1/8/25 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

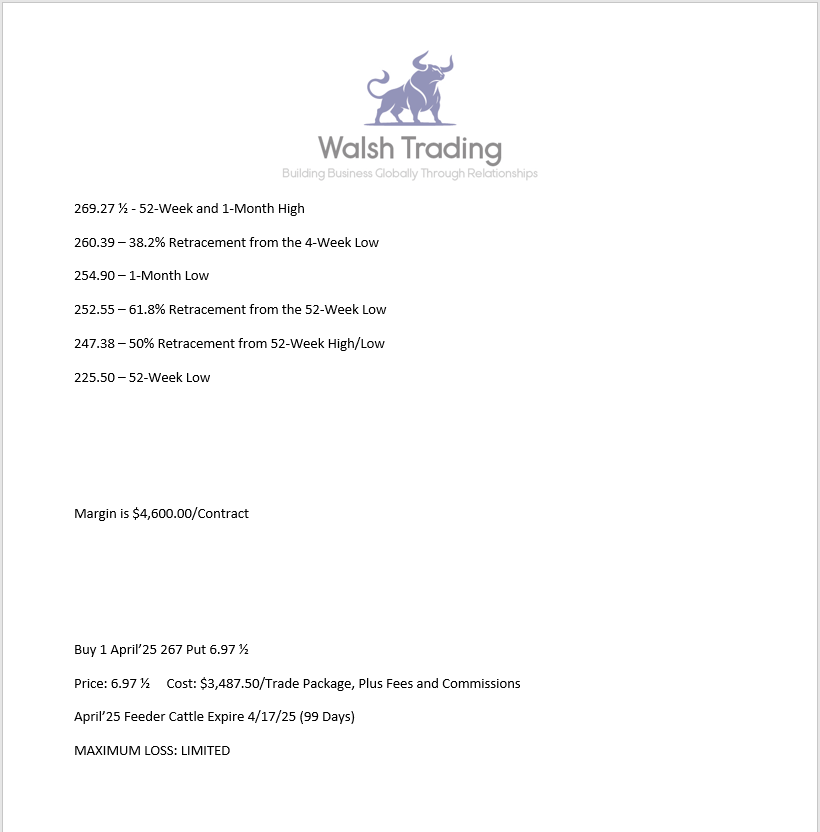

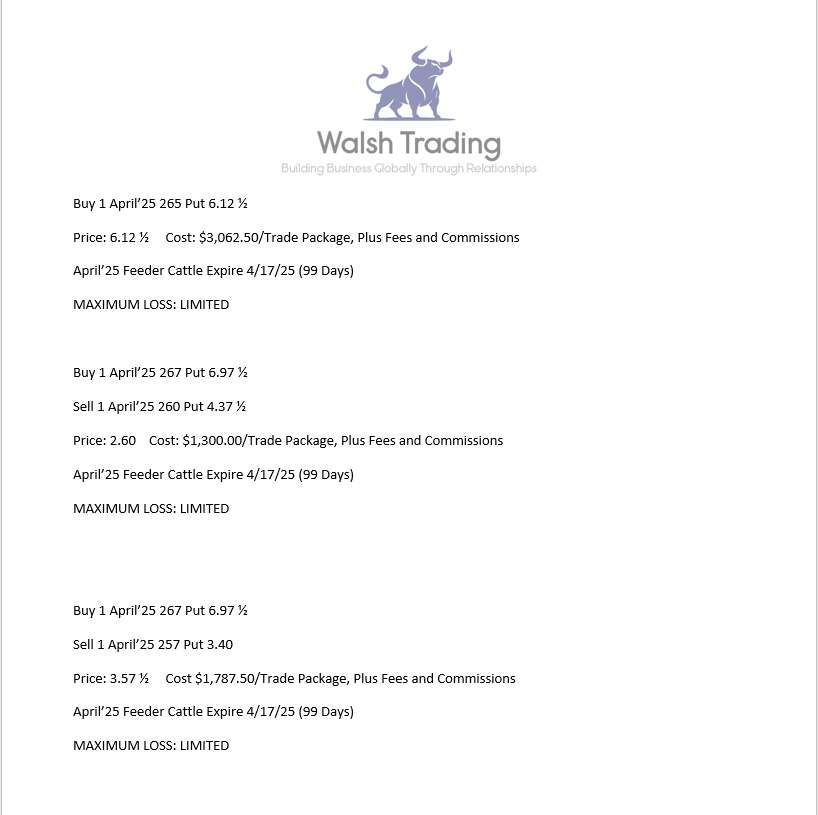

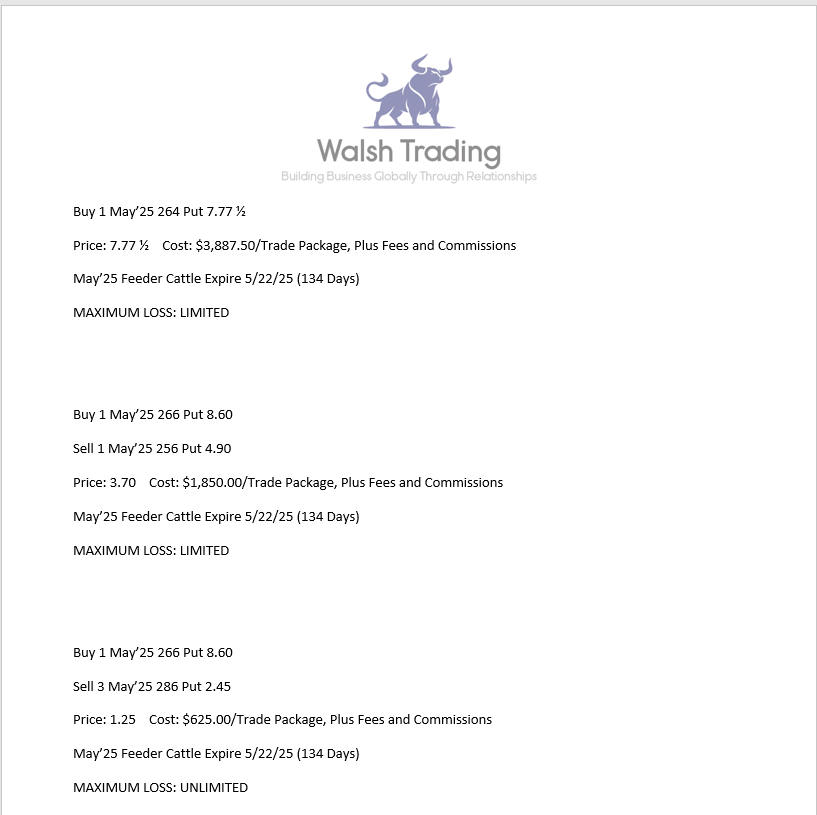

The Cattle Markets were lower today, with the Hogs setting a new 1-month low. The Fats dropped almost 2 dollars today. February’25 Live Cattle were 1.87 ½ lower today and settled at 193.70. Today’s high was 196.35 and the 1-month high is 196.62 ½. Today’s low was 193.47 ½ and the 1-month low is 185.90. Since 12/6 February’25 Live Cattle are 7.52 ½ higher or just over 4%. The Feeders lost almost 3 dollars today. March’25 Feeder Cattle were 295 lower today and settled at 264.97 ½. Today’s high was 268.65 and the 1-month high is 268.77 ½. Today’s low was 263.62 ½ and the 1-month low is 254.00. Since 12/6 January’25 Feeder Cattle are 10.30 higher or more than 4%. The Hogs held on to a gain today. February’25 Lean Hogs were 30 cents higher today and settled at 7947 ½. Today’s high was 79.80 and the 1-month high is 87.87 ½. Today’s low was 78.45 and that is also the new 1-month low. Since 12/6 February’25 Lean Hogs are 7.85 lower or almost 9%. It looks like the US border could be open to Cattle from Mexico starting January 20th. The Cattle Markets headed lower today, and