12/6/24

The Fats closed a little lower on a slow trading day. February’25 Live Cattle were 15 cents lower today and settled at 186.17 ½. Today’s high was 187.00 and the 1-month high is 190.05. Today’s low was 186.00 and the 1-month low is 184.40. Since 11/6 February’25 Live Cattle are 70 cents lower or almost ½%. The Feeders had a small bounce today. January’25 Feeder Cattle were 90 cents higher today and settled at 255.82 ½. Today’s high was 256.75 and the 1-month high is 261.20. Today’s low was 255.37 ½, and the 1-month low is 239.90. Since 11/6 January’25 Feeder Cattle are 12.12 ½ higher or almost 5%. The Hogs were higher again today. February’25 Lean Hogs were 97 ½ cents higher today and settled at 87.32 ½. Today’s high was 87.57 ½ and the 1-month high is 89.60. Today’s low was 85.37 ½ and the 1-month low is 82.10. Since 11/6 February’25 Lean Hogs are 2.32 ½ higher or almost 3%. The February Fats closed just off the lows today, during a short trading range of just a dollar. I still think the February’25 Fats can break at least a couple more dollars. The 100-Day moving average is 184.56, the 50% Retracement from the 52-week High/Low is 184.48, and the 1-Month low is 184.40. The January’25 Feeders settled just 45 cents off the lows today, during a slow session and a pause in the selling pressure. The Funds will have a couple days to think about their position, and I believe they will probably get nervous again and start to take profit. There are many contracts to liquidate before the Cattle on Feed Report in just ten trading days. I doubt they will want to risk their profits, through the last Cattle on Feed Report of the year. The Hogs have continued higher, and there is a lot of room for a correction. The 100-Day moving average is 78.64, the 200-Day moving average is 78.50, and the 50% Retracement from the 52-week High/Low is 78.11. If you would like more information, use this link Sign Up Now

.

.

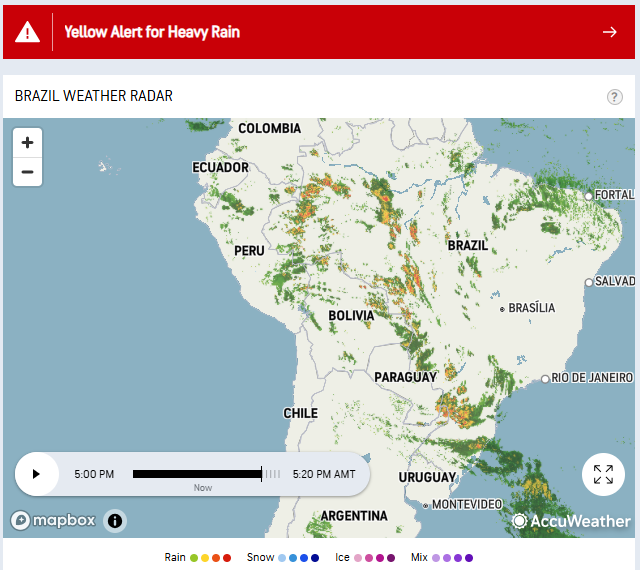

Grains were mixed, with the Corn charging higher. January’25 Soybeans were unchanged and settled at 993 3/4. Today’s high was 997 ½ and the 1-month high is 1044. Today’s low was 987 ¾ and the 1-month low is 975 ¼. Since 11/6. January’25 Soybeans are 10 cents lower or 1%. The Corn Market continued to climb higher today. March’25 Corn was 5 cents higher today and settled at 440.00. Today’s high was 440 ½ and the 1-month high is 447 ¾. Today’s low was 434 ½ and the 1-month low is 425 ½. Since 11/6 March’25 Corn 1 cent higher or fractionally higher. The Wheat Market was a little lower today. March’25 Wheat was 1 cent lower today and settled at 557 ¼. Today’s high was 560 ½ and the 1-month high is 596 ¾. Today’s low was 553 1/4 and the 1-month low is 540 ¼. Since 11/6 March’25 Wheat is 33 ¾ cents lower or almost 6%. The Grains all had a slow day as well. The Beans are not moving, because there is no reason to. The South American crops look great, and so does the weather forecast. We will have to wait and see how much precipitation the Midwest receives this winter, or if any growing concerns develop in Brazil, but right now it is still too early. I still like the Corn Market, and today it climbed another 5 cents. I think we can see the March’25 Corn trade about 10 cents higher from here. The 1-month high is 447 ¾, the 200-Day moving average is 451 ¾, and the 50% Retracement from the 52-week High/Low is 464 ¾. I would probably get out of any longs in the March’25 Corn just short of the 450 level, as the market could reverse from there if the buying stops, or if many have the same idea. The Wheat Market is still nuts and will go where it wants, when it wants. That said, there is potential for a fast rally from current levels if the world gets crazier than it already is. I still Like being long the Soybean Oil, and May’25 has been rallying nicely. I also still like the Natural Gas Market, as it has continued to rally as well, and it a great trade for a 3, 6, 9, and 12-month game plan. If you are interested in any of these markets or would like my recommendations use this link Sign Up Now Just 3 full weeks let in 2024, and that is plenty of time to open an account and start 2025 out fresh and refocused. Use this link Sign Up Now or give me a call if you are interested. Have a great weekend.

.

Today’s Brazil Weather Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.