12/18/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Livestock Markets were mixed today, with the Fats and Feeders dropping lower, and the Hogs staying positive, today anyway. The Fats broke almost a buck and a half today. February’25 Live Cattle were 1.42 ½ lower today and settled at 188.32 ½. Today’s high was 190.27 ½ and the 1-month high is 193.22 ½. Today’s low was 187.77 ½ and the 1-month low is 185.50. Since 11/18 February’25 Live Cattle are 2.35 higher or more than 1%. The Feeders broke about 50 cents today. January’25 Feeder Cattle were 47 ½ cents lower today and settled at 257.00. Today’s high was 258.35 and the 1-month high is 261.20. Today’s low was 256.05 and the 1-month low is 249.12 ½. Since 11/18 January’25 Feeder Cattle are 7.50 higher or 3%. The Hogs gained half a buck today. February’25 Lean Hogs were 50 cents higher today and settled at 83.70. Today’s high was 83.97 ½ and the 1-month high is 89.60. Today’s low was 83.10 and the 1-month low is 82.10. Since 11/18 February’25 Lean Hogs are 42 ½ cents higher or ½ %. The Fats and Feeders started their migration lower today, and it could be a long walk. The Fed cut rates by ¼ of a point today but also said that they expect to cut rates 2 more times next year, NOT 4 times. The Dow Jones Index was up about 50 points when the Livestock Markets closed today. At 2:05 Central Time the Dow Jones Index is down 523 points, S&P down 89 points, and the NASDQ down 443 points. The US Dollar Index is currently up more than a full point, up 1.047 to 107.710. Today is the 10th day in a row that the Dow Jones Index has closed lower. That all looks kinda Bearish for the Livestock Markets to me. The Feeder Index is 263.00, and the all-time high is 263.07, so its close enough. There are still huge, long Fund positions in the Cattle Market, and I know they are nervous now. I would expect the Widget sellers to show up tomorrow as well. There is still a Cattle on Feed Report Friday and that could be interesting as well. Estimates are for Cattle on Feed numbers to be about 99.9% of last year’s numbers, and Placement estimates average around 96%, with Marketings around 98%. Don’t forget that Cattle from Mexico will be available in the market in a couple of weeks as well. There is still time to get an account open before the Cattle on Feed Report, just give me a call. The cutout was down as well this afternoon, down 79 cents to 314.84. Surprise, I am still Bearish, and I feel it will be moving day tomorrow. I think the February’25 Feeders can trade down to 184.50 for starters. The 1-month low is 185.50, the 100-Day moving average is 184.67, and the 50% retracement from the 52-week high/low is 184.48. The feeders could fall through the floor tomorrow. I think we could see the January’25 Feeders trade down to, and through the 250 level. It does not have to move that much lower tomorrow, but I think it is possible and could trade to that level soon. 249.53 is the 50-Day moving average, and 249.52 is the 200-Day moving average. 249.12 ½ is the 1-month low as well. I think the Hogs could trade below 80.00 as well. 79.59 is the 100-Day moving average, 78.71 is the 200-Day moving average, and 78.13 is the 50% retracement from the 52-week high/low as well. Get some rest tonight.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

The Grain Markets took it on the chin today, with Soybean complex getting crushed. January’25 Soybeans were 25 cents lower today and settled at 951 ¾. Today’s high was 977 ½ and the 1-month high is 1012 ¾. Today’s low was 950 ¼ and that is the new 1-mon and 52-week contract low. Since 11/18 January’25 Soybeans are 58 cents lower or almost 6%. The Corn Market broke as well today. March’25 Corn was 6 ¼ cents lower today and settled at 437 ¼. Today’s high was 446 ½ and the 1-month high is 451 ¼. Today’s low was 437 and the 1-month low is 425 ½. Since 11/18 March’25 Corn is 2 ½ cents lower or more than ½ %. The Wheat Market traded lower as well today. March’25 Wheat was 3 ¾ cents lower today and settled at 541 ¼. Today’s high was 554 ¼ and the 1-month high is 577 ½. Today’s low was 540 and that is the new 1-month, and 52-week contract low. Since 11/18 March’25 Wheat is 24 ½ cents lower or more than 4%. The Beans took a beating today and broke more than I thought they would. The January’25 Soybeans held the line at 950 and will probably bounce higher from here. I guess it will stay between 950 and 1000, instead of 970 and 1000. I still think we will see the lows when we have a better idea of exactly how big the South American crop will be. The Soybean Meal and Bean Oil got wacked, and I still think the Bean Oil is a buy, especially at this price level. The Corn has stayed strong but was unable to hold on today, and broke lower, and settled ¼ of a cent off the low. The Corn could be a buy here, as ethanol E-15 could boost the market. The March’25 Wheat traded ¼ of a cent through the 52-week contract low, probably just to prove a point. I believe it would be wise to be long the Wheat Market. The world is on the brink again, and the Wheat could shoot higher if Turkey invades Syria. Turkey already threatened to invade Israel earlier this year. Isreal is already in Syria and if Turkey enters Syria as well, nothing good will happen. Turkey could be a big problem moving forward as well. Anyway, the Wheat has large upside potential. These Markets look like they are about to get nuts, and right now is the time to put on an Option position. I have been buying Puts in the Fats and Feeders for customers, and it looks positive right now. If you would like more information, use this link Sign Up Now or just give me a call. 312-957-8079. Have a great night.

.

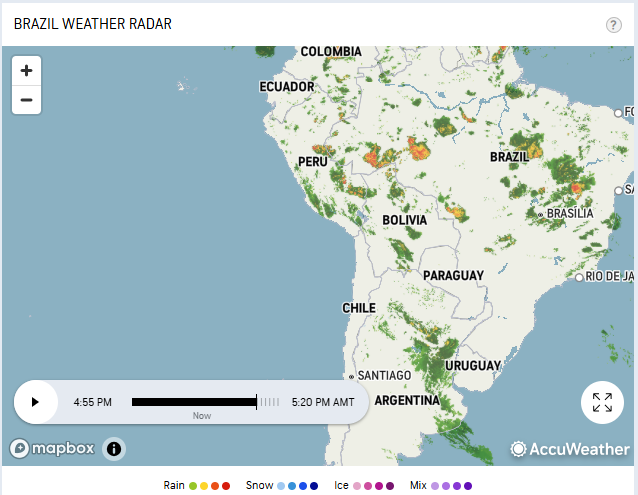

Today’s Brazil Weather Radar Map Below.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.