. The Febeuar’25 Fats on Friday closed 32 ½ cents below the contract high, and did not settle well today either. Today the February’25 Fats settled 1.70 below Friday’s high and just 7 ½ cents off today’s lows, closing 1.37 ½ lower at 197.40. The March’25 Feeders on Friday settled 1.60 off the highs and today broke another 1.50, to settle 3.10 below Fridays high, and just 45 cents above today’s low. The Hogs have bounced since hitting their 50% retracement level and had another gain today. Open interest in the February Fats was down over 12,000 contracts on Friday, so it looks like some Funds may be quietly trying to sell some of their long positions, and that would be about 10% of their long position. Open interest on Friday dropped more than it had gained every day the previous 8 days. That sounds like some sort of liquidation has begun. The February’25 Live Cattle Futures contract expires in 46 days on 2/28/25, so there is plenty of time to sell off, unless the selling gets aggressive. I still like the 186.50 level in the February’25 Fats. The 50% retracement from the 52-week high/low is 186.61, the 100-Day moving average is 186.44, the 200-Day moving average is 186.31, and 1-month low is 186.27. The March’25 Feeder could have an even bigger move if the Fats collapse. The 50-Day moving average for the March’25 Feeders is 254.31 and the 1-month low is 254.00. The next level lower is where the 50% retracement from the 52-week high/low sits at 246.95 and the 100-Day moving average of 245.65. We will see what the Traders and Funds decide to do, sooner than later.

.

Fats and Feeder Trades Below

.

If you realize it is time to open an account, please use this link Sign Up Now only 5 account pages need to be signed.

.

.

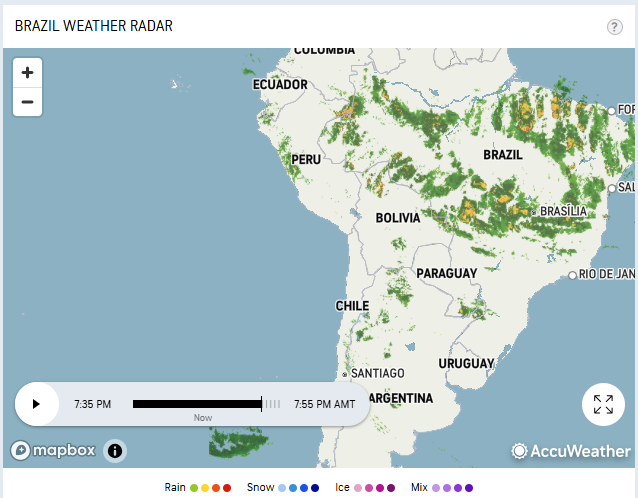

The Grain Markets were all higher today. The Beans shot higher again today. March’25 Soybeans were 27 ¾ cents higher today and settled at 10.53. Today’s high was 1053 ½ and that is the new 1-month high as well. Today’s low was 1024 ¼ and the 1-month and 52-week low is 947. Since 12/13 March’25 Soybeans are 58 cents higher or almost 6%. The Corn Market rallied as well today. March’25 Corn was 6 cents higher today and settled at 476 ½. Today’s high was 477 and that is the new 1-month high as well. Today’s low was 469 ¼ and the 1-month low is 435 ¾. Since 12/13 March’25 Corn is 34 ½ cents higher or almost 8%. The Wheat Market caught up a little today. March’25 Wheat was 14 ¼ cents higher today and settled at 545. Today’s high was 545 ¾ and the 1-month high is 569 ¼. Today’s low was 528 ½ and the 1-month and 52-week low is 526. Since 12/13 March’25 Wheat is7 ¼ cents lower or more than 1%. The Grain Markets were all higher today after the WASDE Report was released on Friday. The Ending stocks were lowered significantly, causing the Corn and Soybeans to rally. There are also potential weather problems in Argentina, with some dryness, and a slow start to the Brazilian Soybean harvest, but I think both Markets have rallied too much too fast. March’25 Soybeans made a new 1-month high today, and maybe they can rally another few cents to the 13-week high of 1055, or the 38.2% retracement from the 52-week low of 1057, but I don’t think there is any reason to panic in the Soybean Market. South America will still produce a record crop, and there is nothing out there yet to say otherwise. If Beans do continue to rally the 200-Day moving average is 1081 and the 50% retracement from the 52-week high/low is 1091. The August’25 Bean Option trades I structured months ago, were structured just for this, and are working with 193 Days left and expire on 7/25/25. Many of you have those Bean Option Trades I sent in October as well. The Corn Market looks good as well, but a pull back is likely to the 450-460 level. The Wheat can still run higher I believe, and the 580 level looks good.

