10/16/24

The Livestock Markets were mixed today, as the Feeders continued to slide lower. December’24 Live Cattle were 7 ½ cents higher today and settled at 186.60. Today’s high was 187.40 and the 1-month high is 188.55. Today’s low was 186.12 ½ and the 1-month low is 178.25 Since 9/16 December’24 Live Cattle are 8.27 ½ higher or more than 4 ½%. The Feeders ended the day just off the lows. November’24 Feeder Cattle were 97 ½ cents lower today and settled at 245.50. Today’s high was 246.92 ½ and the 1-month high is 251.25. Today’s low was 244.92 ½ and the 1-month low is 235.47 ½. Since 9/16 November’24 Feeder Cattle are 9.80 higher or just over 4%. The Hogs took off today. December’24 Lean Hogs were 2.47 ½ higher today and settled at 77.70. Today’s high was 77.85 and the 1-month high is 77.90. Today’s low was 75.22 ½ and the 1-month low is 72.30. Since 9/16 December’24 Lean Hogs are 5.52 ½ higher or more than 7 ½%. The December’24 Fats were able to stay positive today, but not by much. I feel that the Cattle Markets will both continue lower from here. I think the next target level for the December’24 Fats is 182.76 and is the 50% retracement from the 52-week High/Low, and then the 50-Day moving average at 181.01. I have levels below here, but I will save them for later. The November’24 Feeders were almost another dollar lower today and settled 57 ½ cents off the lows. The November’24 Feeders started to break when they could not close above the 250.50 level, that is the 50% retracement from the 52-week High/Low. I feel they will continue lower from here and head toward their 50-Day moving average of 239.53. November’24 Feeders are down 4.45 over the last four trading sessions, and I feel they will continue lower from here. Carcass weights are 5 pounds heavier than last week and 29 pounds heavier than this time last year. There are still plenty of longs in the Cattle Markets, and they could pull the trigger and take profit at any moment. That could send the Cattle Markets much lower.

.

The Soybeans continued their dive lower today. November’24 Soybeans were 11 cents lower today and settled at 980. Today’s high was 1001 ½ and the 1-month high is 1069 ¾. Today’s low was 978 ¼ and that is also the new 1-month low. The 52-week low is 955. Since 9/16 November’24 Soybeans are 24 ½ cents lower or almost 2 ½%. The Corn Market gained a few cents today. December’24 Corn was 3 ½ cents higher today and settled at 404 ¾. Today’s high was 406 ¾ and the 1-month high is 434 ¼. Today’s low was 401 and the 1-month low is 400 ½. The 52-week low is 385. Since 9/16 December’24 Corn is 6 cents lower or almost 1 ½%. The Wheat Market rallied back today. December’24 Wheat was 5 ½ cents higher today and settled at 585. Today’s high was 587 ½ and the 1-month high is 617 ¼. Today’s low was 575 ¼ and the 1-month low is 564. The 52-week low is 520 ¾. Since 9/16 December’24 Wheat is 6 ½ cents higher or more than 1%. The Facts have finally returned to the Market, and the Soybeans are continuing to break, because they should. November’24 Soybeans made another new 1-month low today and are now down 40 ¼ cents over the last 5 trading days. I still feel the Beans can test the 52-week low of 955, and push through it. My range for the bottom is between 910 and 930. Whenever the Soybeans do find their bottom, I would expect to see a fast rally of a dollar or more. The open interest in the Beans has increased almost 20,000 contracts, and when open interest rises on a break, that is a good sign of new shorts entering the market and is Bearish. As a result, the Beans can continue to be pushed lower until the bottom is found. I feel there will be a big bounce off the bottom because of the continuing increase of shorts in the Market, and when the buying starts it could get aggressive fast. To be clear, I do not think the lows in the market have been seen yet, just saying what I think could happen when the bottom is reached. The weather has been good in the Midwest, and Harvest is going well, with the Beans almost 70% complete. The 5-year average is just over 50% over the same time period. Brazil continues to receive rain, and more has been forecast over the next week. CONAB’s estimate for Brazil’s Soybean production is a huge 166.05mt. The USDA’s number is even higher at 169mt, but they are usually on the higher end of estimates, and wrong. Brazil’s Bean crop area is estimated to be almost 3% larger than last year as well. The Corn Market has been breaking as well, and has the same problem the Soybeans do, new shorts. The Funds sold almost 20,000 contracts yesterday, and open interest increased by almost 25,000 contracts. So just like the Bean Market, this is a Bearish development. I would want to be a buyer of Corn at this level. If the market breaks through the 4.00 level, I do not believe it will trade lower than the 52-week low of 385. The Wheat Market had been sent lower the previous three days, down 24 ¼ cents. Some of the break was probably due to following the Corn and Beans lower, in addition to Russia getting some much-needed rain. I feel the Corn and Wheat Markets stabilized today and will continue higher from here. If the Corn and Wheat do rally, I feel that the Corn can get as high as 456, and the Wheat up to 640. I feel this can happen after the Beans find their bottom and start to head North again. I already have Bullish trades ready to go, when the time is right. This would be a good time to prepare for the upside and open an account, so you will be ready to capture a move higher. Give me a call, I will be happy to answer any questions you might have. I would like an opportunity to work with you, whether you want to trade or hedge, and help your bottom line.

.

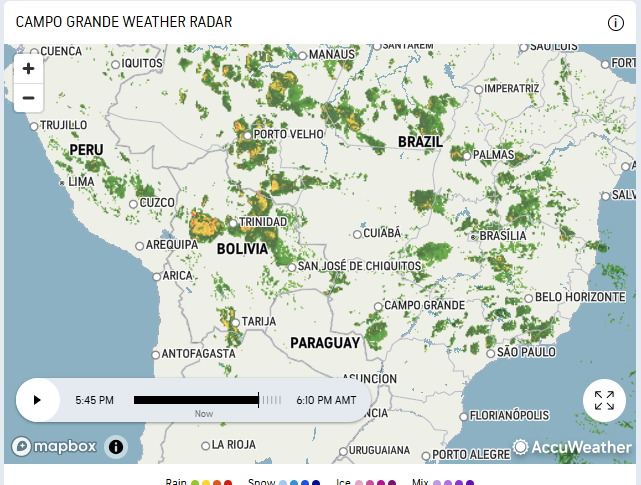

Today’s Weather Radar Map of Brazil

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.