12/23/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Livestock Markets were mixed today, after a quiet Cattle on Feed Report. The Fats dropped almost a buck today. February’25 Live Cattle were 95 cents lower today and settled at 187.45. Today’s high was 188.57 ½ and the 1-month high is 193.22 ½. Today’s low was 187.27 ½ and the 1-month low is 185.90. Since 11/22 February’25 Live Cattle are 75 cents lower or almost ½%. The Feeders gained a dollar even today. January’25 Feeder Cattle were 1.00 higher today and settled at 256.60. Today’s high was 257.15 and the 1-month high is 261.20. Today’s low was 255.40 and the 1-month low is 253.80. Since 11/22 January’25 Feeder Cattle are 2.30 higher or almost 1%. The Hogs dipped lower today. February’25 Lean Hogs were 1.55 lower today and settled at 84.37 ½. Today’s high was 86.07 ½ and the 1-month high is 89.60. Today’s low was 83.35 and the 1-month low is 82.67 ½. Since 11/22 February’25 Lean Hogs are 1.30 lower or 1 ½ %. The Cattle on Feed Report did not produce much price action and the Fats and Feeders moved in different directions today. There is not much that is new to report on, in the Cattle Markets, but that could change tomorrow. There is still a long position in the Cattle, and we will see if they all hold tight, or if one by one they start to sell, and it starts to slip lower. I still believe the February’25 Fats are heading lower, and 185.90 seems to be the level that needs to be traded through. 185.90 is also the 1-month low. Just below there sits the 100-Day moving average of 184.65 ¾ and the 50% retracement from the 52-week high/low of 184.49, and if it reaches that level, look out below. I am still Bearish the Feeders and feel they could head through the 1-month low of 253.80 and then toward the 250 level. the 50-Day moving average is 250.06, and 200-Day is 249.39. If it trades through the 200-Day, hold on to something. The Hogs dropped more than a dollar and a half today and could have the 80.00 level in its sights. The 200-Day and 100-Day moving averages sit below the 80.00 level as well. I am still Bearish the Livestock Markets, and the Fund that sells first, will probably get the better price. We will see how long the Funds play chicken.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

The Grain Markets were mixed as well today, with the Wheat leading the way higher. The Beans settled below the 970 level again. January’25 Soybeans were 5 cents lower today and settled at 969 ½. Today’s high was 979 ¼ and the 1-month high is 1003 ½. Today’s low was 968 and the 1-month and 52-week low is 945 ¼. Since 11/22 January’25 Soybeans are 14 cents lower or about 1 ½ %. The Corn Market climbed a little higher today. March’25 Corn was 1 ½ cents higher today and settled at 447 ¼. Today’s high was 448 ¼ and the 1-month high is 451 ¼. Today’s low was 445 ¼ and the 1-month low is 425 ½. Since 11/22 March’25 Corn is 12 ½ cents higher or almost 3%. The Wheat Market rallied today. March’25 Wheat was 7 ½ cents higher today and settled at 540 ½. Today’s high was 544 and the 1-month high is 569 ¼. Today’s low was 533 and the 1-month and 52-week contract low is 529 ¼. Since 11/22 March’25 Wheat is 24 ¼ cents lower or almost 4 ½ %. The Beans did not do much today and probably won’t for a little while. They might fluctuate between 445 ¼, the Contract low and 1000. I don’t see a reason to move much right now. When the size of the South American crop is realized, the lows will be soon to follow. Then you can buy it. The Corn held strong again today, with a 3-cent trading range. I like the Corn and would buy any dips, but I don’t see it heading to 5.00 yet. If the March’25 Corn trades through the 50% retracement from the 52-week High/low of 462 ¼, then the trip to 5.00 will have begun. The Wheat rallied today, and I think it could be time for a rally. I think the 580 level is possible. The 1-month high is 569 ¼, the 50-Day moving average is 570 ½ and the 100-Day moving average is 580 ½ and where I think the market can go. I have been buying March’25 Wheat Call spreads for Customers new and old. If you are interested give me a call, or use this link Sign Up Now if you need anything from me, call anytime. Merry Christmas Everyone.

.

.

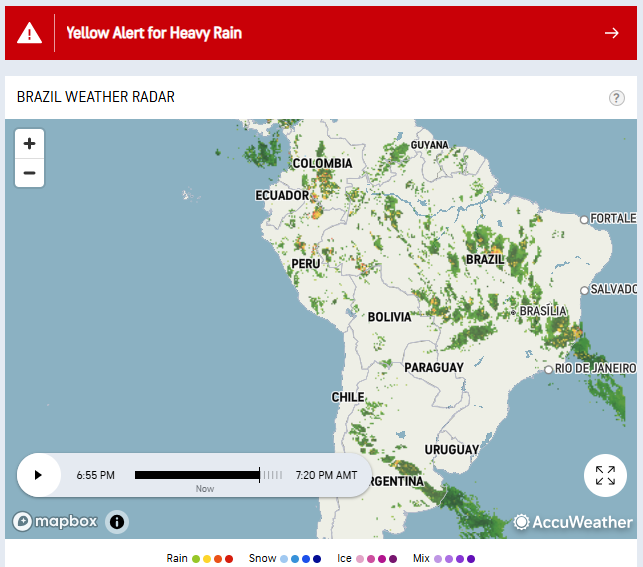

Today’s Brazil Weather Radar Map Below.

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.