they should continue lower from here. The Fats and the Feeders were unable to make new highs again today, and the Markets both pulled back. February’25 Fats were within 27 ½ cents of the 1-month high today, before they headed lower from there, dropping $2.65, and settling 22 ½ cents from the day’s low at 193.70, down 1.87 ½ for the day. The March’25 Feeders were within 12 ½ cents of the 1-month high but pulled back as well falling $3.76 ½ and settling at 264.97 ½, down 2.95 for the day. It did not look like the Funds started selling today. The failure to make new highs in the markets, along with the border opening soon for Cattle from Mexico, probably lead to the break today. I am sure there were some traders trying to push the markets lower as well, trying to find the Funds pain threshold. They might have been close on the lows today; I am sure more will try to find the stops below the markets. when they are found, it will move very quickly. The Funds could be getting nervous again now, with more attention on the Cattle Markets, and they will not have the US Stock Markets to lean back on tomorrow. The equities are all closed tomorrow for a National Holiday for President Jimmy Carter. There could be more eyes on the Livestock and Grain Markets that close at 12:15 Central Time tomorrow, and that could make the Funds nervous as well. The first Fund to sell, usually sells at a better level, and you can’t play chicken forever. I feel the February’25 Fats could head to the 185.50 level. The 200-Day moving average is 186.17, the 1-month low is 185.90, the 100-Day moving average is 185.85, and the 50% retracement from the 52-week high/low is 185.37 ½. The March’25 Feeders could break hard soon. The 1-month low for March’25 Feeders is 254, and the 50-Day moving average is 252.76. The other two Yuge levels are much lower from there, with the 50% retracement from the 52-week high/low at 245.83 and the 100-Day moving average at 244.53. The February’25 Hogs traded down to where I thought they would. They traded down to and through the 200-Day moving average 78.84 ¾ and set a new 1-month low at 78.45. The 50% retracement from the 52-week high/low just happens to be 78.11 as well. I heard very early estimates for the Cattle on Feed Report, and they are Yuge as well. Use this link Sign Up Now if you would like to know more. I structured some Heges or Trades for a Customer in the April’25 and May’25 Feeders this morning. Most of what I sent him is included below.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