.

.

Today’s Brazil Weather Radar Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

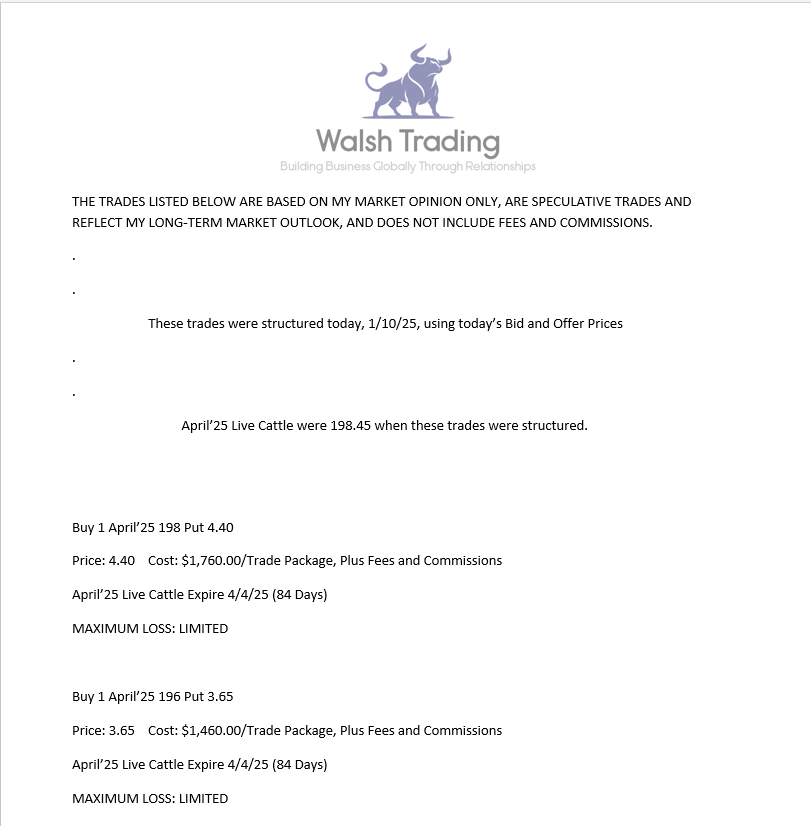

