12/20/25 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

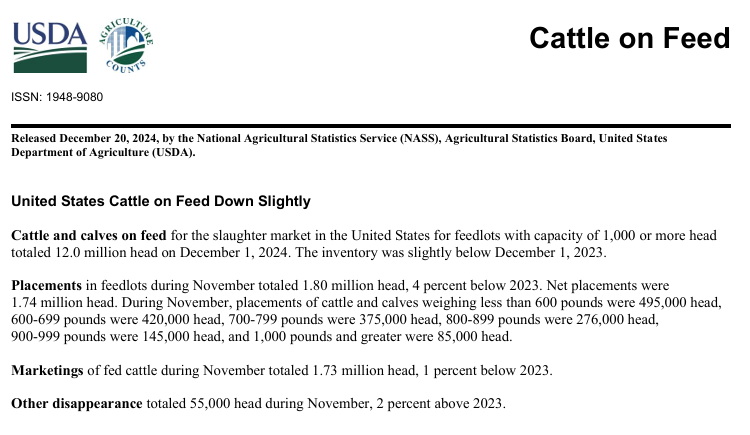

The Livestock Markets were higher today, with the Fats and Feeders regaining some of yesterday’s losses. The Fats gained almost 2 dollars today. February’25 Live Cattle were 1.85 higher today and settled at 188.40. Today’s high was 188.60 and the 1-month high is 193.22 ½. Today’s low was 186.27 ½ and the 1-month low is 185.90. Since 11/20 February’25 Live Cattle are 1.47 ½ higher or ¼ %. The Feeders gained a little more than a dollar today. January’25 Feeder Cattle were 1.12 ½ higher today and settled at 255.60. Today’s high was 256.12 ½ and the 1-month high is 261.20. Today’s low was 253.90 and the 1-month low is 252.00. Since 11/20 January’25 Feeder Cattle are 3.27 ½ higher or more than 1%. The Hogs gained more than 2 bucks today. February’25 Lean Hogs were 2.30 higher today and settled at 85.92 ½. Today’s high was 86.00 and the 1-month high is 89.60. Today’s low was 83.67 ½ and the 1-month low is 82.67 ½. Since 11/20 February’25 Lean Hogs are 1.45 higher or almost 2%. The Cattle on Feed Report was released at 2:00pm today and it showed Cattle on Feed at 99.7%, Placements were 96.3%, and Marketings were 98.5%. That is still plenty of Cattle, especially with the current heavy weights, 38 pounds heavier than this time last year. It is just 34,000 fewer than this time last year. On Sunday, it will be 1-month since the US border was closed to cattle from Mexico, and it won’t be long until the border is reopened. The protocols for testing the Cattle from Mexico are complete, and they will be tested there before entering the US and should be allowed back in very soon. If we were importing 100,000 head from Mexico every month, then there should be an influx of Cattle at the beginning of the year, and that alone could push the Cattle Markets lower. Exports did look good, and last week were just 7,200 Tonnes, which is 50% less than the 4-week average of 14,400 Tonnes. There is also the Stock Markets to worry about, and two days ago the stock markets tanked, sending the Cattle Markets lower. The Dow Jones Index was more than 850 points higher this morning, then was 600 points higher at 1:30, after the Livestock and Grain Markets closed, and settled less than 500 points higher for the day. There could be more profit taking in the stock markets before the end of the year, along with the Funds still needing to get out of their long Cattle positions and bank some profits as well. I bought more Puts and sold more Calls in the Feeders again today. I still feel the February’25 Fats can trade down to the 184.50 level, and then lower is possible. For the week the February’25 Fats are down $3.62 ½. I think the January’25 Feeders can trade down to the 249.50 level and trade lower as well. For the Week, the January’25 Feeders are down $2.05. The Hogs looked strong today, but I still think they can trade at the 80.00 level again soon. For the week, the February’25 Hogs are up 32 ½ cents.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

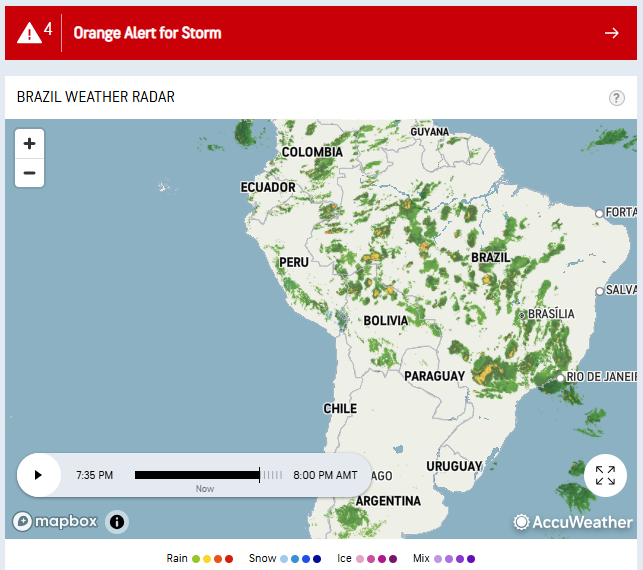

The Grain Markets we mostly higher today, with Soybeans bouncing and leading the way higher. January’25 Soybeans were 11 ½ cents higher today and settled at 974 ½. Today’s high was 977 ½ and the 1-month high is 1003 ½. Today’s low was 960 and the 1-month and 52-week low is 945 ¼. Since 11/20 January’25 Soybeans are 16 cents lower or almost 2%. The Corn Market popped back up today. March’25 Corn was 5 ½ cents higher today and settled at 446 ¼. Today’s high was 447 ½ and the 1-month high is 451 ¼. Today’s low was 439 ¼ and the 1-month low is 425 ½. Since 11/20 March’25 Corn is 6 ¼ cents higher or almost 1 ½%. The Wheat Market closed unchanged today. March’25 Wheat was unchanged today and settled at 533. Today’s high was 537 ¼ and the 1-month high is 577 ½. Today’s low was 529 ¼ and that is the new 1-month and 52-week contract low. Since 11/20 March’25 Wheat is 39 ¼ cents lower or almost 7%. The Beans have rallied since making new lows on Wednesday, trading down to 950 ¼ in the January’25 contract. I said that I thought it could bounce from there and is 24 ¼ cents higher from that level now. I still think the January’25 Soybeans will trade between 950-1000, until we have more info on the South American Bean Crop. We can see the lows in the market after the record setting crop numbers are released next year. I still like the Corn Market, and any pullbacks should probably be purchased, but I don’ think we will see 5.00 Corn, at least not yet. The March’25 Wheat Market made another new contract low today, and I think it can head higher from here. Yesterday I started buying come call spreads in the March’25 and bought more today for a few Costumers. I feel the March’25 Wheat could be trading around the 580 level again soon, with the 1-month high at 577 ½ and the 100-Day moving average at 581. Use this link Sign Up Now to learn more. There is still time to get an account open before the end of the year. I will be back on Monday. Have a great weekend.

.

Cattle on Feed Report Summary Below.

.

.

Today’s Brazil Weather Radar Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.