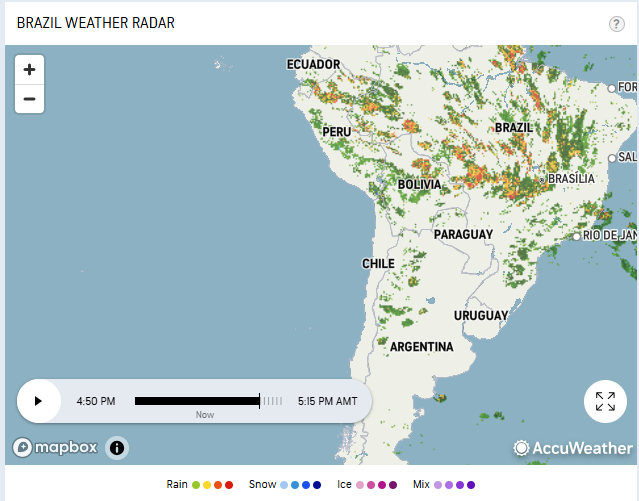

The Grain Markets were all lower today. The Beans gave a few cents back and settled below $10.00 again today. March’25 Soybeans were 2 ¾ cents lower today and settled at 994 ½. Today’s high was 1001 and the 1-month high is 1015 ¾. Today’s low was 991 and the 1-month and 52-week low is 947, for now. Since 12/6 March’25 Soybeans are 4 ¾ cents lower or fractionally lower. The Corn Market took a step back today. March’25 Corn was 4 cents lower today and settled at 454. Today’s high was 459 ¼ and the 1-month high is 460 ¼. Today’s low was 453 ½ and the 1-month low is 435 ¾. Since 12/6 March’25 Corn is 14 cents higher or more than 3 %. The Wheat Market dropped a little lower as well today. March’25 Wheat was 6 ¼ cents lower today and settled at 536 ¼. Today’s high was 544 ¾ and the 1-month high is 569 ¼. Today’s low was 534 ½ and the 1-month and 52-week low is 527 ½. Since 12/6 March’25 Wheat is 21 cents lower or almost 4%. The Grains were all lower today, waiting for the WASDE Report at 11:00am Central time on Friday. The Soybean Market continues to fluctuate around the 1000 level and could eventually head lower. The South American Crops look good, and they were planted to be record size. When we see just how big the Brazilian crop will be, I think we will see the lows close behind. The world ending stocks for Corn are tight, and there could be run higher Friday if people are surprised by the Report. Below you will see a plan for the Corn Market ahead of the report on Friday. It shows the Option values for March’25 Corn, and the Week 2 and Week 3 Option contracts as well. The weekly Options are great before a report if you want to peg a level, without having to pay for all the time value. If you are interested in the weekly Options, use this link Sign Up Now I have them for the Beans and Wheat Markets as well. I now feel the March’25 Corn can trade up to 470, maybe higher. I would sell it if got close to 5 bucks. The Wheat Market is due for a big move again, and I think it can trade up to the 580 level. There are great prices in the Weekly Options for Wheat. If there is anything I can do for you, just ask.

.

.

Today’s Brazil Weather Radar Map Below.

.

.

.

March’25 Corn could get a boost on Fridays Report. After looking more at the Corn Market, the

global stocks look low. In fact, they are at 18-year lows for major exporting countries, Russia, Ukraine,

South Africa, Argentina, and Brazil. The estimates also include South American Production, and Brazil’s

huge Corn crop has not been planted yet. Demand has been strong, and we could see a bigger decline

in US stocks than anticipated. Over the last nine trading sessions, March’25 Corn has settled between

450 and 460, and only once traded higher than 460 on 1/6/25 trading 460 ¼. On 12/30/24 it traded

below 450 to 449 ¾, and on 12/26/24 it traded down to 448 ½. I think it would be a good time to use

the ‘Week 2 or Week 3’ Options and buy some cheap Calls before the Report on Friday. It has been

range bound and could have a breakout after the report is released. If Corn somehow trades near

$5.00, sell it. Below you will see the price difference between regular March’25 Options, Week 2

Options, and Week 3 Options. Regular Options expire 2/21/25, Week 2 Options expire the day of the

Report 1/10/25, and Week 3 Options expire the following Friday on 1/17/25.

.

508 ¼ – 52-Week High

468 3/8 – 61.8% Retracement from 52-Week High/Low*

460 ¼ – 1-Month High

456 – 50% Retracement from 52-Week High/Low

435 ¾ – 1-Month Low

403 ¾ – 52-Week Low

.

March’25 Corn was 457 when these Bid and Offers were recorded.

.

March’25 Corn Options March’25 Week 2 Options March’25 Week 3 Options

455 Calls 11 ¼ – 11 ½ 455 Calls 5 5/8 – 6 455 Calls 6 ½ – 7

460 Calls 9 – 9 ¼ 460 Calls 3 ¼ – 3 ½ 460 Calls 4 1/8 – 4 ½

465 Calls 7 1/8 – 7 3/8 465 Calls 1 ¾ – 1 7/8 465 Calls 2 ½ – 2 ¾

470 Calls 5 ½ – 5 ¾ 470 Calls ¾ – 1 470 Calls 1 3/8 – 1 5/8

.

There is still time to open an account and participate before Friday’s Report, if you act now.

.

.

April’25 & May’25 Feeder Cattle Hedges or Trades I Structured for a Customer this morning below.

.

.

.

.

.

.

.

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.