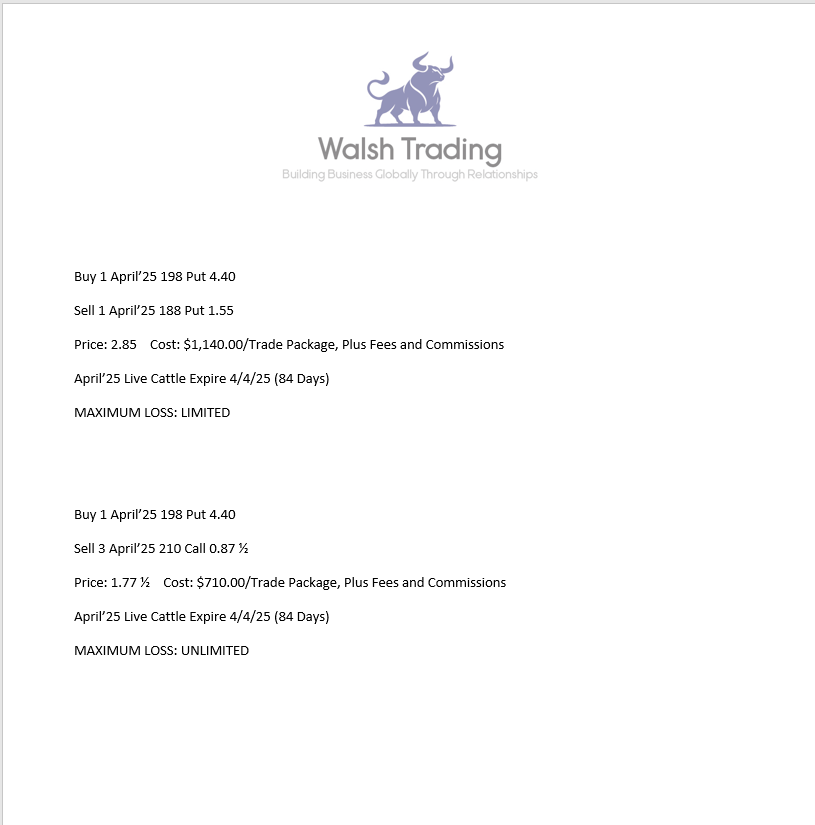

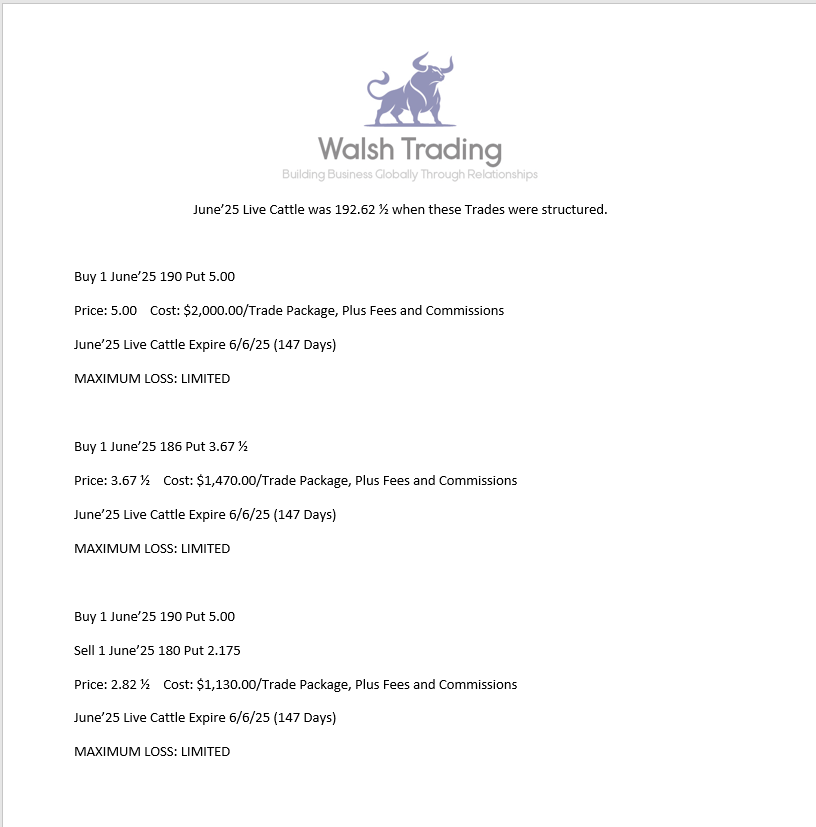

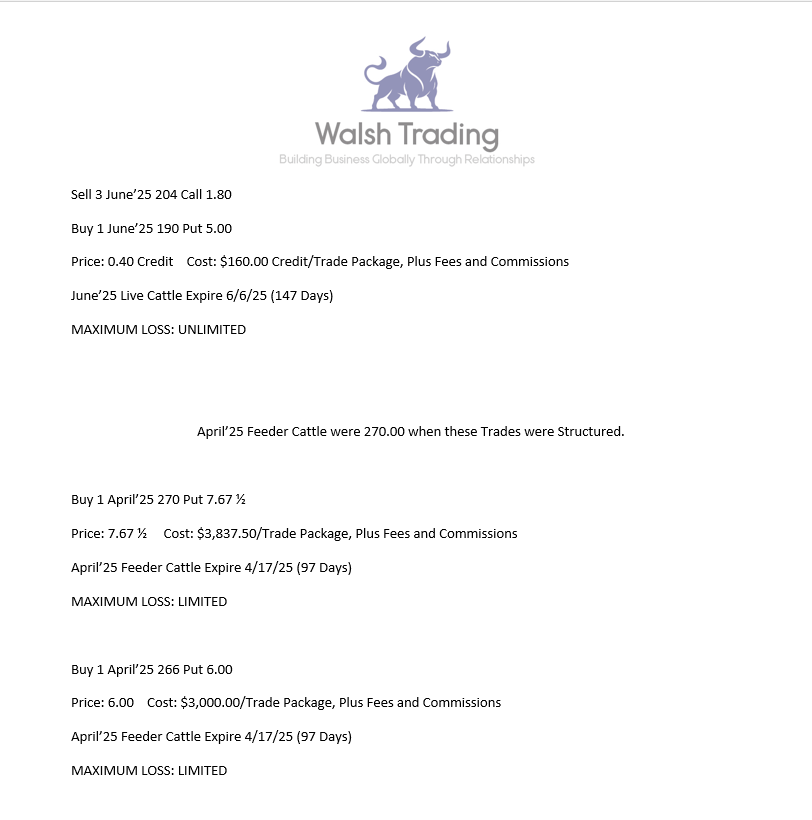

