10/25/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

.

The Cattle Markets were mixed today, but the Fats and Feeders settled near unchanged for the day. December’24 Live Cattle were 10 cents lower today and settled at 189.15. Today’s high was 189.50 and that is the new 1-month high as well. Today’s low was 188.62 ½ and the 1-month low is 183.00. Since 9/25 December’24 Live Cattle are 4.82 1/2 higher or more than 2 1/2%. The Feeders were a dime higher today. January’25 Feeder Cattle were 10 cents higher today and settled at 245.62 1/2. Today’s high was 246.35 and the 1-month high is 248.52. Today’s low was 244.10 and the 1-month low is 235.85. Since 9/25 January’25 Feeder Cattle are 7.10 higher or almost 3%. The Hogs were higher again. December’24 Lean Hogs were 1.02 1/2 higher today and settled at 79.67 ½. Today’s high was 79/72 1/2 and the 1-month and 52-week high is 80.30. Today’s low was 78.17 ½ and the 1-month low is 72.40. Since 9/25 December’24 Lean Hogs are 4.77 1/2 higher or more than 6%. The Cattle on Feed Report was released today and it showed that the numbers were just a little below last year at 11.60 million head. 7.00 million steers and steer calves, up 1% from last year, and accounted for 60% of the total numbers in Feed Yards. Heifers and Heifer calves were down 1% and accounted for 4.60 million head in the Feedlots. Placements totaled 2.16 million head, 2% below last year, and marketings totaled 1.70 million head, 2% above last year. I am reading this as Bearish. The difference this year compared to last year is just 4,000 fewer Cattle on Feed, 4,000. The pre-report estimates for this report were for total Cattle on Feed to be down 0.3%, and Placements to be 4% lower, and Marketings to be 2% higher. The total number on feed and the Marketings came in as expected, but the Placements were only 2% lower from last year, not 4%. Don’t forget that last year’s report at this time had total Cattle on Feed at 11.6 million head, 1% above 2022, and that was the second highest inventory ever, and Placements were 2.21 million head, 6% above 2022 levels. So, there are still plenty of Cattle on feed, and with the expanding drought, there could be more Cattle placed on feed. I thought the Placements were going to be larger than expected, and that was good to see today. If you want to see today’s COF Report, you can us this link Cattle on Feed 10/25/2024 If you want to see last year’s COF Report you can use this link Cattle on Feed 12/22/2023 The US drought monitor said that 79% of the US was experiencing abnormal dryness. The 5-area, 5-Day weighted average this week is 189.33 compared to 187.57 last week. Beef production in September was up 2.6% compared to last year, and the slaughter number for September was 2.57 million head, that was down 1 ½% from last year. The average weight in September was 44 pounds more than this time last year. I have more information I can share with you, if you are interested, please use this link Sign Up Now

.

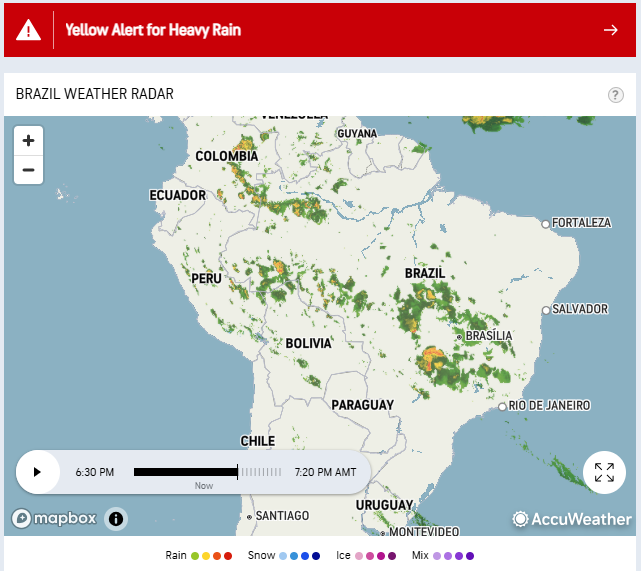

The Grain Markets were all lower today. November’24 Soybeans were 8 1/2 cents lower today and settled at 987 3/4. Today’s high was 996 ¾ and the 1-month high is 1069 ¾. Today’s low was 984 and the 1-month low 968 1/4. The 52-week low is 955. Since 9/25 November’24 Soybeans are 65 1/2 cents lower or more than 6%. The Corn Market dropped as well today. December’24 Corn was 6 1/4 cents lower today and settled at 415 1/4. Today’s high was 421 and the 1-month high is 434 ¼. Today’s low was 414 ½ and the 1-month low is 399. The 52-week low is 385. Since 9/25 December’24 Corn is unchanged. The Wheat Market was knocked down again today. December’24 Wheat was 12 ½ cents lower today and settled at 569. Today’s high was 585 1/2 and the 1-month high is 617 ¼. Today’s low was 566 and the 1-month low is 565 3/4. The 52-week low is 520 ¾. Since 9/25 December’24 Wheat is 20 ¼ cents lower or almost 3 1/2%. The Grains pulled back today, and the November’24 Soybeans will probably continue to break next week, now that November’24 Options have expired. I still recommend selling the March’25 Soybeans and buying the August’25 Beans. After the Beans find a bottom, I think they can rally a dollar, and that will help push the Corn and Wheat Markets higher, if they even need the help. The Corn Market has looked good, despite today’s losses, and closing below the 100-Day moving average of 417 ¼. If the Corn does run higher, and I think it can, it will probably try to get back to its 50% retracement from the 52-week High/Low number of 452. The USDA said that 58% of the winter Wheat crop is in drought conditions, and we will see what happens to Wheat in the Black Sea Region. With uncertainty in the world, this could be a good level to buy Wheat. If the Wheat does rally, I can see it going to its 50% retracement from the 52-week High/Low of 640. I have August’25 Soybean trades ready to go, and they would capture a move high if there was a problem with Brazil’s current planting, their growing season, and their harvest, along with the US Soybean plantings and part of the growing season. With the US drought monitor showing 79% of the US is abnormally dry, next year could get interesting. If you would like to see the trades or would like more information, please use this link Sign Up Now I am still Bullish Canola Oil and Soybean Oil as well.

.

Today’s Brazil Weather Radar Map.

.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.