11/1/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Testicular Fortitude, patience and a little knowledge, that is what it takes to trade these Markets. Always in the Option Markets, so you can take some heat when the Funds get nervous. The Fats broke through 185 today, short higher, but settled a lower on the day. December’24 Live Cattle were 37 ½ lower today and settled at 185.92 ½. Today’s high was 186.60 and the 1-month high is 189.90. Today’s low was 185.45 and that is the new 1-month low as well. Since 10/1 December’24 Live Cattle are 75 cents higher or almost 1/2 %. The Feeders were flying all over the place today. January’25 Feeder Cattle were 1.87 ½ higher today and settled at 243.20. Today’s high was 243.95 and the 1-month high is 248.52 ½. Today’s low was 239.50 and the 1-month low is 238.07 ½. Since 10/1 January’25 Feeder Cattle are 4.75 higher or almost 2%. The Hogs made new highs again today. December’24 Lean Hogs were 27 ½ cents higher today and settled at 84.07 ½. Today’s high was 85.07 ½ and that is the new 1-month and 52-week high as well. Today’s low was 83.87 ½ and the 1-month low is 74.60. Since 10/1 December’24 Lean Hogs are 9.47 ½ higher or more than 12 ½%. The Livestock Markets have been nuts this week and today was no different. The December’24 Fats broke through the 185 level today, but it did not last long. The Fats bounced and were trading higher on the day for a while, before settling ¾ of a cent lower on the day. The Feeders looked like they were going to completely collapse today, but they bounced as well after trading down to 243.20. The January’25 Feeders settled 3.70 off the lows today, and it was impressive to settle 1.87 ½ higher on the day. The December’24 Hogs made new contract highs again today and settled 27 ½ cents higher. The Jobs number that came out this morning was awful, and that could have helped the Cattle Markets lower. They were looking for more than 100,000 plus jobs, and the number was only 12,000. Shockingly there were also revisions again for the last two months that were 112,000 lower, and manufacturing sector lost 46,000 jobs. That could have put a demand scare into the Markets. US Beef exports were 13,900 Tonnes last week and that is below the 4-week average of 17,600. Tonnes. There were also three Farm Workers from Washington State that contracted H5N1 after they cleaned an infected chicken Farm. They were diagnosed in Oregon and are under surveillance. The Cattle Markets both breached important levels lower, and I believe they will make new lows again very soon. The December’24 Hogs traded through 185 today but ran out of stream and settled at 84.07 ½. I still feel we will see the Hogs much lower very soon. I sent out a Hedging Program for the Feeders today, and I will have one for each Livestock and Grain commodity next week. If you are interested in seeing them, please use this link Sign Up Now I am still Bearish the Fats, Feeders, and Hogs for all the same reasons.

.

Today was another great opportunity to sell November’24 or January’25 Soybeans, and hope you took it. January’25 Soybeans were 3/4 cent lower today and settled at 993 ¾ Today’s high was 1008 ¾ and the 1-month high is 1082. Today’s low was 988 ¾ and the 1-month low is 977 ¼. The 52-week low is 973 ½. Since 10/1 January’25 Soybeans are 81 ¾ cents lower or more than 7 ½%. The Corn Market continued to look stable today. December’24 Corn was 3 ¾ cents lower today and settled at 414 ½. Today’s high was 415 ¾ and the 1-month high is 434 ¼. Today’s low was 410 ½ and the 1-month low is 399. The 52-week low is 385. Since 10/1 December’24 Corn is 14 ½ cents lower or just over 3%. The Wheat Market dropped a little lower today. December’24 Wheat was 2 ½ cents lower today and settled at 568. Today’s high was 577 ¾ and the 1-month high is 617 ¼. Today’s low was 564 ¼ and the 1-month low is 557 ¾. The 52-week low is 520 ¾. Since 10/1 December’24 Wheat is 31 cents lower or more than 5%. For some unknown reason, someone paid 1008 ¾ for January’25 Soybeans, and they broke from there. There is not a reason for them to rally yet, and in fact several reasons to sell them, but I think I have covered that enough. If there is a reason to buy front month Soybeans, it will be obvious. The Corn Market continues to look strong and gained another 3 ¾ cents today. The 410 level in December’24 Corn looks like a strong resistance level, and I think we can see the 435-level tested, and the 450-level tested as well. The Wheat Market will probably continue to whip around, and when it heads North again it will be fast. I think up toward the 640 level in December’24 and April’25 is very possible. Another Gamma Trade looks good today. I write the Walsh Gamma Trader on Barchart as well, and 5-weeks ago I recommended buying March’24 Soybean Meal 300 Puts. 5-weeks ago they were trading 3.40, and today they settled at 13.40. Thats not bad, I guess. The other recent one was the 85 Calls in February’25 Lean Hogs, that one worked out alright as well. I used to show 16 different market in the Walsh Gamma Trader, but that was too much for too long. If you are interested in seeing all of them and the current recommendations, please use this link Sign Up Now

I have been Bullish the Soybean Oil for a while and it has rallied about 6 bucks, and Bullish the Canola Oil for the last 45 dollars, and I feel both Markets can continue higher from here as well, for a couple months anyway. I would look to buy Soybean Meal in the 280-285 range as well.

.

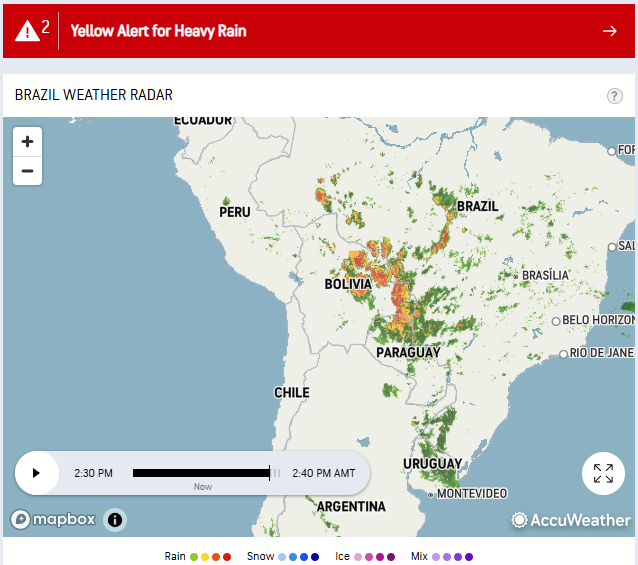

Today’s Brazil Weather Radar Map.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.