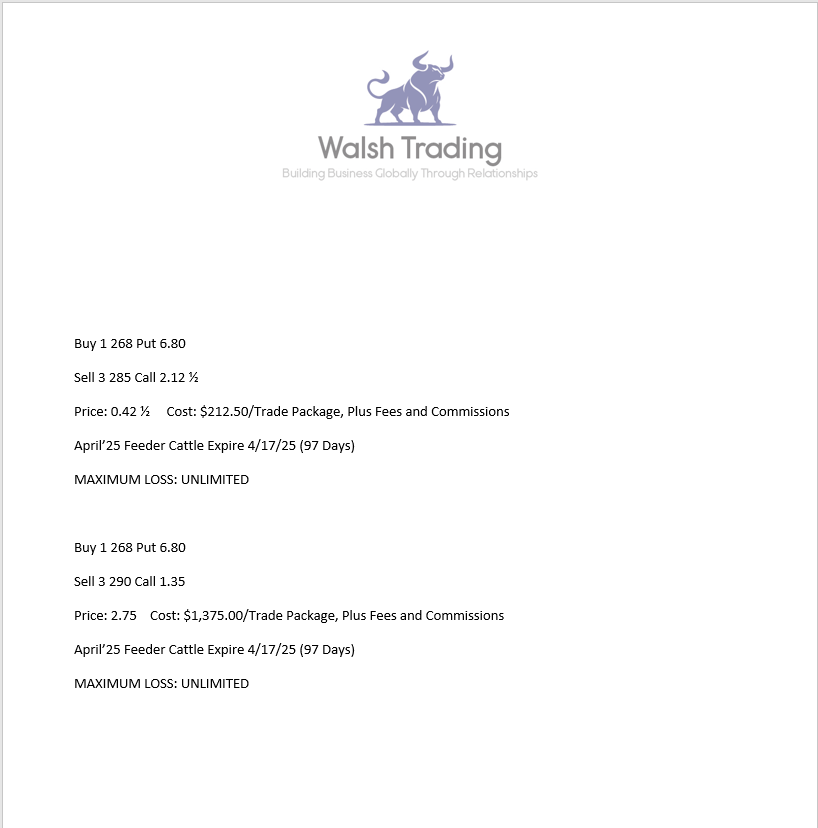

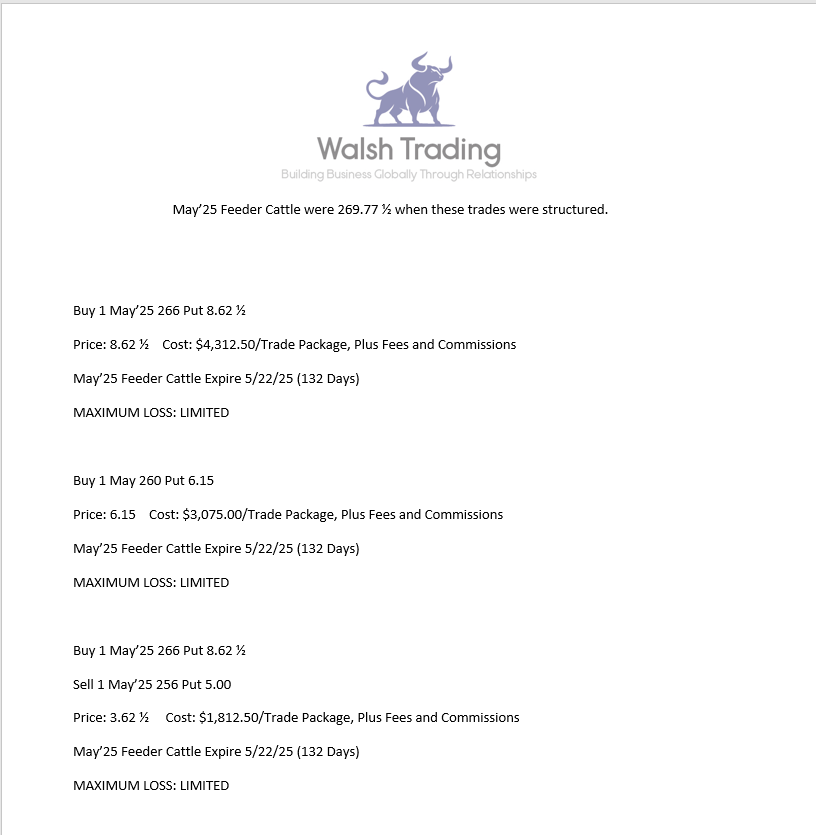

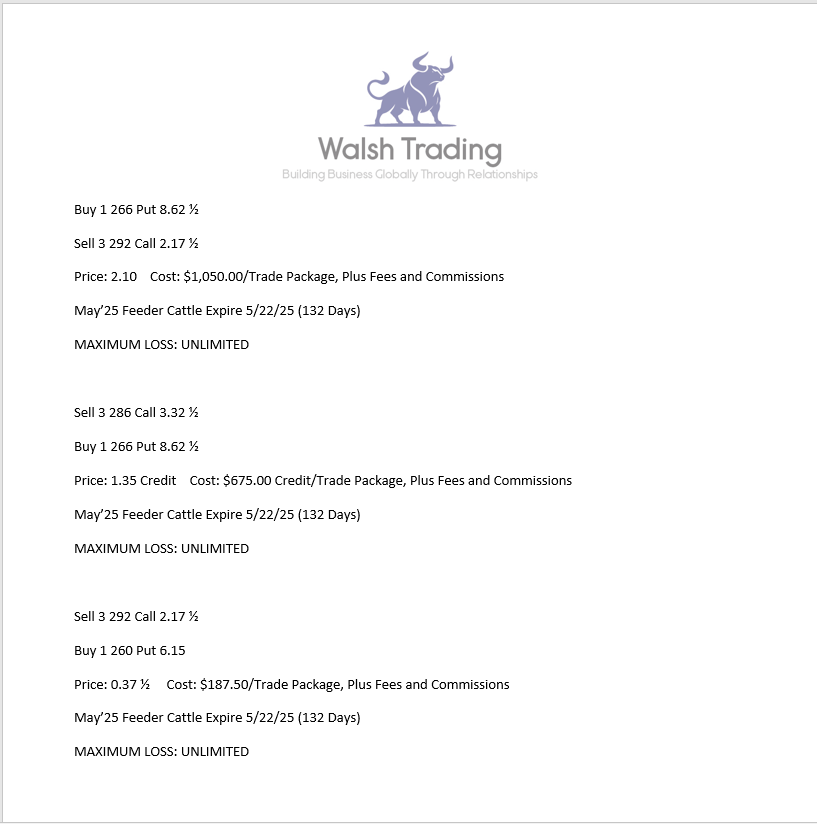

Below are recommendations from Friday, 1/10/25.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.