11/8/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

The Livestock Markets were all lower today. with the Feeders down almost $3.00. December’24 Live Cattle were 2.12 ½ lower today and settled at 183.70. Today’s high was 184.82 ½ and the 1-month high is 189.80. Today’s low was 183.45 and that is the 1-month low as well. Since 10/8 December’24 Live Cattle are 3.92 ½ lower or more than 2%. The Feeders were more than$4.00 lower on the lows today. January’25 Feeder Cattle were 2.90 lower today and settled at 241.42 ½. Today’s high was 243.25 and the 1-month high is 248.52 ½. Today’s low was 240.27 ½ and the 1-month low is 239.50. Since 10/8 January’25 Feeder Cattle are 5.90 lower or more than 2%. The Hogs traded down through 80.00 today. December’24 Lean Hogs were 77 ½ cents lower today and settled at 80.42 ½. Today’s high was 81.17 ½ and the 1-month high is 85.07 ½. Today’s low was 79.80 and the 1-month low is 75.07 ½. Since 10/8 December’24 Lean Hogs are 3.15 higher or more than 4%. It was an ugly morning in the Livestock Markets, unless you expected this break and were prepared for it. The Cattle Markets dropped 1 ½ – 2 dollars on the open, and it broke more from there. The December’24 Fats were almost 2 ½ dollars lower on the lows, and never really recovered through the day. The December’24 Fats did not settle well either, just 25 cents off today’s lows. The December’24 Fats obviously traded through and settled below the 200-Day moving average of 184.55, and the 50-Day of 184.08. That was the level I was waiting for to be breached. Today they traded through the 100-Day moving average of 183.65 and made a new 1-month low of 183.45 but settled just 5 cents above it at 183.70. My next target level lower from here is the 50% Retracement From the 52-Week High/Low of 181.93. I still feel that we will see prices approach the 174 level and then much lower is possible. The 52-week low is 172.25. January’25 Feeders almost traded down to 240 today and they could be in trouble. They were more than 4 dollars lower at one point and settled almost 3 dollars lower. The January’25 Feeders blew through the 100-Day moving average of 243.27 and continued lower. The Feeders bounced just before the 240 level, this time. Just below 240 sits the 50-Day moving average of 239.62 and the 1-month low of 239.50. If or when those two levels are breached, there won’t be much in the way to stop a collapse. My next level lower in January’25 Feeders is 234, and below that is ugly. The 52-week low is 222.80 and below that, the price will be approaching the event horizon. The Hogs traded through the 80.00 level today but were able to settle above it. I still feel we will see the Hogs lower as well. For the December’24 Hogs I think they can head towards the 73.75 level. The 1-month low is 75.07 ½, the 200-day moving average is 74.31, the 50% retracement from the 52-week high/low is 73.45, and the 100-Day moving average is 72.19. I recommend reading the WASDE Report today. The Cattle on Feed Report is next week and if the numbers are as high as I reported before, it won’t be good for Cattle prices. Beef imports increased dramatically as well. The WASDE Report link is here wasde1124.pdf

.

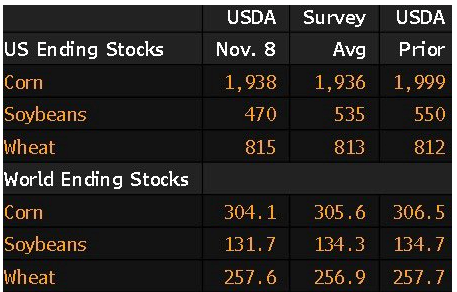

The Grains were a little higher today, with the Beans shooting higher, but closing almost 15 cents off the highs. January’25 Soybeans were 4 cents higher today and settled at 1030 ¼. Today’s high was 1044 and the 1-month high is 1045 ¼. Today’s low was 1017 ½ and the 1-month low is 977 ¼. Since 10/8 January’25 Soybeans are 4 ¼ cents lower or almost ½%. The Corn Market continued to look strong and made another gain today. December’24 Corn was 3 ½ cents higher today and settled at 431. Today’s high was 434 ¾ and that is the new 1-month high as well. Today’s low was 426 ¾ and the 1-month low is 399. Since 10/8 December’24 Corn is 10 ¼ cents higher or just almost 2 ½%. The Wheat Market was slightly higher today. December’24 Wheat was 1 cent higher today and settled at 572 ½. Today’s high was 578 ¾ and the 1-month high is 611 ¼. Today’s low was 566 ½ and the 1-month low is 557 ¾. Since 10/8 December’24 Wheat is 22 ¼ cents lower or almost 4%. The Beans provided a selling gift after the WASDE Report was released, as short covering shot the market as high as 1044 today, just short of the 1-month high of 1045 ¼. The January’25 Soybeans fell back down almost 15 cents from the highs. There is a chart below that shows the results of the WASDE Report for the Grains. There is still no reason for the Beans to rally, and every rally should be sold into. I recommend sell the March’25 Soybeans still. The Corn Market continued higher again today and tested the 435 level I have talked about. It did not get through that level today, but I think it can soon, and then head toward the 200-Day moving average of 442 and then the 50% retracement from the 52-week high/low of 452 ¼. The Wheat Market did not close well today either but stayed positive and settled just below the 100-Day moving average of 573 ¾. I think we can still see a rally in the Wheat, and the December’24 Wheat can head toward the 200-Day moving average of 606 ½ and then to 640, which is the 50% retracement from the 52-week high/low. The ‘Basket” of trades I sent out the other day have turned positive as a whole. Not the best settlement prices, but that happens. The 5-trades are up $50.00 as a package and are approaching their target levels. As they get closer, the Option positions will increase rapidly the closer they get to the strike prices. This was an exercise to show how cheap Options are worth buying when you have the correct game plan. If you would like to learn more, please use this link Sign Up Now I also structured some Option trades in September’25 Feeders today. If the Cattle Markets break like I think they can, it could be a good Hedge against much lower prices. Some of the trades come with a credit as well. Give me a call, and I will structure a hedging plan specifically for your needs, in any Market. 312-957-8079 I look forward to speaking with you. Have a great weekend.

.

WASDE Report Numbers.

.

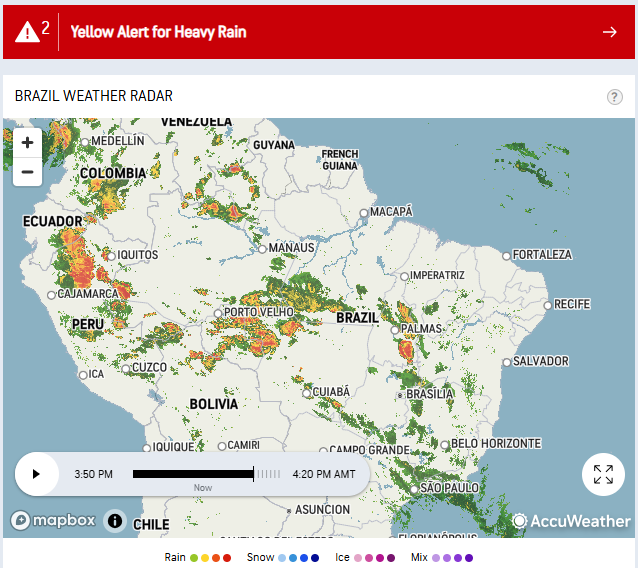

Today’s Brazil Weather Radar Map Below

.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.