12/2/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

The Cattle Markets started to break today, as the Hogs continued higher. February’25 Live Cattle were 70 cents lower today and settled at 187.92 ½. Today’s high was 189.37 ½ and the 1-month high is 190.05. Today’s low was 187.02 ½ and the 1-month low is 184.40. Since 11/01 February’25 Live Cattle are 1.02 ½ higher or more than ½%. The Feeders got wacked today. January’25 Feeder Cattle were 2.62 ½ lower today and settled at 256.85. Today’s high was 261.20 and that is the new 1-month high as well. Today’s low was 255.57 ½, and the 1-month low is 239.90. Since 11/2 January’25 Feeder Cattle are 13.55 higher or more than 5 ½ %. The Hogs were higher again today. February’25 Lean Hogs were 1.62 ½ higher today and settled at 87.95. Today’s high was 88.05 and the 1-month high is 89.60. Today’s low was 86.42 ½ and the 1-month low is 82.10. Since 11/2 February’25 Lean Hogs are 1.92 ½ higher or more than 2%. There has been talk of a potential lift on the ban of Cattle from Mexico, but nothing has been made official yet. I heard a possible lift could come in late December or early January, as US and Mexican officials talk about protocols inspecting the Cattle from Mexico. There is also a good chance some profit taking took place today and expect that to continue this week. Last week the Cattle weights slipped 1 pound, to 868 pounds, but are still 22 pounds heavier than this time last year, and 25 pounds above the 5-year average of 843. It looks like 10 days higher in a row was enough for the Feeders. The Feeders hit a 5-month high on Friday and traded even higher this morning. The January’25 Feeders were $1.72 ½ higher at one point today, and set a new 1-month high, before the market collapsed and traded lower. The January’25 Feeders had a wide $5.62 ½ trading range today and settled $1.27 ½ off the lows. I still feel that the Fats and Feeders will break lower from here. For the February’25 Fats I like the 184.50 level. The 100-Day moving average is 184.60, and the 50% retracement from the 52-week high/low is 184.48. The 1-month low is 184.40 as well. The Feeders have the potential to trade much lower. In the January’25 contract, the Feeders could easily trade back in the 240’s. the 200-Day moving average is 250.00. The 50% retracement from the 52-week high/low is 247.61, the 50-Day moving average is 245.68, and the 100-Day moving average is 242.29. The January’25 Feeders are still up $13.55 from the beginning of November, while the December’24 Fats are only up $1.02 ½. The Packers could slow their bids as well after the aggressive price action in the cash market last week.

.

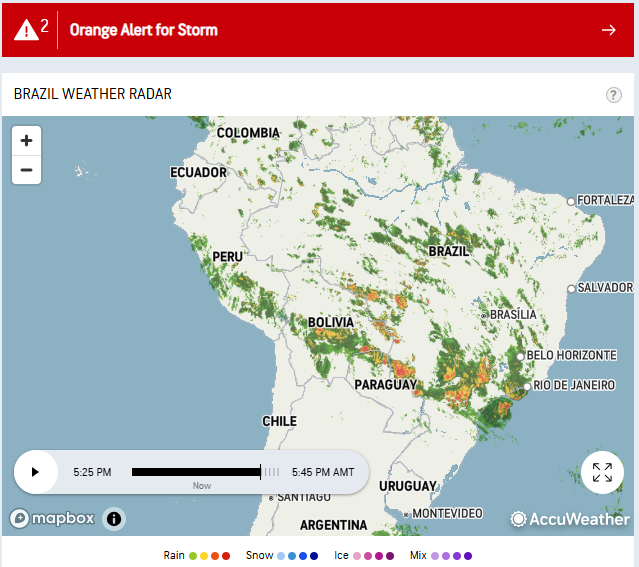

The Grain Markets were all lower today. January’25 Soybeans were 4 ¼ cents lower and settled at 985 ¼. Today’s high was 990 ½ and the 1-month high is 1044. Today’s low was 977 ¼ and the 1-month low is 975 ¼. Since 11/2. January’25 Soybeans are 8 ½ cents lower or almost 1%. The Corn Market gave a little back today. March’25 Corn was ½ a cent lower today and settled at 432 ½. Today’s high was 435 and the 1-month high is 447 ¾. Today’s low was 429 ¾ and the 1-month low is 425 ½. Since 11/2 March’25 Corn is 3 ¼ cents higher or almost 1 %. The Wheat Market was a little lower as well today. March’25 Wheat was ¾ of a cent lower today and settled at 547 ¼. Today’s high was 552 ½ and the 1-month high is 596 ¾. Today’s low was 542 ¾ and that is the new 1-month low as well. Since 11/2 March’25 Wheat is 40 ½ cents lower or almost 7%. I think the Soybean Market will chop around for a while, between 970 and 1000. There is no real reason for the Beans to trade higher. The crops in Brazil are doing great and are huge. There has been plenty of moisture in the Midwest, and it is too early to tell if it will be dry in the Spring. The January’25 Beans traded down to within 2 cents of the 1-month low of 975 ¼ today. I think the Corn Market still looks good and could trade higher from here. The March’25 Corn settled just 1 cent below the 50-Day moving average of 433 ½. There could be another 20 cents on the upside in the March’25 Corn. The 1-month high is 447 ¾, with the 200-Day moving average sitting 20 cents higher at 452 ½. The 50% retracement from the 52-week high/low is just above there at 456 ½. The Wheat Market is always capable of doing anything at any moment, and after making a new 1-month low today at 542 ¾, I like the upside from here. Wheat is called the Political Grain, and there is always a chance of something in the world sending that market higher again. All of the major moving average are much higher as well. For March’25 Wheat, the 100-Day is 585 ¼, and the 50-Day is 590. The 1-month high is 596 ¾, and the 200-Day moving average is 619. Argentina has been making new trade deals with China for the last year and now look to sell wheat to China as well. It would be the first time that Argentina has slod Wheat to China since the 1990’s if the deal gets done. The Soybean Meal has reached my 280-285 level in the December’24 contract today trading 283.40, and it’s not a bad place to take off your shorts or put on long trades in the differed months. The Soybean Oil was lower today and looks even more attractive. The price for Palm Oil is too high, and the need for Soybean Oil could increase dramatically. The spread between Palm Oil and Soybean Oil has not been this wide since the mid 1980’s. I also like the Natural Gas Market, and the export ban put on by the Biden Administration, will be lifted after President Trumps Inauguration. I am actively putting new and old Customers in both of these trades daily, and they come with a Credit. If you would like more information on these trades or any of the Markets, use this link Sign Up Now Now is the time to open an account, before the end of the year. There are just 20 trading days left in 2024, and I look forward to working with you in 2025.

.

.

Today’s Brazil Weather Radar Map Below

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.