12/30/24

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

The Livestock Markets were mixed again today, with the Fats lower and Feeders slightly higher, while the Hogs slammed back down to earth. The Fats were lower on the close today. February’25 Live Cattle were 35 cents lower today and settled at 190.30. Today’s high was 191.60 and the 1-month high is 193.22 ½. Today’s low was 190.12 ½ and the 1-month low is 185.90. Since 11/29 February’25 Live Cattle are 1.67 ½ higher or almost 1%. The Feeders gained a quarter today. January’25 Feeder Cattle were 25 cents higher today and settled at 261.62 ½. Today’s high was 262.20 and the 1- month high as well. Today’s low was 259.90 and the 1-month low is 253.80. Since 11/29 January’25 Feeder Cattle are 2.15 higher or almost 1%. The Hogs fell down today. February’25 Lean Hogs were 2.52 ½ lower today and settled at 81.62 ½. Today’s high was 84.15 and the 1-month high is 89.27 ½. Today’s low was 80.90 and the 1-month low is 82.67 ½. Since 11/29 February’25 Lean Hogs are 4.70 lower or almost 5 ½ %. The Cattle Markets were bouncing all over the place today, and it felt like there was a bigger range than there was. At the end of the day, the February’25 Fats closed down 35 cents, and the January’25 Feeders closed 25 cents higher. The Hogs fell out of the sky today and were within a dollar of my 80.00 level. The February’25 Hogs climbed off the bottom but still closed the day down 2.52 ½. The Dow Jones Index was down more than 750 points this morning and I think that helped push the Cattle Markets lower, but when the Dow gained more than half back, the Fats and Feeders rallied as well. I still feel that the Cattle Markets will break from here. I guess the Funds don’t want to liquidate during this slow two-week period, at least not yet. The Hogs were stuck in the mud and could sink deeper. I still think they will trade South of 80.00 soon. I recommend staying short the Livestock Markets through the end of the week.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

The Grain Markets were mixed again as well today, with prices flying all over the place. The Beans had a 20-cent range today. January’25 Soybeans were 2 cents higher today and settled at 982. Today’s high was 994 ¾ and the 1-month high is 1003 ½. Today’s low was 974 ¾ and the 1-month and 52-week low is 945 ¼. Since 11/29 January’25 Soybeans are 7 ½ cents lower or almost 1%. The Corn Market gave a little back today. March’25 Corn was 1 ¾ cents lower today and settled at 452 ¼. Today’s high was 458 ½ and that is the 1-month high as well. Today’s low was 449 ¾ and the 1-month low is 428 ¼. Since 11/29 March’25 Corn is 19 ¼ cents higher or almost 4 ½ %. The Wheat Market gained again today. March’25 Wheat was 1 ¾ cents higher today and settled at 548 ¼. Today’s high was 554 ¾ and the 1-month high is 569 ¼. Today’s low was 544 ½ and the 1-month and 52-week low is 529 ¼. Since 11/29 March’25 Wheat is ¼ cent higher or fractionally higher. The Beans did what I continue to think they will for a while and have swings up and down between 940 and 1000. I would be careful if the Beans trade a few cents above 1000, it could be a trap, and shoot 20 cents higher, to get the shorts out, and then sell off again. The Corn is doing just about what I thought it would. I said I did not want to buy it over 450 and today was an example why. The Corn Market looks strong but is not ready to rocket forward. I would continue to but it on breaks between 435-440. If March’25 Corn does trade above 461 ¾ than it could express to 471. The Wheat Market had a nice rally for a while but slipped lower with everything else. I still believe the March’25 Wheat can trade to and through the 580 level. I still like the Soybean Oil Market and the Canola Oil Market as well. I definitely feel the Natural Gas Market could be the best market to be long right now. I have been Bullish for a while as you know, and today it got a huge bounce higher. The February’25 Contract gained more than 53 cents today and settled at 3.917. It traded as high as 4.201. The March’25 gained more than 27 cents and July’25 was up more than 13 cents. There is still time to get long, and I feel the Natural Gas Market can move MUCH higher. There could be a pull back after such a large rally, and that would me opportunity to get long or buy more. I feel this market can rally for a year or more. I sent my Natural Gas Plan to every email I have last week, and it is looking good right now. If you would like to see it, or want to know why I am Bullish, give me a call. There will be plenty of volatility to look forward to next year. Have a safe and Blessed New Year. – I will be in San Antonio for Cattle Con February 3rd, and in Denver for the Commodity Classic March 1st. If you are there, stop by, I would like to meet you.

.

And Hedge your Cattle

.

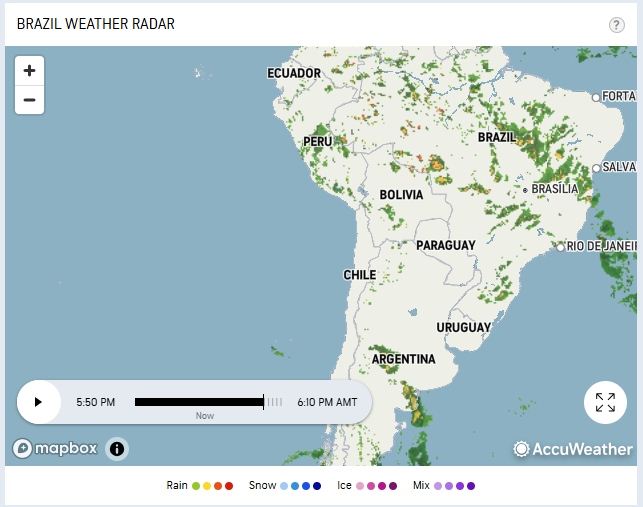

Today’s Brazil Weather Radar Map Below.

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.