11/15/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Livestock Markets were absolutely crazy today, with the Feeders spiking higher, on nothing. December’24 Live Cattle were unchanged today and settled at 182.95. Today’s high was 186.50 and the 1-month high is 189.80. Today’s low was 184.65 and the 1-month low is 182.80. Since 10/11 December’24 Live Cattle are 3.57 ½ lower or almost 2%. The Feeders shot higher today. January’25 Feeder Cattle were 4.02 ½ higher today and settled at 247.22 ½. Today’s high was 248.22 ½ and that is the new 1-month high as well. Today’s low was 243.12 ½ and the 1-month low is 239 ½. Since 10/11 January’25 Feeder Cattle are 3.00 higher or almost 1 ½%. The Hogs were lower today. December’24 Lean Hogs were 60 cents lower today and settled at 79.50. Today’s high was 80.60 and the 1-month high is 85.07 ½. Today’s low was 75.22 ½ and the 1-month low is 75.22 ½. Since 10/11 December’24 Lean Hogs are 4.27 ½ higher or more than 5 ½%. The Feeders went nuts while the Fats watched, and the Hogs stayed lower. The January’25 Feeders had more than a five-dollar trading range and still settled more than four-dollars higher. I am still looking into the Feeders rally, and I doubt it was the full moon, or a fat finger Friday. The most probable answer is algorithms. The offers above the market before the rally were not that big, and that could have sent the algorithms on a hunting trip to find any stops above the market, and it looks like they found some. The trading volume on the spike was not large as well, which somewhat confirms stops were hit. The January’25 Feeders broke two dollars off the high before climbing a buck higher and settling 1 dollar lower off the highs. It’s too bad there are not Weekley Options in the Cattle Markets, it could have been the perfect day to buy some week 3 Puts. The December’24 Fats took a long time to react to the spike higher in the Feeders as well and were only 1.15 higher on the highs. The December’24 Fats did trade to within 66 cents of the 50% retracement from the 52-week high/low today of 181.94. The December’24 Hogs traded lower through the day and stayed there. I still think the Hogs can trade about 5 dollars lower from here. If you would like to learn more about these markets, or have questions for me, please use this link Sign Up Now I am still Bearish the Cattle Markets and feel both markets will head lower before and after the Cattle on Feed Report next Friday.

.

The Grains were all higher today. January’25 Soybeans were 11 cents lower today and settled at 998 ½. Today’s high was 1005 ¼ and the 1-month high is 1044. Today’s low was 987 ¼ and the 1-month low is 977 ¼. Since 10/11 January’25 Soybeans are 5 cents lower or 1/2%. The Corn Market looked good again today. December’24 Corn was 5 cents higher today and settled at 424. Today’s high was 425 and the 1-month high is 434 ¾. Today’s low was 417 and the 1-month low is 399. Since 10/11 December’24 Corn is 22 ¾ cents higher or more than 5 ½%. The Wheat Market was up today. December’24 Wheat was 6 ¼ cents higher today and settled at 536 ½. Today’s high was 541 ¼ and the 1-month high is 595 1/2. Today’s low was 530 ½ and the 1-month low is 528. Since 10/11 December’24 Wheat is 43 cents lower or almost 7 ½%. The January’25 Soybeans were 18 cents higher at one point today, and I hope you sold them. There is still not a reason for the Beans to be above $10.00, not yet at least. The Corn still looks strong to me and gained 5 cents on the day. I still think it can retest the 435 level. The December’24 Wheat gained 6 ¼ cents today, but that is not enough. The Wheat will rally quickly if it even happens again. I am still Bearish the Soybeans and the Soybean Meal, and Bullish the Corn, Canola Oil and Soybean Oil. The US dollar index has been strong and should be having a bigger effect on some of these commodity markets. In addition to that, the US Stock Markets got crushed today. The Dow Jones was Down 333, the S&P down 81.75 and the NASDAQ Down 518. That should have pushed the Cattle Markets lower. I am guessing that the longs in the Cattle market took advantage of the rally and helped to hold it up. Next week could be a completely different story, before and after the Cattle on Feed Report. It’s time to circle the wagons and start shooting back in the Option Markets, by buying Puts. If you would like more information on how to do that, please use this link Sign Up Now Now is a great time to open an account, before it is next year again. Have a great weekend and enjoy the full moon tonight.

.

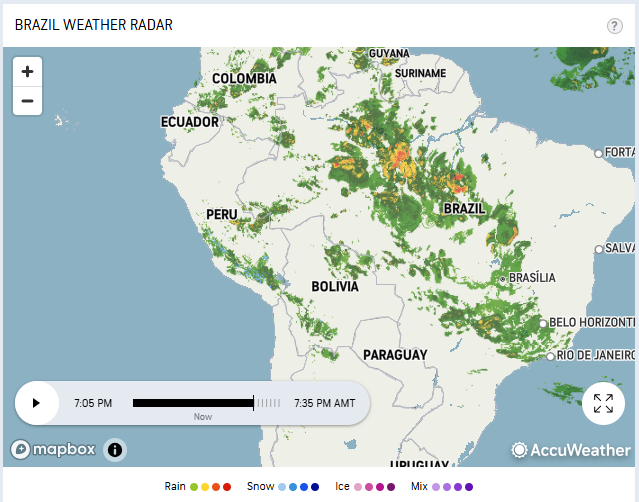

Today’s Brazil Weather Radar Map Below.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.