11/13/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

The Livestock Markets were mixed today, with the Feeders staying positive. December’24 Live Cattle were 37 ½ cents lower today and settled at 184.02 ½. Today’s high was 184.62 ½ and the 1-month high is 189.80. Today’s low was 183.82 ½ and the 1-month low is 182.80. Since 10/11 December’24 Live Cattle are 3.55 lower or almost 2%. The Feeders settled in the green today. January’25 Feeder Cattle were 7 ½ cents higher today and settled at 243.65. Today’s high was 244.45 and the 1-month high is 248.52 ½. Today’s low was 239.50 and the 1-month low is 222.80. Since 10/11 January’25 Feeder Cattle are 3.60 lower or almost 1 ½%. The Hogs were sent lower today. December’24 Lean Hogs were 47 ½ cents lower today and settled at 81.87 ½. Today’s high was 82.02 ½ and the 1-month high is 85.07. Today’s low was 81.87 ½ and the 1-month low is 75.10. Since 10/11 December’24 Lean Hogs are 4.22 higher or more than 5%. The open interest in the Fats has started to slowly decline, as the Funds have quietly started to liquidate some of their long position. The packers look as if they could be losing money again as well, and that could pull their bids lower in the cash market. We will see who flinches first tomorrow, but if the Funds pick up the pace of selling, or traders try to get in front of the Funds and race them lower, the Futures Market and the cash bids could both drop. There tends to be pressure on the Cattle Market on Thursdays, and I think we can see that continue tomorrow. Turkey season is almost here and that will cut into some of the demand for beef. The two following holidays, being Christmas and New Years are both in the middle of the week, and that could limit some peoples long distance travel plans due to work, which could limit large get-togethers, and again decrease the demand for Beef. The December’25 Fats settled in the middle of the 200-Day and 100-Day moving averages, though today’s low of 183.82 ½ did get close to the 100-Day moving average of 183.58. The 1-month low sits just over a dollar lower from the low today at 182.80, and less than another dollar lower from there is the 50% retracement from the 52-week high/low of 181.94. I think we will the market trade down to the 50% retracement level and then head lower. I feel that 174 is a real possibility in the December’24 Fats. The January’25 Feeders barley stayed positive today, closing 7 ½ cents higher, but still closed well off the highs for the day. Today’s low of 243.00 is just 20 cents above the 100-Day moving average, and I think we can see it trade through there very soon. Below that level, there is not much left. The 50-Day moving average is 240.27 and 1-month low is 239.50. Below there and you could see prices start swirling around the large black hole that only contains the 52-week low of 222.80. The Hogs were lower today, but did settle near the day’s highs. The December’24 Hogs were more than a dollar and a half lower on the lows today but did manage to climb a buck higher before the close. I still feel the Hogs are heading lower, toward the 73.75 level. The 1-month low is 75.10, the 200-Day moving average is 74.42, the 50% retracement from the 52-week high/low is 73.45, and the 100-Day moving average is 72.55.

.

The Grains were all lower today, with the Wheat closing double digits lower again. January’25 Soybeans were 2 ¾ cents lower today and settled at 1007 ¾. Today’s high was 1012 ¾ and the 1-month high is 1044. Today’s low was 1001 ¾ and the 1-month low is 977 ¼. Since 10/11 January’25 Soybeans are 13 ¼ cents lower or more than 1%. The Corn Market lost a couple cents today. December’24 Corn was 2 cents lower today and settled at 426 ½. Today’s high was 429 ¾ and the 1-month high is 447 ¾. Today’s low was 424 ¼ and the 1-month low is 414. Since 10/11 December’24 Corn is 4 ½ cents higher or just over 1%. The Wheat Market continued to dive lower today. December’24 Wheat was 11 ¼ cents lower today and settled at 541. Today’s high was 553 ¾ and the 1-month high is 601. Today’s low was 536 ¼ and that is the new 1-month low as well. The 52-week low is 520 ¾. Since 10/11 December’24 Wheat is 58 cents lower or almost 10%. The Grains have been a pain in the you know what this week, but that provides more opportunity as well. There is still no reason for the Beans to rally, so I would continue to sell into strength. Although China did say their Soybean imports could fall by 10% next year, but that could have been said because Trump won. The Soybean Meal is getting closer to where I think the bottom could be. I feel that the 280-285 level is a good spot to cover shorts or possibility get long many months out. The Soybean Oil I still like, and it rallied about 8 dollars recently, but has given about 3 dollars back. I still think there is way to be long from here and be profitable, along with the Canola Oil, that rallied 80 bucks but just gave 30 back. They have both been rallying chasing the Palm oil market higher, that just traded to its highest level since 2022, and then broke, sending the Canola and Bean oil lower with it. There is still potential for the Trump administration to put tariffs on the imported used cooking oil from China, or stop imports altogether, and that would send the markets higher again. It could be a good long play before the inauguration. The Corn Market still looks good, and only lost 2 cents today, The December’24 Corn traded through, and settled ¾ of a cent below the 100-Day moving average of 427 ¼. I think we can see it trade through the 50-Day moving average of 431 ½ and retest the 435 level. the 200-Day moving average is 455 ½. I do not care to talk about the Wheat market, but it was another ugly trading day. The December’24 Wheat has lost 58 cents in the last 5-days. It made a new 1-month low today as well at 536 ¼, and the 52-week low is 520 ¾, so you know. I guess there is nothing but upside from here, possibly. There is still great opportunity in these markets and would like to talk to you about it. Please use this link if you are interested in learning more Sign Up Now I highly recommend giving me a call, so you can hear about the Natural Gas Market, and the potential for large returns. I have several Option Trades structured, and ready to go. The Natural Gas Market has a real chance to double over the next year. The rally has already begun, and I feel prices will be much higher when President Trump is inaugurated, and then higher from there. 312-957-8079 Sign Up Now I look forward to hearing from you.

.

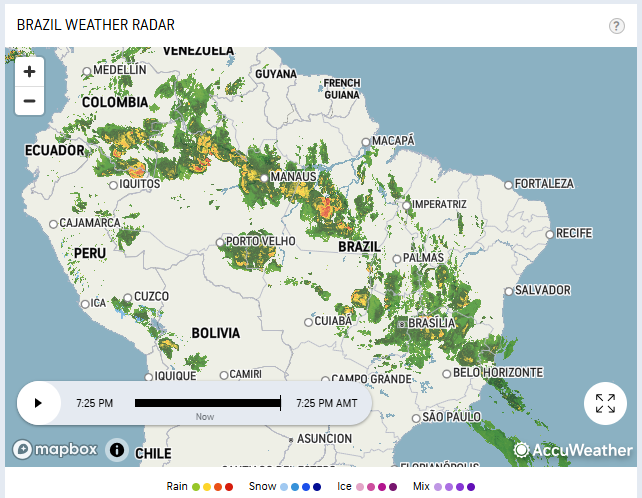

Today’s Brazil Weather Radar Map Below.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.